Hargreaves Lansdown PLC (HL) is a Bristol-based provider of investment management products and services to private investors in the UK. The company's investment platform gives investors the flexibility to choose from a wide range of investments and also issues recommendations about which managers to back to an army of retail investors.

Its flagship service, Vantage, is a direct-to-private investor fund and wrap platform which enables clients to hold and manage their investments. In addition to offering externally managed investment products, it manages funds through its own range of multi-manager funds and Portfolio Management Service.

Dragged into the deepening crisis at Neil Woodford's investment group, the company's share fell on Tuesday by around 6% by early afternoon in London. On Monday, redemptions from Equity Income Fund, Mr Woodford's flagship fund, was suspended. The fund had underperformed since early 2018, and clients had withdrawn their money on a net basis for 23 consecutive months, which prompted Neil Woodford's decision on Monday to block withdrawals from his Equity Income Fund.

Mr Woodford was long promoted to an army of retail investors by Hargreaves. At the end of last year, the company's customers owned 31 per cent of the Equity Income Fund. At the end of March, the company had invested around £700 million in Woodford Equity income through six of its own-brand funds, while also recommending the troubled fund manager to more than 1.1m customers. At the end of March, out of Mr Woodford's £10.1bn in assets, Hargreaves' customers owned around £2 billion. The company had been one of the most prominent backers of Mr Woodford and the flagship fund along with Income Focus Fund was removed by Hargreaves from its Wealth 50 list of recommended funds on Monday only, prompting investors' anger towards the stockbroker.

Emma Wall, head of investment research at Hargreaves, noted that when the fund begins trading again, and a true net asset value emerges, the value of the fund will be based on the value of the underlying holdings which could result in a significant drop in customers' values. She accepted that investors would be concerned by the developments and the company continue to review the situation. She added that trading of the company's multi-manager funds would not be affected. Shore Capital analyst Paul McGinnis said that shareholders in Hargreaves feared the company might lose business as its reputation among retail investors might suffer. The company might be blamed by investors and move their money to another investment manager.

According to market analysts, Hargreaves' business created a potential conflict as it was in a position where it couldn't sell the funds from the multi-manager portfolios without hurting the clients to whom the company had recommended those funds. Investors have no certainty about the length of the redemption freeze, with no guidance on timing and listed companies with deep links to the prominent fund manager felt the contagion as their share prices declined on Tuesday.

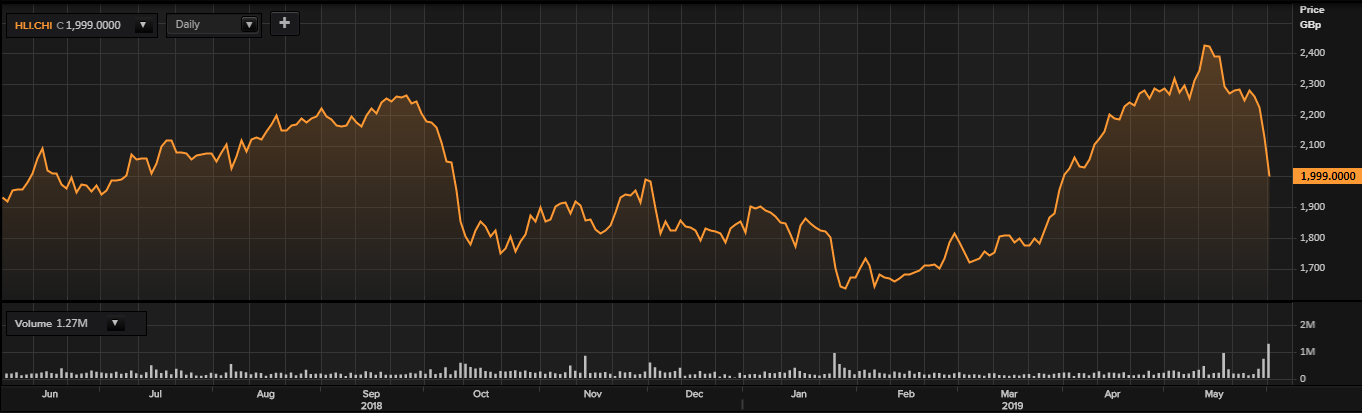

Share Price Commentary

Daily Chart as at June-05-19, before the market closed (Source: Thomson Reuters)Â

On 5th June 2019, at the time of writing (before the market closed, GMT 3:45 pm), HL shares were trading at GBX 1,999, down by 5.92 per cent against the previous day closing price. Stock's 52 weeks High and Low is GBX 2,447.33/GBX 1,622. The companyâs stock beta was 1.29, reflecting more volatility as compared to the benchmark index. Total outstanding market capitalisation was £10.06 billion, with a dividend yield of 1.52 per cent.