Considering the current situation, it is quite evident that the Covid-19 pandemic disease has hit hard everyone- individuals, businesses and economies. However, governments are taking all the measures to address the impact, including stimulus packages and social distancing measures. Moreover, businesses are also coming up with several initiatives and measures to minimise the impact on their growth.

In this article, we are discussing few stocks listed on ASX that have recently released significant market updates.

Magellan Financial Group Limited (ASX: MFG)

Magellan Financial Group Limited (ASX: MFG) is engaged in funds management for ANZ and global institutional investors. Its goal is to offer international investment funds to retail and high net worth investors.

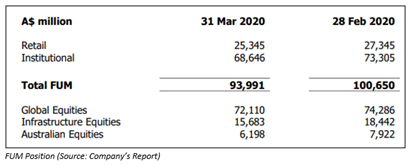

March FUM Position - The Company recently notified the market with its FUM position for March 2020 and outlined the following:

- As at 31st March 2020, the total funds under management stood at $93.99 million as compared $100.65 million at 28th February 2020.

- Moreover, the Company witnessed net inflows amounting to $469 million for the month. This includes net retail outflows of $303 million and net institutional inflows of $772 million.

The stock of MFG was trading at $48 per share on 7th April 2020 (AEST 02:30 PM), indicating a rise of 1.053% from its previous closing price. As on same date, the total outstanding shares stood at 182.28 million. During the span of three months and six months, the stock of MFG has provided shareholders with returns of -19.95% and -4.43%, respectively.

SEEK Limited (ASX: SEK)

SEEK Limited (ASX: SEK), which officially got listed on Australian Stock Exchange in 2005, is the operator of online employment classifieds and education and training.

Business Update - As per a company announcement dated 6th April 2020, all the markets in which SEK operates have experienced a material economic impact of COVID-19 government measures. Consequently, the Company withdraw its anticipations for employment businesses (excluding Zhaopin).

- Considering the material uncertainties in the operating environment, short-term forecasts are extremely challenging.

- SEK witnessed an increase in declines in rate of billing as march 2020 progressed which coincided with phased government restrictions in response to the Virus.

- On the outlook front, it expects near-term economic challenges to impact its short-term profitability. SEEK anticipates its long-term focus to unlock large new revenue pools as well as create significant long-term shareholder value.

- Due to the fear from COVID-19, the Company has deferred payment of interim dividend until 23rd July 2020.

The stock of SEK was trading at $15.010 per share on 7th April 2020 (AEST 02:38 PM), indicating a rise of 5.038% against its previous closing price. As on same date, the total outstanding shares stood at 352.06 million. During the span of three months and six months, the stock of SEK has provided shareholders with returns of -36.63% and -31.50%, respectively.

Caltex Australia Limited (ASX: CTX)

Caltex Australia Limited (ASX: CTX) is involved in the purchase, refining, distribution and marketing of petroleum products. The Company also operates convenience stores.

Impacts of COVID-19 & Financial Position - The Company is committed to take necessary actions to ensure the health of its people, protect its assets and market-leading position, and optimise cashflows in the current challenging environment caused by COVID-19.

- CTX expects impact on refining conditions for several months, owing to the global fuel demand erosion caused by COVID-19.

- The Company reviewed its aviation business and undertook early action with respect to stranded costs, which cover changes to its on-airport operations as well as deferral of capital investments.

- CTX possesses a strong investment grade credit rating with Moody’s and S&P. CTX has committed debt facilities of around $2.7 billion from several high-quality financiers, with undrawn committed facilities and cash amounting to around $1.5 billion.

The stock of CTX was trading at $24.460 per share on 7th April 2020 (AEST 02:50 PM), indicating a decline of 0.204% against its previous closing price. As on same date, the total outstanding shares stood at 249.71 million. During the span of three months and six months, the stock of CTX has provided shareholders with returns of -28.67% and -3.43%, respectively.

Oil Search Limited (ASX: OSH)

Oil Search Limited (ASX: OSH) is in the exploration, development and production of oil & gas resources. Its 98% assets are in Papua New Guinea.

Trading halt/capital raising update - Securities of the Company have been placed under a trading halt, as it is expecting to release an announcement related to capital raising. Its securities would be in halt until the earlier of commencement of trading on 14th April 2020 or the release of announcement.

According to a company announcement dated 6th April 2020, OSH intends to raise up to US$700 million via the issue of approximately 552 million new ordinary shares. Proceeds of the raise would be directed towards strengthening the Company’s balance sheet and boost liquidity, enabling OSH to withstand a prolonged period of low oil prices.

The Company is well-positioned to deliver its world-class growth projects in Papua New Guinea and Alaska when market conditions improve.

The stock of OSH last traded at $2.730 per share on 3rd April 2020. As on same date, the total outstanding shares stood at 1.52 billion. During the span of three months and six months, the stock of OSH has provided shareholders with returns of -63.55% and -61.06%, respectively.

Origin Energy Limited (ASX: ORG)

Origin Energy Limited (ASX: ORG) is in the exploration and production of natural gas, electricity generation, wholesale and retail sale of electricity and gas, as well as sale of liquefied natural gas.

Beetaloo JV arrangement update - ORG has agreed with JV partner Falcon Oil and Gas to boost its interest in the Beetaloo Basin JV by 7.5% to 77.5%. In exchange, the Company would increase its carry of Falcon’s share of costs by $25 million from $34 million to $59 million from Stage 2 onwards over the coming years.

Operational and financial update - The Company is focused on safely maintaining energy supply and reassuring customers in response to COVID-19. ORG would not disconnect any residential or small business customers in financial stress. As of now, it has not experienced any material impact on its energy supply operations, with customers continuing to receive reliable electricity, natural gas and LPG supply.

For FY20, the Company anticipates underlying EBITDA in the range of $1.4 billion to $1.5 billion, which is subject to any material increase in bad and doubtful debt provisioning associated with the changing economic conditions.

The stock of ORG was trading at $4.870 per share on 7th April 2020 (AEST 03:02 PM), indicating a decline of 1.616% against its previous closing price. As on same date, the total outstanding shares stood at 1.76 billion. During the span of three months and six months, the stock of CTX has provided shareholders with returns of -42.31% and -36.46%, respectively.

McGrath Limited (ASX: MEA)

McGrath Limited (ASX: MEA) is engaged in the facilitation of real estate sales and property management services.

COVID-19 update - In response to COVID-19, the Company’s priority is to safeguard health and well-being of its employees, agents and other contractors, in addition to clients and the wider community. MEA has implemented numerous cost-saving measures to address the potential financial impact of COVID-19 on the business.

- In order to reduce operating expenses, the Company has temporarily closed its certain offices. Agents have been redeployed to neighbouring offices.

- MEA has cancelled all discretionary expenditure and non-essential spend.

- Hiring freeze and minimisation of capex

- Remuneration reduction (40%) for CEO and Board of Directors for the coming months of May, June and July 2020, with salary reduction of 30% for some staff

Meanwhile, the Company has a strong balance sheet with approximately $10 million in cash and no debt.

The stock of MEA was trading at $0.190 per share on 7th April 2020 (AEST 03:06 PM), indicating an increase of 8.571% against its previous closing price. As on same date, the total outstanding shares stood at 166.85 million. During the span of three months and six months, the stock of MEA has provided shareholders with returns of -47.76% and -22.22%, respectively.