Summary

- IG Group Holdings Plc had reported a record increase of 67% year-on-year in its net trading revenue during H1 FY21 ended on 30 November 2020.

- The profit before tax had witnessed an excellent jump of 129% during the period.

- The Group had declared an interim dividend of 12.96 pence per share to be paid on 25 February 2021.

- The Company had 238,600 number of active clients as of 30 November 2020.

IG Group Holdings Plc (LON:IGG) is the FTSE 250 listed financial stock. The Company is the UK-based provider of the online trading platform. IGG’s shares have generated a return of about 20.98%.

The Company will announce Q3 FY21 trading update in March 2021.

Business Model

The OTC (over the counter) leveraged derivatives market helped clients to make money by investing without owing any security. The Company has around 176,000 active clients base worldwide as of FY20 with its footprint in 17 countries. The Company generates its revenue out of the client’s transaction fees, and the business is driven by the volume of client trading activity. As per the revenue generation, the operations can be classified into three categories -

- OTC Leveraged Derivatives accounted for 95% of FY20 revenue.

- Exchange-traded derivatives represented 3% of FY20 revenues.

- Share dealing and Investments contributed 2% of FY20 revenues.

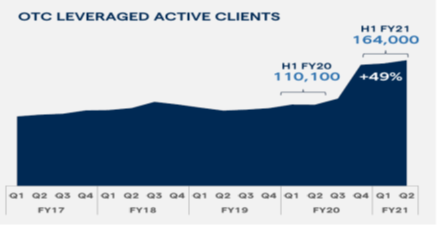

The OTC leveraged clients base has reached 164,000 as of 30 November 2020.

(Source: Company presentation)

Acquisition Update (as of 21 January 2021)

On 21 January 2021, the Company had announced the proposed acquisition of tastytrade Inc for the total consideration of USD 1.0 billion consisting of USD 300 million of cash and total 61 million shares of IGG Group worth USD 700 million. The transaction would support the Company to increase its footprint in the US region. The US market is the largest derivatives trading market in the world. tastytrade was founded in 2011 and engaged in trading education and offering sophisticated brokerage services to the client base across the U.S.

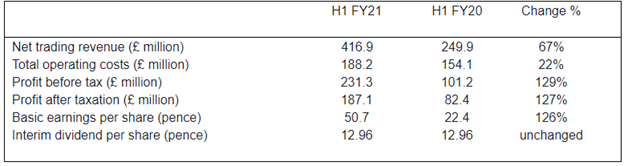

H1 FY21 Financial Highlights (for 26 weeks period ended 30 November 2020, as on 21 January 2021)

(Source: Company result)

- The Company had achieved a significant rise of 67% in net trading revenue to £416.9 million during H1 FY21 ended on 30 November 2020 driven by the management’s strategic growth objectives.

- Similarly, the profit before tax had also witnessed a record jump of 129% to £231.3 million reflecting excellent trading performance and efficient cost management during the period.

- The basic earnings per share were 50.7 pence for the period while it was 22.4 pence for the prior year’s comparative period.

- Based on the resilient financial performance, the Group had declared an interim cash dividend of 12.96 pence per share to be paid on 25 February 2021.

- The Company’s cash balance had reduced by £63.0 million and stood at £423.2 million as of 30 November 2020 compared to £486.2 million as of 31 May 2020. The decline in cash was utilized to fund the margin requirement of the broker.

- The Group had £2,458.0 million of the clients’ money in its account as of 30 November 2020.

- The Company had maintained a significant capital ratio of 32.3% as of 30 November 2020 reflecting the robust capital base.

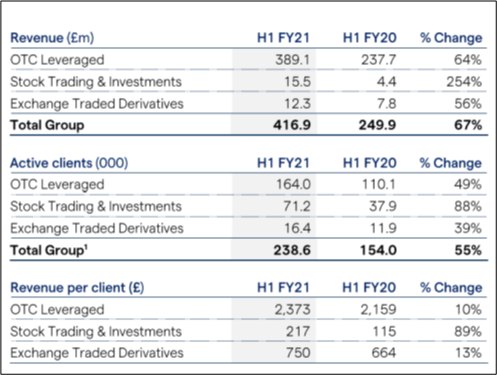

Segmental Update (as of 21 January 2021)

(Source: Company result)

- The Company had shown a robust jump of around 55% in the number of active clients as it had 238,600 active clients base as of 30 November 2020 compared to 154,000 clients as of 30 November 2019 reflecting the elevated level of client acquisition activities throughout the six months.

- The Company had added 33,300 new clients in Stock Trading & Investments segment. The revenue per client had seen exceptional growth of 89% from £115 per client during H1 FY20 to £217 in H1 FY21 boosted by the advantageous market conditions.

- The Company had generated around £12.3 million of revenue during the period from Exchange-traded derivatives out of which £10.2 million was achieved through Nadex and £2.1 million through European MTF which was launched during October 2019.

- The asset under management remained at £2.4 billion as of 30 November 2020.

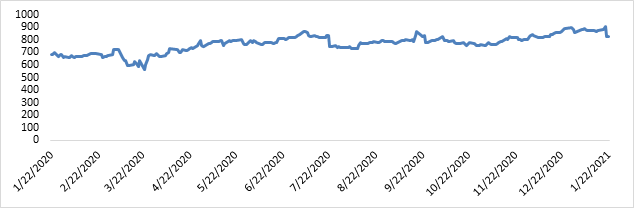

Share Price Performance Analysis of IG Group Holdings Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of IG Group Holdings Plc were trading at GBX 813.00 and were down by close to 1.69% against the previous closing price as on 22 January 2021, (before the market close at 08:30 AM GMT). IGG's 52-week High and Low were GBX 919.50 and GBX 534.22, respectively. IG Group Holdings Plc had a market capitalization of around £3.06 billion.

Business Outlook

The Company had provided proper financial guidance for FY21, and it is well-positioned to sustain a record level of growth achieved during the first half to continue for H2 FY21. The underlying operating expenses excluding of variable remuneration was projected to grow by 3% during FY21. The variable remuneration was anticipated to remain on the same lines during H2 FY21 as for H1 FY21. The Company had announced £10 million investment to spend towards enhancing its technology and advancement of operations. The Company had shown tremendous financial growth during H1 FY21 by spending a large chunk of the amount in marketing activities towards the acquisition of new clients, and it would continue to do the same during the remaining half of 2021. The recently announced acquisition of tastytrade Inc would expand the Company into US Futures & Options trading market, which is the largest market of this industry. The Company has tremendous potential to penetrate US markets further and record attractive client acquisition growth.