Summary

- Cannabis stocks noted a growth in trading activities in the wake the advancement in the COVID-19 vaccine trials and Democrat Joe Biden’s presidential victory in the US.

- Aphria Inc stocks climbed over 50 per cent year-to-date and nearly 76 per cent in the last six months.

- Canopy Growth stocks rebounded by almost 85 per cent in the last nine months since the March lows.

While the onset of the coronavirus pandemic put a dent on the growth trajectory of cannabis stocks around the months of March and April, most of them have since posted notable recovery. Especially with the advancement in the COVID-19 vaccine trials and Democrat Joe Biden’s presidential victory in the US, most cannabis companies noted quite a spike in their trading activities around November.

With all that in mind, here is a list of pot stocks to keep in mind for 2020.

Aphria Inc (TSX:APHA)

The trending stocks of Canadian pot company Aphria Inc climbed over 50 per cent year-to-date (YTD). The shares had tumbled sharply amid the pandemic-triggered March market crash but have since risen by nearly 76 per cent in the last six months.

In the light of the progress in COVID-19 vaccine manufacture, Aphria stocks shot up about 82 per cent in the month of November. However, the scrips slumped by about seven per cent by the second Friday in December.

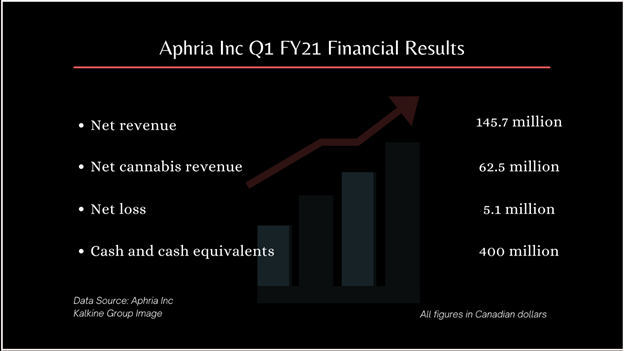

Aphria, which closed the acquisition deal of SweetWater Brewing Company in November, recorded a 16 per cent year-over-year (YoY) growth in its net revenue of C$ 145.7 million in Q1 FY21. Its net cannabis revenue rocketed by 103 per cent YoY in the latest quarter.

Canopy Growth Corporation (TSX:WEED)

Stocks of Canopy Growth Corporation, which are also trending high on the TSX, are up nearly 24 per cent this year. Having dropped to its lowest level in 2020 during the March lows, the scrips rebounded by almost 85 per cent in the last nine months and by over 56 per cent in the last six months.

Canopy Growth, which moved its US stock exchange listing to Nasdaq from the NYSE in November, accumulated an average trading volume of 1.58 million in the last 10 days and that of 2.34 million over the past month.

The Canada-based pot company’s net revenue grew from C$ 76.6 million in Q2 FY2020 to C$ 135.3 million in the second quarter of fiscal 2021.

Cronos Group Inc (TSX:CRON)

While their value is up by only about two per cent YTD, Cronos Group stocks shot up nearly 37 per cent in the last nine months since the March meltdown. The scrips climbed almost 48 per cent in the last three months and about 66 per cent int November.

Its 10-day average share trading volume stands at 2.19 million.

Cronos Group currently records a return on equity (ROE) of 5.7 per cent and a return on assets (ROA) of 4.81 per cent, as per the TMX data.

Village Farms International Inc (VFF)

Ranked high among trending consumer stocks on the TSX, Village Farms International surged by nearly 54 per cent this year. The company, which runs agricultural greenhouse facilities in Canada, saw its stocks shoot up about 58 per cent in the last six months.

Stocks of Village Farms jumped over 140 per cent in the month of November.

Village Farms International’s subsidiary Pure Sunfarms received the Cannabis Research License from Health Canada in November, allowing it to perform human administration trials for sensory assessment of marijuana.

Green Thumb Industries Inc (CSE: GTII, GTII:CNX)

Listed on the Canadian Securities Exchange (CSE), stocks of Green Thumb Industries Inc skyrocketed over 118 per cent this year. Since deflating around the March market collapse, the stocks ballooned by about 303 per cent in the last nine months.

The shares grew by about 53 per cent in the last three months and around 125 per cent in the last six months.

Green Thumb Industries currently have a market cap of C$ 4.96 billion, as per the data on the TMX Group.