Highlights

- Latest soil and rock chip sampling assays for the Gooroo Project have enhanced gold anomalies.

- A rock chip sample from the new Foxglove anomaly has returned assays up to 48.3g/t Au.

- Higher Au values also reported from infill soil sampling undertaken at the Smokebush and Darwinia anomalies, enhancing their prospectivity.

- Further infill sampling planned after securing all required regulatory approvals.

Cooper Metals Limited (ASX: CPM) has confirmed more high-grade gold in rock chips at its Gooroo Project. The company has received significant assay results from soil and rock chip sampling conducted at its Western Australia-based project in May 24. The additional mapping and rock chip sampling focused on the areas of significant outcrop, particularly the Smokebush and Foxglove prospects.

The assays have revealed enhanced gold anomalies at the project area, with an iron-rich mafic outcrop sample from the Foxglove prospect reporting a concentration of up to 48.3 g/t Au. Notably, soil sampling at Foxglove yielded higher gold values compared to previous programs, reporting a maximum value of 118 ppb Au.

Furthermore, sampling at the Smokebush and Darwinia anomalies also returned higher gold values. Infill soil sampling recorded maximum gold values of 16.2 ppb Au at Smokebush and 42.8 ppb Au at Darwinia, enhancing the prospectivity of these anomalies.

The company identified occurrence of six gold soil anomalies that sit in structurally advantageous trap sites. These includes regional faults traversing the greenstone belt and nose of the Gullewa syncline. Such faults are recognised as crucial for the development of gold deposits in other areas of the belt.

The company plans to conduct additional infill sampling with the aim to define the anomalies and controls on mineralisation before undertaking drill testing. The additional exploration work will follow approvals from regulatory authorities.

The Gooroo Project is situated around 413km north of Perth and nearby mining projects including the Deflector Mine of ASX-listed company Red 5 Limited.

The company is targeting orogenic Au and Cu-Au mineralisation in the Gullewa Greenstone Belt, located in the Yilgarn Craton region. Most exploration efforts have focused on the northern limb of the Gullewa syncline, which provides more exposures of the greenstone belt. This area has reported success in discovering several gold deposits, including the significant Deflector deposit, a blind gold deposit beneath the surface.

Priority targets identified for further follow up

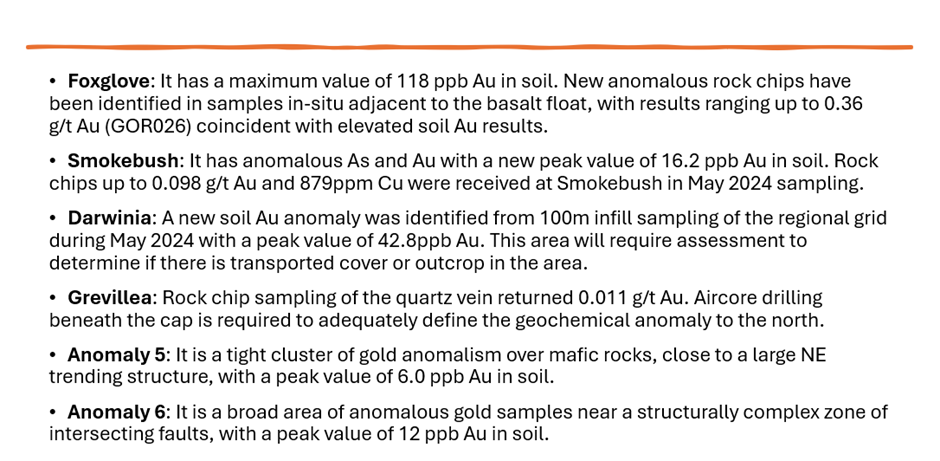

Additional infill soil sampling primarily focused on a 50m grid at the Smokebush and Foxglove anomalies and additional infill 100m spaced grid between Smokebush and Foxglove. In May 2024, 257 soil samples were collected, and sampling returned gold assay of up to 118 ppb, with samples over 4ppb Au were considered anomalous. February 2024 saw the previous high result of 33.2ppb.

Six priority areas identified for further follow up-

Data source: Company update

What’s ahead

Focused on low-impact exploration, Cooper Metals plans a field trip to conduct additional infilling and mapping of the key gold anomalies to locate areas for drill testing. The company intends to conduct aircore drilling in areas of cover where basement rocks are not exposed.

Drilling is dependent upon the receipt of required regulatory approvals. Depending on the results, RC drilling will be conducted for deeper targets and areas where outcrops are present at the surface.

CPM shares trade higher

CPM shares were trading at AU$0.070 apiece, up over 4%, at the time of writing on 26 June 2024.