Highlights

- Lynas is an ASX-listed rare earths material production company.

- The company is currently focused on its expansion program, which began two years ago.

- Post the expansion program, LYC expects to produce 12,000 tonnes from its Mt Weld project in FY25.

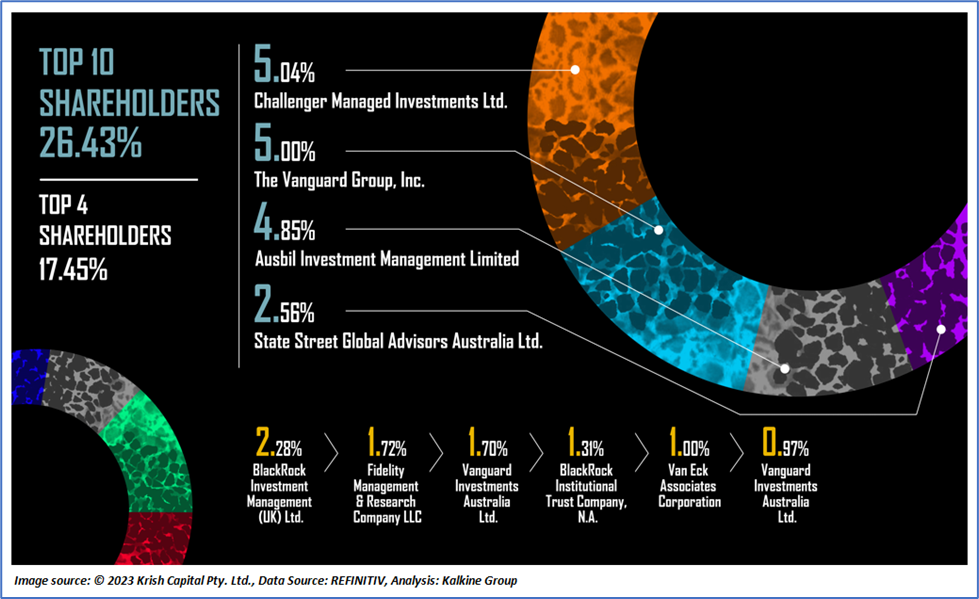

- Challenger Managed Investments Limited has the highest stake in LYC, with a shareholding of nearly 5.04%.

Lynas Rare Earths Limited (ASX:LYC) is a rare earth materials producer which operates the Lynas Mt Weld mine in Western Australia and a rare earths processing plant in Malaysia. The company exports its output to the United States, Europe and Asia manufacturing markets. The materials have applications in electric vehicles, high technology, wind turbines and turbines, among others.

Over the last two years, the company has focused on its expansion program, which comprises building a new Kalgoorlie Rare Earths processing facility and construction of new facilities in Kuantan to get mixed rare earth carbonate feedstock from Kalgoorlie and a significant upgrade to Mt Weld.

In the financial year 2023 (FY23), the company registered a 19.6% YoY fall in revenue to AUD 920.01 million and a 42.5% YoY decline in net profit after tax to AUD 540.80 million.

Top 10 shareholders of LYC

The top 10 shareholders of LYC have around 26.43% shareholding in the company, while the top four have 17.45% stake in the firm. Challenger Managed Investments Limited and The Vanguard Group, Inc. have the highest stake in the firm, with a shareholding of 5.04% and 5.00%, respectively.

Recent business update

On 1 August 2023, the company informed that it has entered into a follow on contract with the US Department of Defense (DoD) for building a heavy rare earths component of the Lynas US rare earths processing facility in Texas.

Presently, around USD 258 million of contribution by the US government has been allocated to the project, compared to USD 120 million announced in June 2022.

Outlook

FY23 witnessed an investment of AUD 595 million in capital projects, which is expected to bring operational efficiencies and support production. With the aim to meet customer requirements and take advantage of increased demand, multiple production ramp-ups were conducted by LYC.

The long-term demand outlook is promising as the global energy transition needs around USD 6 trillion worth of metal, five times more than today.

Moreover, the company ended FY23 with a strong balance, offering the certainty of completing its key growth projects.

Share performance of LYC

LYC shares closed 0.3% lower at AUD 6.68 apiece on 27 September 2023. With this, LYC’s stock price increased by 3.73% in the last six months and fell by 11.76% in the past one year.

The 52-week high of LYC is AUD 9.845 apiece, recorded on 1 February 2023, and the 52-week low is AUD 6.02 apiece, recorded on 6 April 2023. Noteworthy here is that today’s closing price is 32.15% lower than its 52-week high.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 27 September 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.