Summary

- With the official cash rate on hold at 0.25% until March 2021, and interest rates expected to drop below 0 by the end of this year, mortgage rates have fallen to an all-time low amid COVID-19.

- Heartland Bank has announced the lowest home loan rate in the history of NZ, with a 1-year fixed loan rate of 1.99% and fixed 2-year, as well as the 3-year rate of 2.35% and 2.45%, respectively.

- The Bank had trialled with a digital platform in March 2020, where customers could apply and get approval without making any appointments, broker visits, etc and it has now been 100% launched.

- First home buyers have become more active and borrowed $1.34 billion in new mortgages in August 2020, up 45.6% compared to August 2019, with the falling mortgage rates being the main driver of the same.

Coronavirus outbreak has caused mortgage rates in NZ to drop to all-time lows. Major banks are announcing low interest rates to boost up the economy and prompt Kiwis to spend more.

Mortgage rates have been dropping since April and have now fallen below 2% for some borrowers amid COVID-19 impact. The move comes on the backdrop of historic low-interest rates and the possibility of a negative cash rate by the end of 2020.

ALSO READ: Banks raise an alarm as RBNZ Governor prepares for Negative Interest Rate

Mortgage interest rates are affected by several factors like developments in domestic, and global fixed-interest markets, official cash rate and other effects on bank funding, as well as quantitative easing.

DO READ: RBNZ keeps rates unchanged, shows a mark of confidence?

The main motive behind low mortgage rates is to make more money available to customers to repay debt or aid the broader NZ economy.

Heartland Bank announced the lowest mortgage rate in NZ history

Heartland Bank has declared the lowest home loan rate in the history of New Zealand. The Bank has announced a 1-year fixed loan rate at 1.99%, with home loan rates dropping below 2% for the first time. It has also revealed 2-year or 3-year fixed-term options for 2.35% and 2.45% respectively.

INTERESTING READ: October Financial Stability Review: Banks Performing Better Than 2008 GFC

While the 1-year fixed-rate has fallen by 90 bps (basis points), 2-year and the 3-year rates have declined by 62 bps and 94 bps, respectively. Further, the Bank has also cut its floating rate to 2.95%, down 1% from the previous rate.

Heartland Bank has created a digital home loan platform through which people will apply for the home loan online. The Bank had trialled with the idea of providing digital home loan offer in March 2020, where customers could get the approval without going through the physical process involving making appointments, visiting broker, etc.

In this trial, all the funds available were authorised within a month of the platform launch, indicating that their "do it yourself" online offering had a market interest.

For the eligibility to obtain home loans of Heartland Bank, customers must:

- Be refinancing or buying a standalone house on a single segment in a major NZ centre

- Have a deposit or equity of minimum 20%

- Have an intention to live in a home

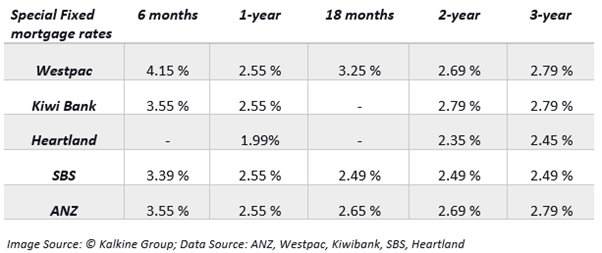

ASB, BNZ, Westpac, and Kiwibank are all advocating a fixed 1-year rate of 2.55%.

SBS bank has also stepped into a fight for mortgage market share, giving a lead of 16 bps, 20 bps and 30 bps for 18 months, 2 years and 3 years over the major banks.

Let’s have a look at the fixed mortgage rates on offer by key banks that are as follows:

Jeff Greenslade, Heartland’s Chief Executive Officer emphasised the value of its digitalisation strategy and funding flexibility provided by its structure, while announcing 2020 financial results of the Bank.

He stated that digitalisation implied a low onboarding cost that can be passed to borrowers and implies speed. Customers do not have to go through the lengthy application process and can receive answers within minutes through this platform.

ALSO READ: With interest rate at an all-time low, how are Businesses managing their debt funding?

Mr Greenslade also informed that the offer will be available for a limited time and is unavailable for new-build projects. It will put additional pressure on other banks of NZ to reduce their home loan rates.

First home buyers more enthusiastic amid falling mortgage rates

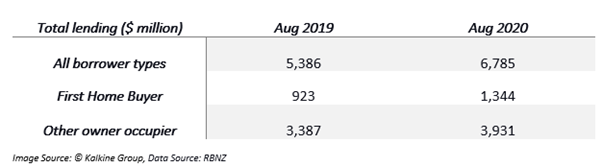

As per the latest figures of RBNZ, first home buyers have borrowed $1.34 billion in new mortgages in August, up 45.6% on $923 million of new mortgages taken out in August 2019. They are also taking a more significant market share, accounting for 19.8% of all new residential mortgage lending in August 2020 compared to 17.1% in August 2019.

The continuing drop in mortgage interest rates has been the main driver of the high market share of first home buyers, with the average of the standard 2-year fixed rates offered by major banks falling to 2.72% in August 2020 to 3.70% last year.

However, the elimination of loan-to-value ratio restrictions on new mortgage lending that made it simpler for borrowers to get a mortgage with just 10% deposit (less than the standard 20% deposit earlier), had less effect on the market.

(NOTE: Currency is reported in NZ Dollar unless stated otherwise)