Highlights

- MyState is a diversified financial company that offers banking and wealth management services

- In FY23, the company registered an over 20% surge in net profit after tax and 33% growth in new customers

- The company expects to register customer deposits of more than 70% of funding in FY24

Established in September 2009, MyState Limited (ASX:MYS) is an ASX-listed diversified financial services company. The company offers trustee, banking and wealth management services nationwide via its retail brands – MyState Bank and TPT Wealth.

During the financial year 2023, the company registered record customer growth and net profit after tax. The period saw a 20.33% YoY surge in net interest income to AUD 132.60 million and a 20.31% increase in net profit after tax to AUD 38.5 million. The profit growth was underpinned by a 33% growth in new customers to 25,690 and a decline in the cost-income ratio by 440 basis points to 64%.

In FY23, the home lending portfolio increased by 14.1% to AUD 7.8 billion and customer deposits zoomed by 12.3% YoY to AUD 6.2 billion.

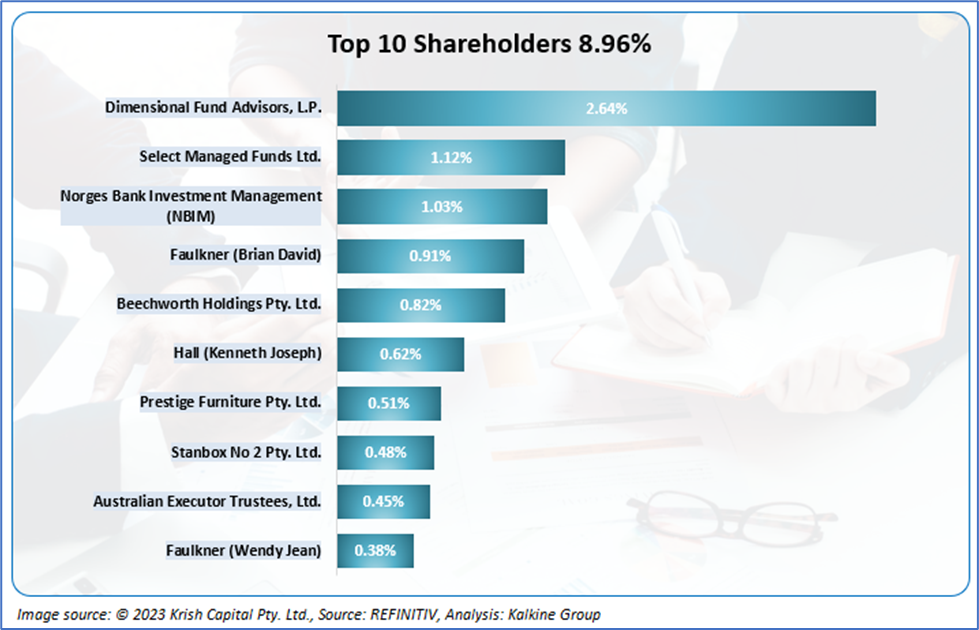

Top 10 shareholders of MYS

The top 10 shareholders of MYS together have around 8.96% shareholding in the company. Dimensional Fund Advisors, L.P. and Select Managed Funds Ltd hold the highest stake as they have ~2.64% and ~1.12% shareholding, respectively.

Recent business update

Through an ASX filing dated 4 September 2023, the company announced an update on the final dividend declared while sharing the 2023 full year results. The company informed that the DRP (dividend reinvestment plan) price applicable to the final dividend of AUD 0.115 apiece is AUD 3.201 per share, and the DRP securities will be issued on 19 September 2023.

Outlook

In FY24, the company intends to achieve lending growth of 2x the system and targets to achieve customer deposit growth of over 70% of funding.

MYS expects its cost-to-income ratio, earnings per share and return on equity to remain at par with FY23 levels.

Share performance of MYS

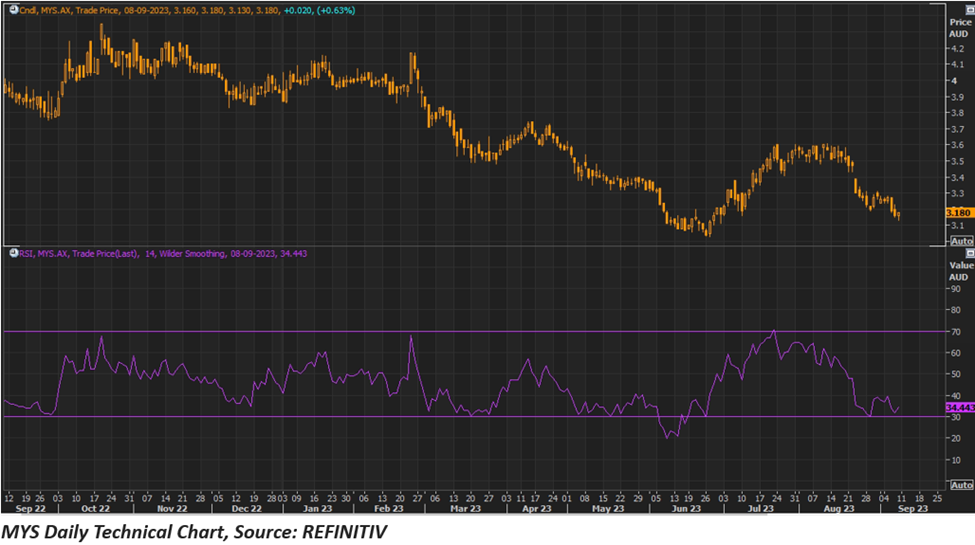

MYS shares closed 0.63% up at AUD 3.18 apiece on 8 September 2023 with a market cap of AUD 346.46 million. With this, MYS’ share price dropped by 19.49% in the last 12 months and gained almost 1.60% in the previous three months.

The 52-week high of MYS is AUD 4.35 apiece, recorded on 19 October 2022, and the 52-week low is AUD 3.03 apiece, recorded on 27 June 2023. Worth mentioning here is that the existing share price is 26.9% lower than its 52-week high.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 8 September 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.