Highlights

- Deep Yellow has proposed to acquire Vimy Resources to create a new global uranium player.

- Under the deal, Vimy shareholders will receive 0.294 DYL shares for each Vimy share.

- DYL shareholders will hold 53% of the merged group while Vimy shareholders will control 47%.

- The merger combines two world-class assets in Tier-1 mining jurisdictions with significant cash resources.

- The merged entity will have a highly credentialled uranium team with a proven track record.

Marking a significant milestone, Deep Yellow Limited (ASX:DYL| OTCQX:DYLLF) has entered into a Scheme Implementation Deed to acquire 100% of the issued share capital of Vimy Resources Limited (ASX:VMY|OTCQB:VMRSF).

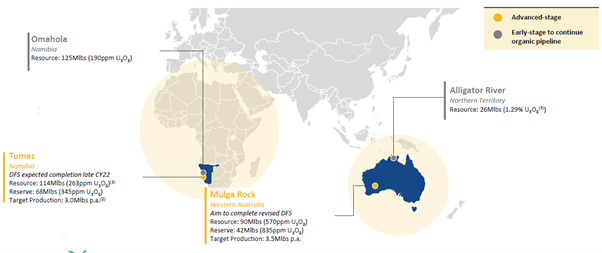

The merger is expected to create a new global uranium player with one of the world’s largest uranium Mineral Resource inventories of 389Mlbs. The merged group will operate two advanced, world-class assets, with annual production capacity potential of ~3.0Mlbs and 3.5Mlbs for Deep Yellow and Vimy, respectively. These uranium assets sit within Tier-1 uranium jurisdictions of Australia and Namibia.

What’s more, the combined entity with significant scale will also have a cash resource of AU$106 million.

Let us quickly glance through the key details of Deep Yellow’s proposed merger deal with Vimy Resources:

Value-creating opportunity for DYL and Vimy shareholders

Under the proposed deal, shareholders of Vimy will receive 0.294 new fully paid shares of DYL for each Vimy share. The transaction values each Vimy share at AU$0.285, which represents an 18.8% premium to the closing Vimy share price on 25 March 2022 and a 35.3% premium to the 30-day volume-weighted average price (VWAP), as of 25 March 2022.

Upon successful merger, DYL shareholders will own 53% of the merged group, while Vimy shareholders will control 47%.

The Board of Vimy has recommended the shareholders to accept the offer in the absence of any other superior deal. Moreover, Vimy Directors intend to vote in favour of the proposal.

Merged entity to have highly credentialled, proven uranium team

The merged group will have representatives from both companies. DYL’s Managing Director & CEO Mr John Borshoff, and Non-Executive Chairman Mr Chris Salisbury, will lead the new entity.

Vimy’s Managing Director & CEO Mr Steven Michael will join the new entity’s Board as Executive Director, while Mr Wayne Bramwell will join the merged group as Non-Executive Director. Also, the exploration, technical and environmental team of Vimy will transition to the merged group.

The re-organisation of the Board of the Merged Group is expected to be completed over the next 12 months as per the ASX Corporate Governance Principles and Recommendations.

Compelling opportunity to build a leading global uranium platform

The merger of Deep Yellow and Vimy is expected to create a leading independent uranium platform in Tier-1 uranium jurisdictions, positioned to become a supplier of choice to major utilities.

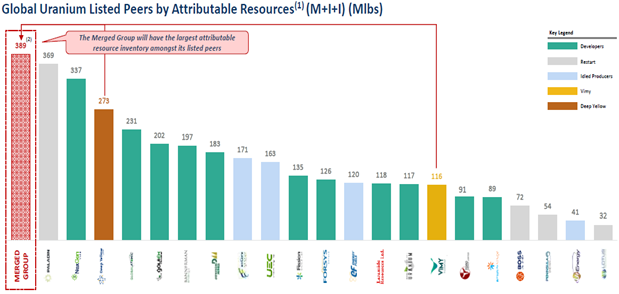

Global uranium listed peers by attributable resources (Image source: DYL update, 31 March 2022)

Significantly, the merged entity will have access to 389Mlb of attributable resource inventory – which is likely to be one of the largest in the world and the highest among its peers. DYL also highlighted benefits from the financial strength and stability of the combined platform.

DYL operates its flagship project in Namibia, while Vimy has its assets in Australia. Both are premium mining jurisdictions for uranium and would add diversity to the asset portfolio.

Image source: DYL update, 31 March 2022

The merged group is estimated to have a Pro-Forma Market Capitalisation of AU$658 million. The strong balance sheet of the merged group with cash and cash equivalents of ~AU$106 million and no debt as of 31 December 2021 would enable the Group to have more funding flexibility.

Also, the combined Board and Management team have deep experience in uranium exploration and marketing that would certainly help to capture a larger market share.

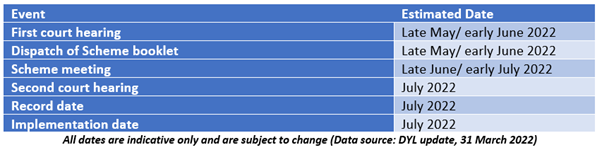

Key dates and indicative timetable

A scheme booklet will be circulated to all Vimy shareholders at a later stage. The booklet will contain information pertaining to the Scheme and the basis for unanimous recommendation of the Vimy Board. It will also contain an Independent Expert Report and other vital details of the Scheme for the shareholders.

sponsoreDYL shares were trading at AU$1.015 in the early hours of 1 April 2022.