Highlights

- Tax liabilities spike: ATO review raises Perpetual’s estimated tax liabilities for KKR deal from AU$106M–$227M to AU$493M–$529M.

- Shareholder returns dip: Expected cash proceeds per share drop to AU$5.74–$6.42 from AU$8.38–$9.82.

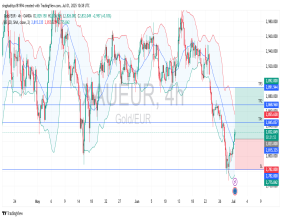

- Market impact: Shares fall 9.7% to AU$19.785, marking the biggest intraday drop since July 2023.

Perpetual Ltd (ASX:PPT) saw its shares tumble nearly 10% on Tuesday after the Australian Taxation Office (ATO) withheld a binding ruling on its deal to sell its wealth management and corporate trust businesses to KKR & Co (NYSE:KKR). The ATO’s stance, which could potentially invalidate the tax benefits of the transaction, significantly raises the deal’s tax liabilities, casting doubt on its viability.

Revised Tax Liabilities and Shareholder Impact

Perpetual now estimates that taxes and duties tied to the deal will range between AU$493 million and AU$529 million, a sharp increase from its earlier projection of AU$106 million to AU$227 million. This change slashes the expected cash proceeds per share to AU$5.74–$6.42, down from the previously anticipated AU$8.38–$9.82.

Following this announcement, Perpetual's shares plunged 9.7% to AU$19.785, their lowest since late July 2023, making it the biggest loser on the ASX 200 index.

Company and Analyst Reactions

Perpetual expressed its disappointment, stating that it disagrees with the ATO's position. “Perpetual considers it has strong grounds to dispute this position ... Perpetual and KKR are engaging to consider the potential impact on the transaction,” the company said.

However, analysts at Citi pointed out that the tax ruling significantly erodes the deal’s appeal. According to Citi, it now seems unlikely that an independent expert would recommend the deal as being in shareholders' best interest, and a shareholder vote may not proceed.

Citi further noted that Perpetual’s options could include retaining its businesses and seeking a new buyer for the entire company, including its asset management segment.

Outlook for Perpetual

The ATO ruling has cast serious doubt on the completion of the Perpetual-KKR deal in its current form. With significant tax leakage and reduced shareholder returns, Perpetual faces the challenge of re-evaluating its strategic options.

If the transaction fails to proceed, the company may need to explore alternative approaches, including keeping the business intact or finding a new buyer for its combined operations.