Highlights

- Whitehaven Coal Limited (ASX:WHC) has produced 5% more coal in its third quarter relative to the same quarter in FY21.

- Despite a fall in the company's total managed coal sales, the miner is committed to delivering its FY22 guidance.

- The Company aims to deliver a strong final quarter from Maules Creek and an improved production rate at Narrabri.

A leading producer of premium-quality coal, Whitehaven Coal Limited (ASX:WHC) has produced 5% more coal in its third quarter (ended 31 March 2022) relative to the previous corresponding period (pcp). In a market update released on Wednesday, the Company stated that its March quarter managed saleable coal production stood at 4.5Mt, up 50% from the previous quarter.

The significant announcement by the coal player comes at a time when Russia’s invasion of Ukraine and unprecedented economic sanctions by the Western allies on Russia have thrown the global energy market into chaos. The world’s top consumers are trying to find ways to fulfil the supply gaps caused in the energy market due to Russian coal embargoes.

Good read : Whitehaven (ASX:WHC) slashes output forecast, shares drop on ASX

However, the current turmoil is not the only reason for skyrocketing coal prices; the markets were already tight even before Russia invaded Ukraine due to the high demand for coal in generating electricity amid soaring natural gas prices in Europe and Asia in late 2021.

Whitehaven is on track to deliver FY22 guidance

Despite a fall in the Company’s total managed coal sales to ~4.7 million tons, from ~4.8 million tons in the same period last year, the miner is committed to delivering its FY22 guidance.

Image source: Copyright © 2022 Kalkine Media®

For lower sales, WHC blames a tight labour market, COVID-related absenteeism, and wet weather events that slowed operations and disrupted rail and port activities during the quarter.

Good read: YAL, WHC, BHP: 3 ASX-listed stocks on the rise as coal prices soar

At the same time, the Company’s Managed Sales of Purchased Coal also tumbled by a whopping 62% during the quarter, falling from 569 tons in the pcp to 218 tons. Managed run-of-mine (ROM) coal production during the quarter stood at ~5.2Mt.

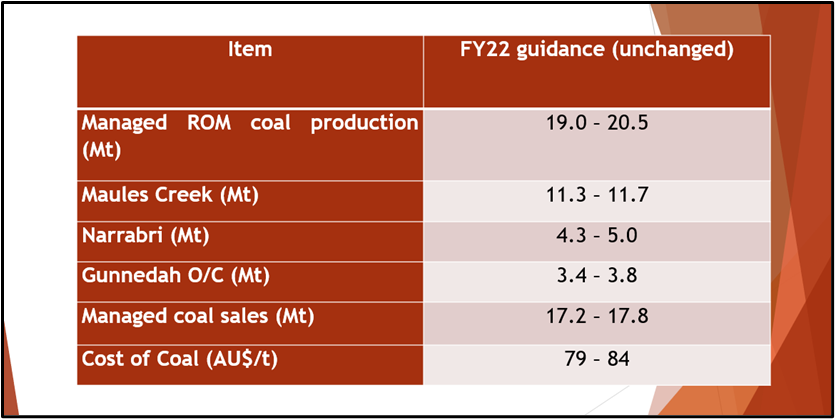

FY22 Guidance

In order to meet the FY22 ROM production guidance, the Company expects to lift June quarter ROM production to a range of 5.4Mt-6.9Mt. The Company aims to deliver a strong final quarter from Maules Creek and an enhancing production rate at Narrabri.

Source: © 2022 Kalkine Media® | Data Source: Company announcement (20 April 2022)

Furthermore, the Company also expects the cost of coal to be towards the upper end of the unit cost guidance range due to higher diesel prices, increasing labour costs, and increased demurrage costs as a result of weather impacts at the Port of Newcastle.

Must Read: Coal prices firm up amid Russia-Ukraine war, ASX mining share advances 20% in 5 days

Bottom Line

Australia’s Whitehaven Coal has logged a significant decline in its Q3 coal sales due to a tight labour market, COVID-related absenteeism, and wet weather events. However, the Company is committed to achieving its FY22 guidance.

WHC stock settled at AU$4.800 on 20 April 2022.