UK Market: The UK stock market rebounded from last session’s fall on Tuesday amid upbeat investor sentiments following the news that the Russian troops positioned on the Ukraine border will return to their bases after completing drills. The blue-chip FTSE 100 index moved higher by around 0.80%, while the mid-cap focused FTSE250 index was up by 1.1%.

IP Group Plc (LON: IPO): The private equity firm’s share was up by over 3.5%, with a day’s high of GBX 100.40. The stock saw buying interest from investors after yesterday’s announcement that two of the portfolio companies (Bramble & First Light Fusion) successfully raised funding during the investment round.

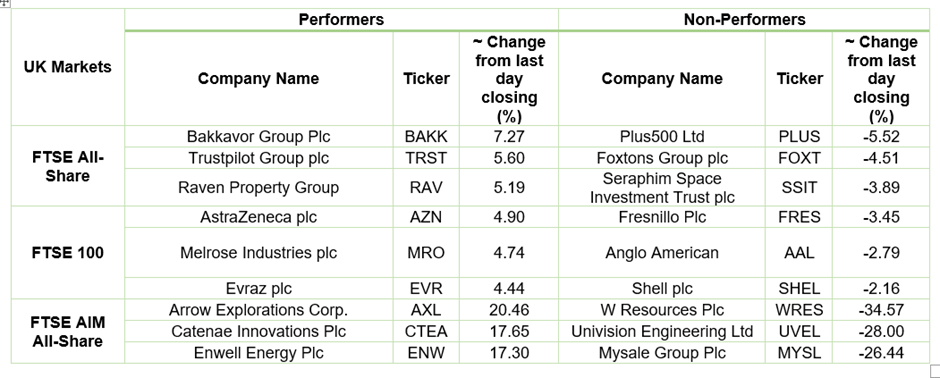

Plus500 Ltd (LON: PLUS): The financial sector company that operates an online trading platform was down by over 6 %, with a day’s low of GBX 1,416.50. The stock price was down after the company announced its full-year results for the year ended 31 December 2021. The overall revenue was down by 18% to USD 718.7 million.

Red Rock Resource Plc (LON: RRR): The AIM-listed metal and mining company was up by over 22%, with a day’s high of GBX 0.68 after the company gave a positive update about the drilling program carried out at its Luanshimba copper-cobalt project located in the Democratic Republic of Congo.

US Markets: The US market is likely to start in positive territory as indicated by the futures indices and positive cues from the global stock market following ease in Russia-Ukraine tensions. S&P 500 future was up by 56 points or 1.30% at 4,450, while the Dow Jones 30 future was up by 1.01% or 347 points at 34,820. The technology-heavy index Nasdaq Composite future was up by 1.78% at 14,506 (At the time of writing – 8:50 AM ET).

US Market News:

The chip-making company, Tower Semiconductor (TSEM), was up by over 44% after the US semiconductor giant Intel Corp. announced a USD 5.4 billion takeover deal to buy the company. Tower Semiconductor makes a wide variety of chips for its clients from different industries like medical and automotive.

The networking software and services company, Arista Networks (ANET), was up by over 10% in premarket trading after positive quarterly earnings. The company’s revenue was better than the market forecast.

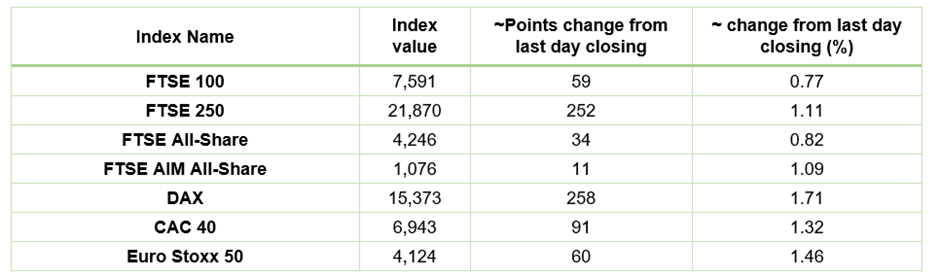

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 15 February 2022)\

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Glencore plc (GLEN), Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Healthcare (3.34%), Industrials (1.72%), Technology (1.64%)

Top 2 Sectors traded in red*: Energy (-1.56%), Basic Materials (-0.14%)

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $94.23/barrel and $93.08/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,853 per ounce, down by 0.85% against the prior day closing.

Currency Rates*: GBP to USD: 1.3548; EUR to USD: 1.1353.

Bond Yields*: US 10-Year Treasury yield: 2.033%; UK 10-Year Government Bond yield: 1.5770%.

*At the time of writing