Summary

- Probability of new Covid variant attacking, travel restrictions bog down market enthusiasm

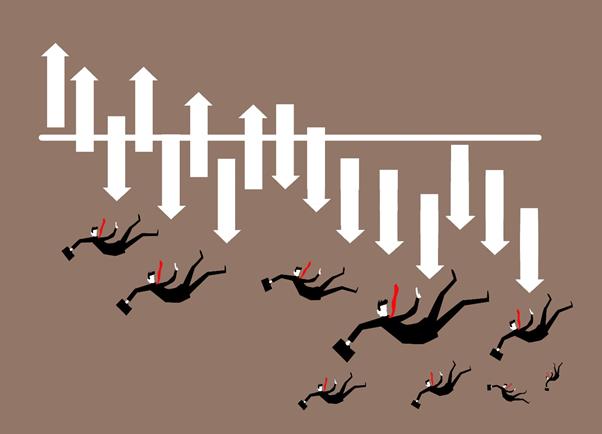

- North American benchmarks ended in red after weeks of modest gains

- Upcoming US policy announcements will have significant impact

A mini stock-bubble seen in the North American markets in mid-January may seem to have proved short-lived. It contrasts with what many market-gazers would have expected, especially when most company earnings reports were in the positive and a new US presidency echoing friendly sentiments.

Factors to Consider

Several factors may have contributed to this fading enthusiasm in the markets. The COVID-19 situation has once again appeared to have worsened with the discovery of new variants of the virus.

Countries in the Northern Hemisphere are already mulling tighter controls on domestic and cross-border movements. Coupled with the delay in the rollout of some key vaccines, the stress is palpable.

Besides, the Biden administration’s $1.9 trillion economic stimulus plan may take more time to see the light of the day, especially when he is seeking bipartisan support for passing the bill.

Several friction points concerning the bill are beginning to emerge that include opposition voices from both sides of the anvil, primarily whether the government should go on a deficit spending in a time of great economic stress weighing on the country.

President Biden has proposed to give additional financial support to American households reeling under the pandemic. He has also allocated a significant amount for the revival of the small-and-medium businesses across the country, which he hopes will create more jobs for the common citizens.

While most Republican and Democratic lawmakers support his intent, they differ on the provisions. Some have suggested a targeted intervention rather than a broad financial outlay. Also, increasing the amount of relief pay-out to American households would put additional pressure on the fiscal deficit.

As this is being sorted out, markets would closely keep an eye on Washington. The early the politicians arrive at a decision, the early the cloud of uncertainty would lift from the markets.

The pandemic is another important area of concern for the markets. Canada has reported thousands of new cases of infections over the weekend, further grounding the fears of a new variant of the virus.

Most Canadian lawmakers on Tuesday favored stringent rules for air and road travel, including visits to foreign countries. And the government is expected to renew some of the earlier provisions.

The US too is not behind. It has made Covid testing compulsory for all domestic flyers, and international visitors must produce Covid certification in advance for entry into the country.

The Centre of Disease Control and Prevention (CDS), which is coordinating the US anti-Covid efforts, said that it has stepped up efforts to screen all new infections.

@Kalkine Image 2021

What Happened Yesterday?

Amid the uncertainties, all major stock exchanges in the US and Canada ended the session lower on Wednesday despite witnessing amazing rallies of major tech, healthcare, pot, and consumer stocks.

The S&P 500 was down by nearly 3 percent, Dow Jones by 2 percent, S&P/TSX (2 percent), Nasdaq (nearly 1 percent), and NYSE nearly (3 percent). However, the US dollar has seen the highest increment since last November on Wednesday, while the Treasury yields fell.

The S&P 500 saw its worst performance since October, with a fall of 2.6 percent. Wednesday’s market sentiments may have been partly affected by the Federal Reserve Bank’s decision to keep the interest rates unchanged, which seemed varying from Biden’s promise of attractive rates to boost lending and economic activities.

It led to intensive selloffs across most sectors, though some stocks, such as GameStop Corp. and AMC Entertainment Holdings Inc., remained in a safer zone as far as price movement goes.

Canada’s benchmark TSX also saw a significant drop in numbers, at nearly 2 percent, following some modest gains over the past two weeks.

The upcoming policy announcements of the respective governments would be critical to how North American markets react in the coming weeks.