Download Sample Report: https://www.alliedmarketresearch.com/request-sample/12112

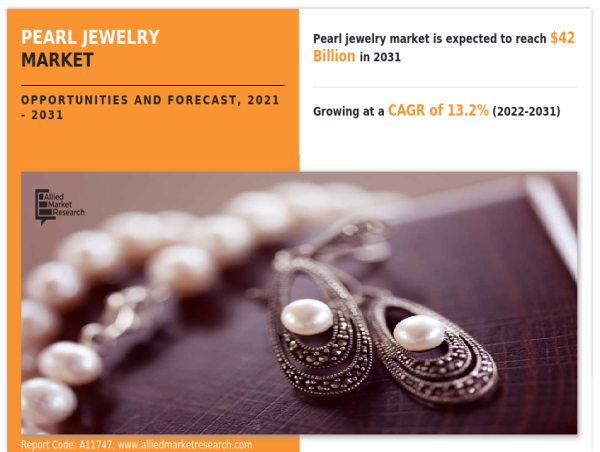

Necklaces, earrings, rings, and other items are available in the pearl jewelry market. Pearl jewelry is created by embedding a pearl into a piece of jewelry, either alone or in conjunction with other stones, whereas pearl necklaces may include a piece of metal completely surrounded by pearls. The study does not cover the various colors of pearls because the color of the pearl is not always guaranteed during the manufacturing process.

The general public has a lot of misconceptions about cultured pearls. The market is hampered by the uncertainty surrounding cultured pearls. To mimic the natural event of pearl formation, cultured pearls are produced by inserting a pearl grain into pearl-creating mollusks. The term cultured refers to a pearl that was created by human involvement rather than found naturally. Customers are discouraged from buying these pearls because this term creates the negative perception in their minds that pearls formed through human interference are not genuine pearls. Many customers confuse cultured pearls with imitation pearls, which are different stones that look like pearls but have multiple distinguishing features that distinguish them from real pearls, thus limiting the pearl jewelry market size.

Pearl cultivation is the process of inserting seeds into mollusks in hopes of imitating the pearl formation process. Consequently, there are some challenges associated with cultured pearl production. The life of the mollusks, the quality of the water, and the length of time of pearl production all have an impact on cultured pearl production. Fresh water pearl cultivation is less difficult; however, over-cultivation causes environmental damage and lessens pearl quality, negatively impacting pearl production.

The pearl jewelry market is segmented on the basis of type, material, pearl nature, pearl source, distribution channel, and region. By type, the pearl jewelry market is classified into necklace, earrings, rings, and others. Depending on material, the market is categorized into gold, silver, and others. By pearl nature, the market is divided across cultures and natural. By pearl nature, the market is divided across fresh water and salt water. According to the distribution channel used for the sale of pearl jewelry, the market is segmented into offline channels and online channels. By region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, United Arab Emirates, South Africa, and the Rest of LAMEA).

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂: https://www.alliedmarketresearch.com/checkout-final/8c19941d39f44f418ceb87b0e4cb5d69

Necklaces accounted for the majority market share of the pearl jewelry market, and rings segment is expected to grow at a CAGR of 13.8% during the forecast period, owing to its fresh styles and cutting-edge metal bands and rings created by engaged stakeholders in the market. Silver segment held the highest market share in 2021 while the others segment is expected to have the highest growth during the forecast period owing to the increase in various different types of metals in pearl jewelry production. Cultured pearls held the highest market share in 2021 and are expected to maintain their dominance in the market in the future. Fresh water pearls held the highest market share in 2021 and saltwater pearls are expected to have significant growth in the market.

According to region, Asia-Pacific held the largest share of the market in terms of revenue in 2021, which represented more than two-fifths of the pearl jewelry market revenue, while Europe is expected to experience the fastest CAGR of 14.2% from 2022 to 2031, as pearls are widely used in the European fashion jewelry industry and can be found in a variety of jewelry items.

The players operating in the pearl jewelry market have adopted various developmental strategies to increase their pearl jewelry market share, gain profitability, and remain competitive in the market. The key players operating in the pearl jewelry market analysis include- K. Mikimoto & Co., Ltd., T&CO., Isle of Wight Pearl, Pearl Paradise, Kailis, Jewelmer, CPI Luxury Group Assael, TASAKI & Co., Ltd., Pearl Falco., Wing Wo Hing Jewelry Group, Akuna Pearls, Pearl Jewelry.

