UK Market News: The UK stock market bounced on Friday to recover most of the last session’s losses. The blue-chip FTSE100 index was up by over 3%. The benchmark index is supported by some strong cooperate earnings announcements today, like Evraz Plc (+25.04%) and Pearson Plc (+12.07%).

Eurasia Mining Plc (LON: EUA): The metal and mining company was up by over 51%, with a day’s high of GBX 14.50 after the company issued a statement that the new sanctions did not impact its business operation, and it continues to operate normally.

Darktrace Plc (LON: DARK): The cybersecurity firm was up by over 14%, with a day’s high of GBX 416.60. The company’s stock is up by over 26% since Monday amid positive news of acquisition this week. The company has entered into a definitive agreement to acquire Cybersprint, an attack surface management company.

Evraz Plc (LON: EVR): The metal and mining company’s share was up by over 25%, with a day’s high of GBX 245 after the company reported an upbeat financial result for 2021. Its total segment revenue increased by 45.2% to USD 14,159 million, with a net profit of USD 3,107 million.

US Markets: The US market is likely to extend gains of the last session with a positive start, tracking the global market and as indicated by the futures indices. S&P 500 future was up by 20 points or 0.47% at 4,304, while the Dow Jones 30 future was higher by 0.41% or 146 points at 33,303. The technology-heavy index Nasdaq Composite future was up by 0.54% at 14,046 (At the time of writing – 8:50 AM ET).

US Market News:

The movie theatre operator, Cinemark (CNK), was up by over 3% in premarket trading after the company reported upbeat business performance in the last quarter. The company’s revenue was above the market expectation due to the opening of theatres after an ease in restrictions.

The cryptocurrency exchange firm, Coinbase (COIN), was down by over 2% despite the company reporting higher quarterly revenue, which was above the market forecast. The share prices came under pressure despite good quarterly performance as the company expects lower transactions volume amid volatility in the cryptocurrency market.

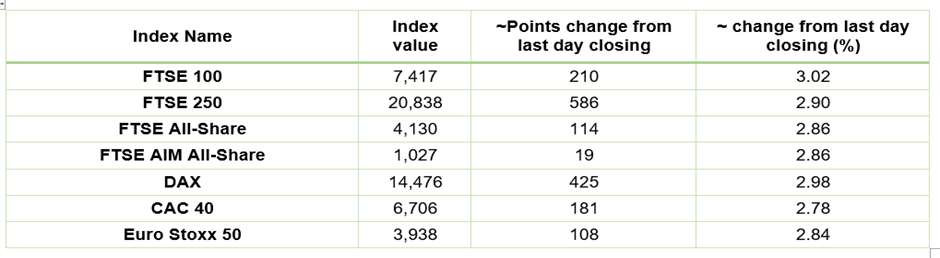

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 25 February 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), BP Plc (BP.), Rolls-Royce Holdings Plc (RR.)

Top 3 Sectors traded in green*: Real Estate (4.65), Utilities (4.61%), Financials (4.49%)

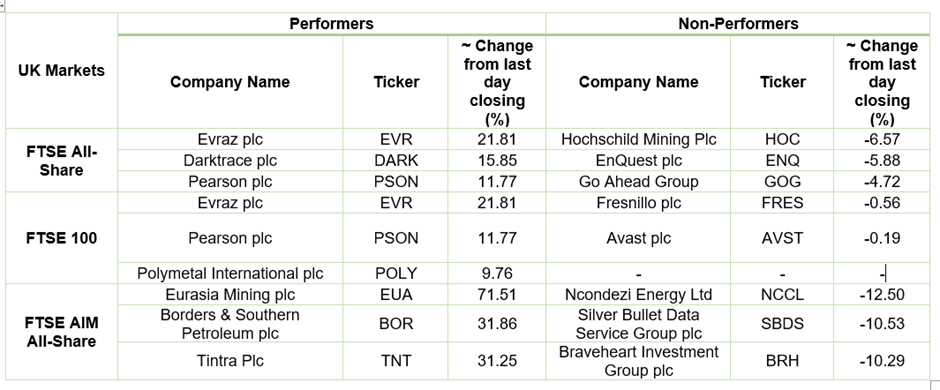

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $94.72/barrel and $92.40/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,890 per ounce, up by 1.87% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.3383; EUR to USD: 1.1226.

Bond Yields*: US 10-Year Treasury yield: 2.000%; UK 10-Year Government Bond yield: 1.4605%.

*At the time of writing