Highlights

The Australian share market opened modestly higher on Tuesday.

The ASX 200 rose 5.80 points to 6,858 at the open.

The index has lost 2% in the past five days and 8.91% in the last 52 weeks.

The Australian share market opened modestly higher on Tuesday despite a decline in European markets, while domestic investors await a decision by the Reserve Bank of Australia’s (RBA) on the cash rate at its monetary policy meeting today. According to analysts, the RBA may increase the official interest rate by 50 basis points to 2.35%.

The ASX 200 index rose 5.80 points to 6,858 at the open. The index has lost 2% in the past five days and 8.91% in the last 52 weeks.

The ASX All Ordinaries index rose 0.065% to 7,079.1, while the A-VIX fell 1.792% to 15.453 at the open. On Monday, the benchmark index ended 0.35% higher at 6,852.2 points.

The benchmark ASX 200 index was trading at 6,870.40, up 18.20 points, or 0.27%, in the first 10 minutes of the trade.

Meanwhile, Wall Street was closed on Monday for the Labor Day public holiday. In Europe, the Stoxx 50 fell 1.5%, the FTSE gained 0.1%, the CAC dipped 1.2%, and the DAX ended 2.2% lower after the UK named its new prime minister.

Market action

The two-year US Treasury yields was down 11.8 basis points at 3.404%. The yield on 10-year Treasury notes was down 6.6 basis points to 3.199%.

Data Source: ASX (as of 6 September 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

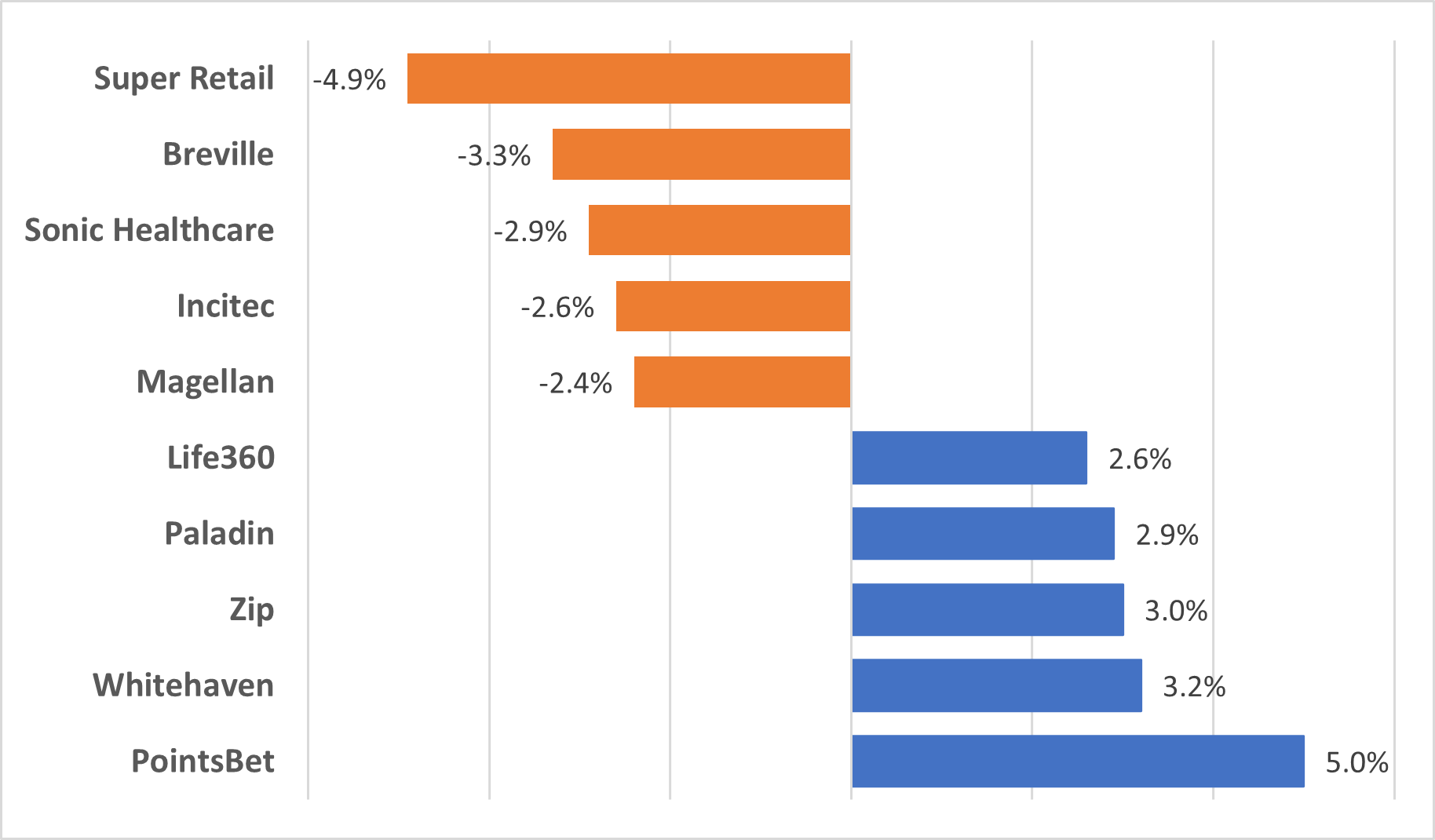

PointsBet was the top gainer, while Super Retail was the top loser. On the ASX, barring utilities and healthcare, all sectors were trading higher today. Metals & Mining was the top gainer, rising over 1.2%.

Newsmakers

- Airtasker announced the appointment of Mahendra Tharmarajah as its new chief financial officer (CFO).

- Magellan reported AU$1.3 billion of net outflows in August.

- According to BHP’s economic contribution report, the company contributed AU$79.3 billion to the Australian economy in FY2022.

- Hastings Tech Metals said it would raise AU$110 million via a two-tranche placement.