"𝙀𝙣𝙜𝙖𝙜𝙚𝙙 𝙢𝙖𝙧𝙠𝙚𝙩 𝙨𝙩𝙖𝙠𝙚𝙝𝙤𝙡𝙙𝙚𝙧𝙨 𝙖𝙧𝙚 𝙘𝙤𝙣𝙨𝙩𝙖𝙣𝙩𝙡𝙮 𝙨𝙚𝙚𝙠𝙞𝙣𝙜 𝙩𝙤 𝙘𝙧𝙚𝙖𝙩𝙚 𝙞𝙣𝙣𝙤𝙫𝙖𝙩𝙞𝙫𝙚 𝙙𝙚𝙨𝙞𝙜𝙣𝙨 𝙩𝙤 𝙨𝙪𝙞𝙩 𝙩𝙝𝙚 𝙛𝙖𝙨𝙝𝙞𝙤𝙣 𝙞𝙣𝙙𝙪𝙨𝙩𝙧𝙮'𝙨 𝙚𝙘𝙡𝙚𝙘𝙩𝙞𝙘 𝙩𝙖𝙨𝙩𝙚 𝙥𝙖𝙡𝙚𝙩𝙩𝙚𝙨 𝙖𝙨 𝙬𝙚𝙡𝙡 𝙖𝙨 𝙘𝙤𝙣𝙨𝙪𝙢𝙚𝙧𝙨 𝙡𝙤𝙤𝙠𝙞𝙣𝙜 𝙩𝙤 𝙥𝙪𝙧𝙘𝙝𝙖𝙨𝙚 𝙥𝙚𝙖𝙧𝙡 𝙟𝙚𝙬𝙚𝙡𝙧𝙮 𝙛𝙤𝙧 𝙛𝙖𝙨𝙝𝙞𝙤𝙣 𝙖𝙘𝙘𝙚𝙨𝙨𝙤𝙧𝙞𝙚𝙨. 𝙈𝙖𝙣𝙪𝙛𝙖𝙘𝙩𝙪𝙧𝙚𝙧𝙨 𝙖𝙧𝙚 𝙘𝙤𝙢𝙗𝙞𝙣𝙞𝙣𝙜 𝙙𝙞𝙛𝙛𝙚𝙧𝙚𝙣𝙩 𝙘𝙤𝙡𝙤𝙧𝙨 𝙤𝙛 𝙥𝙚𝙖𝙧𝙡𝙨 𝙩𝙤 𝙘𝙧𝙚𝙖𝙩𝙚 𝙘𝙤𝙡𝙤𝙧 𝙘𝙤𝙣𝙩𝙧𝙖𝙨𝙩𝙨 𝙖𝙣𝙙 𝙜𝙞𝙫𝙚 𝙖 𝙙𝙞𝙫𝙚𝙧𝙨𝙚 𝙘𝙤𝙡𝙤𝙧 𝙙𝙞𝙢𝙚𝙣𝙨𝙞𝙤𝙣 𝙩𝙤 𝙩𝙝𝙚 𝙟𝙚𝙬𝙚𝙡𝙧𝙮 𝙞𝙩𝙚𝙢𝙨. 𝙄𝙣𝙘𝙧𝙚𝙖𝙨𝙚𝙙 𝙤𝙣𝙡𝙞𝙣𝙚 𝙖𝙙𝙫𝙚𝙧𝙩𝙞𝙨𝙞𝙣𝙜 𝙗𝙮 𝙥𝙚𝙖𝙧𝙡 𝙟𝙚𝙬𝙚𝙡𝙧𝙮 𝙢𝙖𝙣𝙪𝙛𝙖𝙘𝙩𝙪𝙧𝙚𝙧𝙨, 𝙖𝙨 𝙬𝙚𝙡𝙡 𝙖𝙨 𝙧𝙖𝙥𝙞𝙙𝙡𝙮 𝙞𝙣𝙘𝙧𝙚𝙖𝙨𝙞𝙣𝙜 𝙘𝙤𝙣𝙨𝙪𝙢𝙚𝙧 𝙠𝙣𝙤𝙬𝙡𝙚𝙙𝙜𝙚 𝙖𝙗𝙤𝙪𝙩 𝙙𝙞𝙛𝙛𝙚𝙧𝙚𝙣𝙩 𝙩𝙮𝙥𝙚𝙨 𝙤𝙛 𝙥𝙚𝙖𝙧𝙡𝙨, 𝙬𝙞𝙡𝙡 𝙘𝙤𝙣𝙩𝙧𝙞𝙗𝙪𝙩𝙚 𝙩𝙤 𝙢𝙖𝙧𝙠𝙚𝙩 𝙚𝙭𝙥𝙖𝙣𝙨𝙞𝙤𝙣 𝙞𝙣 𝙩𝙝𝙚 𝙛𝙪𝙩𝙪𝙧𝙚."

𝐊𝐞𝐲 𝐟𝐢𝐧𝐝𝐢𝐧𝐠𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐬𝐭𝐮𝐝𝐲:

○ The necklace segment held the largest market share in 2021, capturing almost fifty percent of the global pearl jewelry market revenue, and the rings segment is expected to grow at the fastest rate during the forecast period.

○ By material, the silver segment claimed the biggest share of the market in 2021, contributing to nearly half of the global pearl jewelry market revenue, while the others category is expected to grow at the fastest CAGR during the forecast period.

○ By pearl nature, the cultured segment accounted for the largest share in 2021 and is also predicted to have the highest growth during the forecast period.

○ By pearl source, the freshwater segment accounted for the largest share in 2021, and the saltwater segment is expected to portray the largest CAGR during the forecast period.

○ By distribution channel, offline channels held the largest market share in 2021 and online channels are expected to have the highest growth.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/12112

𝐊𝐞𝐲 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐅𝐨𝐫 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬:

○ This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pearl jewelry market analysis from 2021 to 2031 to identify the prevailing pearl jewelry market opportunities.

○ The market research is offered along with information related to key drivers, restraints, and opportunities.

○ Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

○ In-depth analysis of the pearl jewelry market segmentation assists to determine the prevailing market opportunities.

○ Major countries in each region are mapped according to their revenue contribution to the global market.

○ Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

○ The report includes the analysis of the regional as well as global pearl jewelry market trends, key players, market segments, application areas, and market growth strategies.

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 "𝐀𝐌𝐑 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬:

○ U.S. Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/u-s-pearl-jewelry-market-A95450

○ UK Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/uk-pearl-jewelry-market-A95454

○ Canada Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/canada-pearl-jewelry-market-A95451

○ Mexico Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/mexico-pearl-jewelry-market-A95449

○ Europe Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/europe-pearl-jewelry-market-A95452

○ Spain Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/spain-pearl-jewelry-market-A95453

○ Italy Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/italy-pearl-jewelry-market-A95455

○ Germany Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/germany-pearl-jewelry-market-A95456

○ France Pearl Jewelry Market Opportunity Analysis and Industry Forecast, 2022-2031

https://www.alliedmarketresearch.com/france-pearl-jewelry-market-A95457

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()