Highlights

- Cyprium Metals (ASX:CYM) has received firm commitments for a placement of 318.6 million shares at AU$0.11 per share to raise AU$35 million (before costs).

- The participants of the placement will get 1 attaching option for each share, with a two-year term and an exercise price of AU$0.15 per option.

- The proceeds from the placement will be used to fund the restart of the Nifty Copper Project.

- The placement and options will be completed in two tranches.

Cyprium Metals (ASX:CYM) has received firm commitments for AU$35.0 million via a placement of 318,636,364 fully paid ordinary shares to investors at AU$0.11 per share. The participants of the placement will get one free attaching option for every one share to be issued under the placement (Options).

Upon completion of the capital raising, the ASX-listed company will be able to start its construction plans as well as the production of copper metal plate on site in H1 2024.

According to the company, the restart project economics remain very robust and are further enhanced based on current copper prices of AU$13,000 per tonne which is above those applied in the Nifty Copper Project Restart Study.

Details of AU$35Mn Placement

Numerous sophisticated and professional investors, including new and existing high-quality domestic and offshore institutions have strongly supported the placement.

Cyprium Metals has announced that the options will be exercisable at AU$0.15 each on or before a date which is two years following the date of Cyprium shareholder approval. The company will seek quotation for the options. However, this remains subject to fulfilling some requirements of the listing.

The issue price of AU$0.11 per share marks a discount of about 18.5% on the last closing price of AU$0.135 as spotted on 31 January 2023.

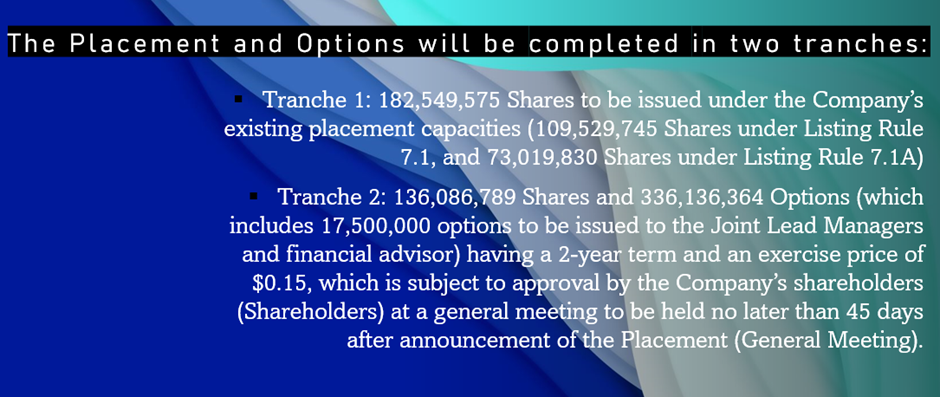

The placement and options will be completed in two tranches.

Data source: Company update; Image source: © 2023 Krish Capital Pty. Ltd.

The settlement of the Tranche 1 Placement is subject to fulfilment of binding commitments relating the Senior Secured Bond Issue with settlement of Tranche 1 to complete by 28 February 2023.

Under Tranche 2, there will be allocation of shares and options to the Directors of the company. These will be issued depending upon the shareholder approval at the General Meeting.

Euroz Hartleys Limited, Canaccord Genuity (Australia) Limited, and Evolution Capital have taken charge as the joint lead managers to the placement, while Longreach Capital is fulfilling the role of a financial adviser to the placement.

Placement proceeds to aid Nifty Copper Project Restart

Cyprium Metals plans to utilise AU$20 million of the placement funds to support its funding strategy for the restart of the Nifty Copper Project. The project restart is aimed at providing a sustainable, secure, and stable supply of copper metal at 25,000tpa.

The rest of the capital raised via the placement will be directed towards the costs of the capital raise, resource drilling, exploration activities, financing costs and usual working capital purposes.

Management commentary

Data source: Company update; Image source: © 2023 Krish Capital Pty. Ltd.