Summary

- British Land Group has resumed the dividend payment and is expected to declare an interim dividend in November

- British Land has witnessed huge success from its retail parks portfolio, which have played a pivotal role in getting revenue streams for the company in the post-lockdown era

- Recovering rent has been slightly challenging throughout the unprecedented crisis

One of Europe's largest listed real estate investment companies, British Land Company Plc (LON:BLND) has recently announced the resumption of dividend, according to its operational update released on 9 October 2020.

British Land to resume dividend pay-out

The FTSE 100 listed property development and investment company had taken a tough call of suspending the dividend temporarily with an objective of preserving the long-term value of the business and bolstering its financial position during the unprecedented circumstances posed by the coronavirus pandemic.

Real estate investment companies manage a portfolio of real estate assets to generate returns for their shareholders. Like many other companies in the sector, British Land continued to face unprecedented challenges in the wake of Covid-19 pandemic. The property manager company has a unique and world-class portfolio of real estate assets along with a strong financial position.

The company valuing the importance of the dividend to its shareholders has decided to resume dividend pay-out despite the coronavirus crisis. The company is expected to make dividend payments once in six months and shall announce them in its interim or final results. The company has set its dividend pay-out at 80 per cent of its Underlying Earnings Per Share (EPS). Notably, the company intends to make dividend payment in November 2020.

Since 1 October 2020, 86 per cent of BLND’s stores are open. The Company has been witnessing consistent improvement in footfall since the re-opening of non-essential retail in June with footfall in September recorded at 84 per cent in contrast to the previous year. The like-for-like retail sales in September stood at 90 per cent of the same period previous year. The company has outperformed the benchmark (ShopperTrak UK National Footfall Index) in terms of footfall, which was 21 per cent ahead.

British Land’s business riding high on Retail Parks

Nearly half of the retail assets portfolio of the company comprises of retail parks. These commercial spaces have played a pivotal role in getting revenue streams for the company in the post-lockdown era. The company is doing really well at these locations.

The success of these retail parks concept can be attributed to a shift in consumer shopping habits. The unprecedented surge in online shopping, convenient return policies and Click & Collect service has been a major driving force in the success of these retail parks. Moreover, these retail parks are very affordable to retailers and are well equipped to support mission-based shopping. The trend of shopping at open-air locations is catching up rapidly as they support social distancing protocols and can be conveniently accessed through cars.

The company’s footfall in its retail parks during September was close to 90 per cent, in contrast to the same period last year. The stores witnessed encouraging trading performance in sales on a like-for-like basis.

Also read: The Plight of High Street Retailers Amid the Covid-19 Crisis

Encouraging rent recovery by British Land

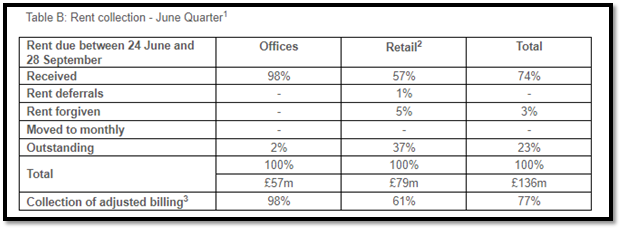

The company witnessed an increase in rent collection for the quarter ended June 2020 with around 74 per cent of the rent received by the real estate manager.

(Source: Company’s filings, LSE)

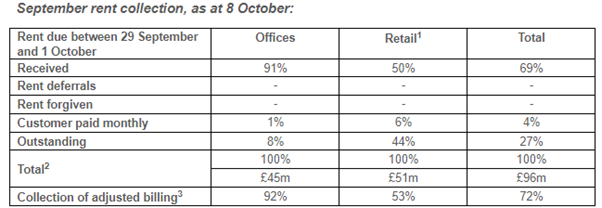

The company witnessed encouraging rent collection for September quarter as well. A total of £96 million rent comprising of £45 million in Offices and £51 million in Retail was due for payment at September end. So far, the company has managed to collect 69 per cent of the total amount due.

(Source: Company’s filings, LSE)

The commercial property landlord has successfully completed the sale of £245 million of retail property. British Land is also committed to deliver a net-zero carbon portfolio by 2030. With the prevailing uncertainties in the economy with respect to Brexit and coronavirus pandemic, the company needs to take a cautious approach in handling its commercial property range. The trading environment and economic outlook remain highly uncertain in the near term. From January till date, BLND shares were down by more than 40 per cent.

Most of the other commercial property owners are facing similar issues such as delay in rent recovery. UK based leading property group, Land Securities Group Plc (LON:LAND) has recovered nearly 62 per cent of rent due in September from their commercial assets.

The High street retail and businesses have been severely impacted during the crisis. Despite the lockdown being lifted, the footfall is not at the levels of the pre-pandemic era. In addition, as the pandemic is likely to continue, shoppers are refraining themselves from making non-essential purchases. Sector experts suggest that commercial leases are likely to become shorter by one year. Notably, an average lease lasts for six years in the UK. Shortening of leases could translate to lesser certainty over future cash flows and occupancy rate, which could put the commercial property owners in a tight spot.

For commercial property managers, sale, or lease of the property to retailers was the bread and butter before the coronavirus pandemic took a toll on the global economy. The shift to online shopping has burdened the high-street retailers with higher operating costs. These costs are translating to delay in rent payments. Moreover, geopolitical risks such as Brexit along with novel coronavirus can severely impact the business model of the real estate investment companies and might also lead to several job redundancies. The commercial property market is expected to remain sluggish in the near term.