Gold explorer Magnetic Resources skyrocketed after the company announced massive growth in its gold targets zone. It outlines the positive daily price movement of as high as 52% in Magnetic Resourcesâ stock that is currently trading at $0.190 (7 January 2019; 2:21 PM AEST).

In todayâs market release, Magnetic Resources NL (ASX:MAU) announced that the gold geochemical target zone had been grown to significant 2KM in length at HN9. This comes after the company has undertaken an extensive 602 soil sampling programme which revealed a 2km long soil geochemical anomaly being between 50 to 200m wide and open to the north and south and is currently being further investigated over a 3.6km length.

Managing Director George Sakalidis commented that âWith the Australian gold price greater than $1,800 as compared to much lower prices between $400-$550 from 1986 to 2001 when previous companies drilled some parts of this HN9 gold zone, it now makes strong sense to fast-track drilling and potential economic studies of this significant 2km long gold target.â

This highly prospective gold zone is located just 10km NE of the Jupiter Operations owned by Dacian Gold Ltd at Laverton, Western Australia, and 15km NW of the Granny Smith Operations owned by Gold Fields Australia Pty Ltd.

As per the companyâs information, this 2km zone contains several anomalous soil sample results with 99 samples that are greater than 25ppb Au of which 32 samples are greater than 100ppb and 18 samples are greater than 200ppb. Moreover, the company intends its plan to take further 501 samples in January 2019 with the target to extend this anomalous zone up to 800m to the north and 800m to the south, totaling 3.6km in length.

Recently, the company has optioned a granted mining lease M38/1041 that extended 1.1km HN9 drill-mineralized zone by 400 meters to 1.5 km. Magnetic Resources stated that over a significantly combined 1.5km, there are now 45 gold intersections greater than 0.5g/t of which 17 are more significant than 1g/t which are within the 2km gold target zone outlined by the soil geochemistry.

The company further plans to release the pending results for 40-hole programme totaling 1655m. It was designed to test shallow down-dip extensions of the drilled gold mineralized shears which show potential for near-surface bulk tonnage mineralization over a significant 1.5km.

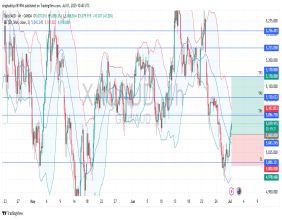

In todayâs trading session, MAU closed at $0.190. The stock has fallen by 35.90% over the past 12 months including a negative price change of 16.67% witnessed in the past three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.