Highlights:

- Cyprium Metals (ASX:CYM) is riding high on a new arrangement with Transamine SA.

- The term sheet pertains to a copper cathode offtake secured prepayment facility.

- The offtake prepayment facility is part of a debt funding package of AU$240-260 million aimed at restarting the Nifty Copper Project.

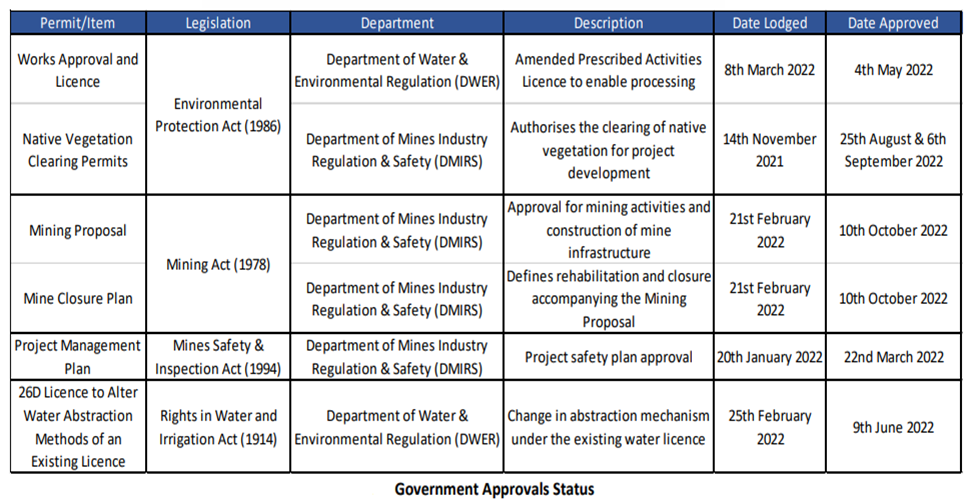

- Cyprium has received all the required regulatory approvals prior to financing.

Cyprium Metals (ASX:CYM) has updated on the execution of an exclusive term sheet with Transamine SA in respect of a copper cathode offtake secured prepayment facility.

The company highlighted that the offtake prepayment facility is part of an AU$240-260 million debt funding package for the Nifty Copper Project restart.

Indicative terms – Offtake and Prepayment Facility

As per the term sheet, the following are the conditions upon which Cyprium Metals have agreed upon:

(Source: © 2022 Kalkine Media®, data source: Company update, 22 December 2022)

The crucial terms of the copper cathode prepayment facility are

Indicative terms – Offtake

- During Phase 1 of the project restart, 100% of copper cathode production, which is expected to be more than 140,000 tonnes.

- Average market rates would be taken as the benchmark to determine the offtake pricing of copper cathode shipments.

Indicative terms – Prepayment Facility

The facility amount is US$35 million, and the term is for 42 months from the first production date. The interest rate will be incurred as the commercial rates of financing charges.

Offtake and financing documentation in progress, regulatory approvals secured

Cyprium has secured all the required regulatory approvals prior to financing. On the other hand, Transamine SA has also completed technical, legal, commercial, and financial due diligence activities.

The emphasis has now been turned towards completing the offtake and financing documentation for execution. Even on this part, the documentation is also well advanced with senior and prepayment financing counterparties.

Additionally, post finance, the final approval for the amendment to the State Agreement is needed to be submitted.

(Image source: Company update, 22 December 2022)

This is what CYM’s Managing Director has to say about the development:

(Source: © 2022 Kalkine Media®, data source: Company update, 22 December 2022)

About: The Nifty Copper Mine

The mine is located on the western edge of the Great Sandy Desert in the Pilbara region of Western Australia. As per Cyprium, it holds a 2012 JORC Mineral Resource of 940,200 tonnes of contained copper.

The company is committed to a heap leach SX-EW operation to retreat the current heap leach pads and open pit oxide and transitional material.

CYM shares were trading at AU$0.092 in the early hours of trade on 23 December 2022.