Owner and operator of Westfield in Australia and New Zealand, Scentre Group (ASX: SCG) has introduced a new joint venture partner for a 50% interest in Westfield Burwood, Sydney. In an announcement made on 20 May 2019, the company has announced that Perron Group will be a new 50% joint venture partner in Westfield Burwood in Sydney.

Today, SCGâs stock price was slightly up by 0.26% during the intraday trade.

As per the announcement, Perron Group will pay $575 million for its interest, representing a 4.1% premium to Scentre Groupâs book value at 31 December 2018. It is expected that the proceeds will provide the Group with further capital to pursue the companyâs strategic objectives of creating long-term value for securityholders. The proceeds from the transaction will initially be used to repay debt.

According to Scentre Group CEO Mr. Peter Allen, this transaction is extending the companyâs long-standing relationship with the Perron Group into Westfield Burwood and it is highlighting the value of Scentre Groupâs extraordinary platform of 41 Westfield living centres.

Today, the company has also reaffirmed its forecast distribution for 2019 which is unchanged at 22.60 cents per security.

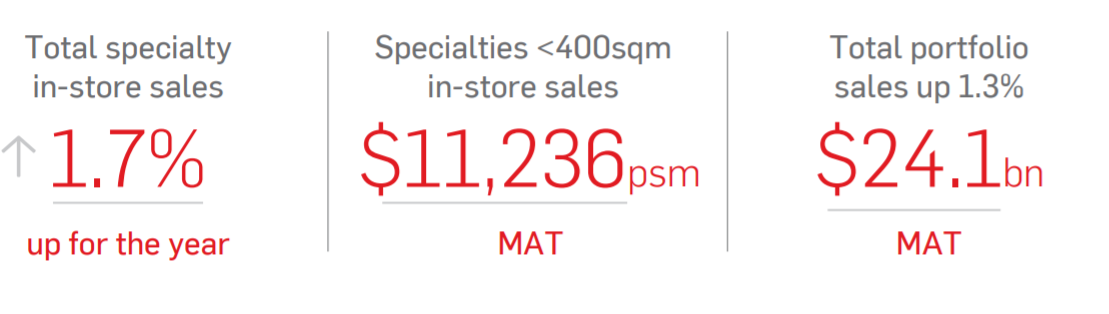

In 2019 March quarter, the companyâs total specialty in-store sales were up 1.5 percent for the quarter and 1.7 percent for the year.

Retailer In-Store Sales (Source: Company Reports)

Retailer In-Store Sales (Source: Company Reports)

In 2018, the company delivered strong financial results which were in line with its forecasts. During the year, the companyâs Funds from Operations increased by 3.9% to 25.24 cents per security, or $1.34 billion.

During the year, the company successfully completed over $1.1 billion of developments. Collectively these developments added more than 106,000 square metres of lettable area at Westfield Plenty Valley in Melbourne, Westfield Carousel in Perth, Westfield Tea Tree Plaza in Adelaide, Westfield Kotara in Newcastle and Westfield Coomera on Queenslandâs Gold Coast â Scentre Groupâs first greenfield development.

As at 31 December 2018, Scentre Groupâs portfolio comprised interests in 41 centres in Australia and New Zealand, of which the Scentre Group Trust 1 has a joint interest in 40 centres with a combined value of $19.7 billion. At the end of 2018, the company had assets under management (AUM) of $54.2 Bn and Group assets of $39.1 Bn.

Now, letâs have a glance at the companyâs stock performance and the return it has posted over the past few months. The stock is trading at a price of $3.850, up by 0.26% during the dayâs trade with a market capitalisation of ~$20.42 Billion as on 20 May 2019. In the last one year, the company shares decreased by 4.95% and in the last six months, the share prices decreased by 0.78% as on 17 May 2019. SCGâs shares last traded at $3.850 with a market capitalization of circa $20.42 billion as on 20 May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.