Highlights

- Significant progress made in mineralogical and metallurgical testing for Kihabe-Nxuu..

- Initial findings suggest high-grade concentrates of gallium and germanium are achievable through flotation methods.

- Botswana's mineral potential in gallium, germanium, and vanadium pentoxide drive local energy solutions.

- Environmental Impact Assessment approved, paving the way for infill drilling at the Nxuu Deposit.

Mount Burgess Mining NL (ASX:MTB) made significant progress in the September quarter with mineralogical and metallurgical test work aimed at evaluating the potential benefits of the Kihabe-Nxuu Project, particularly regarding gallium, germanium, and vanadium pentoxide.

The company is advancing its polymetallic Kihabe-Nxuu project, located near the Namibian border in Western Ngamiland, Botswana. This work is being conducted through its wholly owned subsidiary, Mount Burgess (Botswana) Pty Ltd.

The Kihabe-Nxuu Project

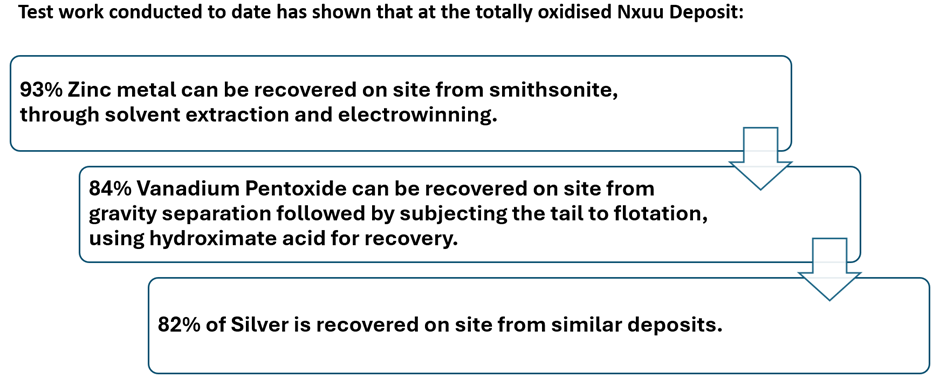

The Kihabe-Nxuu project has both oxide and sulphide mineralisation. The Nxuu Deposit is completely oxidised. In the Kihabe Deposit, the top one-third is oxidised, while the bottom two-thirds are sulphide. Oxide deposits have a distinct advantage as they are easier and more cost-effective to extract metals from compared to sulphide ores.

Data source: Company update

In 2024, preliminary metallurgical test work was conducted to develop an effective process flowsheet for extracting and recovering valuable minerals. Key activities included:

- Mineral assessment

- Diagnostic leach tests

- Size fraction analysis

- Heavy media separation

- Flotation test work

- Dual leaching process

Advantages of On-Site Mineral Processing

Current test work is focused on assessing the feasibility of recovering gallium and germanium on-site. Initial findings indicate that a significant portion of these critical minerals resides within micas, which can be effectively processed through flotation methods to yield a high-grade concentrate.

This breakthrough could position Botswana as a key player in the global supply of these essential minerals, particularly as they gain recognition from the US Geological Survey for their importance in various technological applications.

In addition to gallium and germanium, Botswana has the capability to produce vanadium pentoxide, further enhancing its potential in the mineral supply chain. Given the country's abundant sunlight, there is a promising opportunity to develop local VRF battery units for solar power storage. This initiative could empower rural communities by providing reliable energy solutions independent of a centralised grid, facilitating sustainable development and energy resilience in the region.

Recently, the company announced that the Department of Environmental Protection approved an Environmental Impact Assessment for infill drilling at the Nxuu Deposit. This assessment is a critical step towards estimating a Measured/Indicated Mineral Resource, which will then enable the company to estimate a Reserve for a Definitive Feasibility Study for advancing to mine planning and production.

Shares of MTB last traded on 23 October 2024 at AU$0.0010.