Highlights

- The ASX 200 benchmark index closed up today (5 September), gaining 0.34% to end at 6,852.20 points.

- Over the last five days, the index has lost 1.63% and it has plunged 8.92% over the last 52 weeks.

- Energy was the best performing sector today, gaining 3.97%, while telecom services was the worst performing sector, losing 0.90%.

Australian share market closed on a positive note today (05 September 2022) with the benchmark S&P/ASX 200 gaining 0.34% to end at 6,852.20 points.

Oil and gas producers gained along with bulk metal and coal miners. These helped the market in overcoming a weak lead from the US as it entered the Labor Day holiday weekend. The fall in bank and technology stocks, however, stifled the rise.

Key pointers from ASX close today

- The ASX 200 benchmark index closed up today, gaining 0.34% to end at 6,852.20 points.

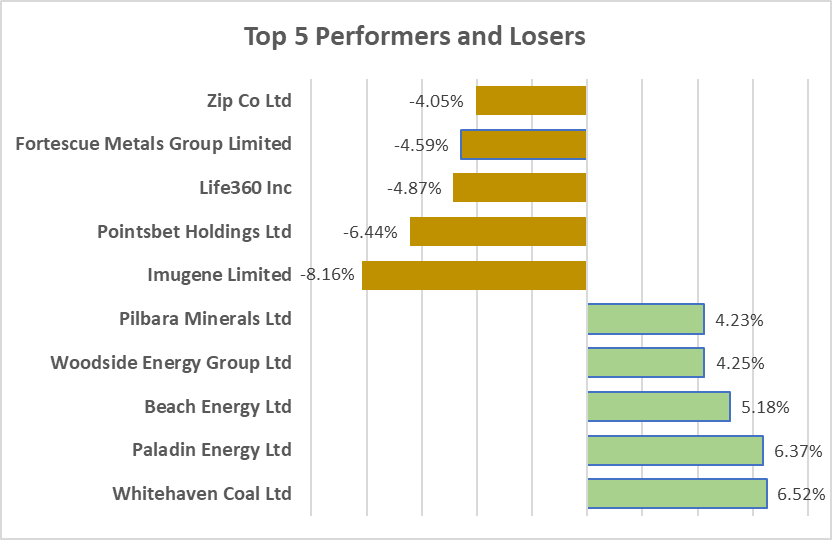

- Top performing stocks were Whitehaven Coal Ltd (ASX:WHC) and Paladin Energy Ltd (ASX:PDN), up 6.52% and 6.37% respectively.

- Bottom performing stocks in this index were Imugene Ltd (ASX:IMU) and Pointsbet Holdings Ltd (ASX:PBH), ending 8.16% and 6.44% lower respectively.

- Over the last five days, the index has lost 1.63% and 8.92% over the last 52 weeks.

- 8 of 11 sectors ended the day in red zone.

- Energy was the best performing sector today, gaining 3.97%, while telecom services was the worst performing sector, losing 0.90%.

- Volatility indicator A-VIX index was down 0.35% at 4.10 PM AEST.

- The All-ordinaries Index gained 0.26%.

Newsmakers

Recce Pharmaceuticals (ASX:RCE): Dr John Prendergast has been appointed Executive Chairman of Recce Pharmaceuticals, starting immediately.

Dr. Prendergast has a background in microbiology.

Meanwhile, shares of Recce closed trading 4.38% lower at AU$0.76 per share on ASX today.

Aurumin (ASX:AUN): Aurumin has revealed additional results from its reverse circulation (RC) and diamond drilling campaign at its gold project in Western Australia.

Meanwhile, shares of Aurumin ended flat at AU$0.12 apiece on ASX today.

Bond yield

Australia’s 10-year Bond Yield stands at 3.67% as of 4.18 PM AEST.

Image Source: © 2022 Kalkine Media ®

Data Source- ASX website dated 05 September 2022

In global markets

Wall Street indices fell on Friday, September 2, as investors reviewed the job report, while the European gas crisis heightened market players' concerns ahead of the long weekend.

The S&P 500 fell 1.07% to 3,924.26. The Dow Jones was down 1.07% to 31,318.44. The NASDAQ Composite lost 1.31% to 11,630.86, and the small-cap Russell 2000 fell 0.72% to 1,809.75.

According to the Labor Department's September 2 report, nonfarm payrolls increased 315,000 in August after a revised increase of 526,000 the previous month. The unemployment rate rose to a six-month high of 3.7% in August, the first increase since the first month of the year.

Wall Street will be closed tonight for Labor Day, providing investors with a brief breather from recent pressure.

In Asia, the Asia Dow was down 0.19%, the Hang Seng in Hong Kong decreased by 1.24%, Nikkei in Japan fell 0.12% while Shanghai Composite in China increased 0.078% at 4.20 PM AEST.

In commodities markets

Crude Oil WTI was spotted trading at US$88.67/bbl while Brent Oil was at US$95.26/bbl at 4.21 PM AEST.

Gold was at US$1711.39 an ounce, copper was at US$3.44/Lbs and iron ore was at US$98.00/T at 4.22 PM AEST.