Highlights

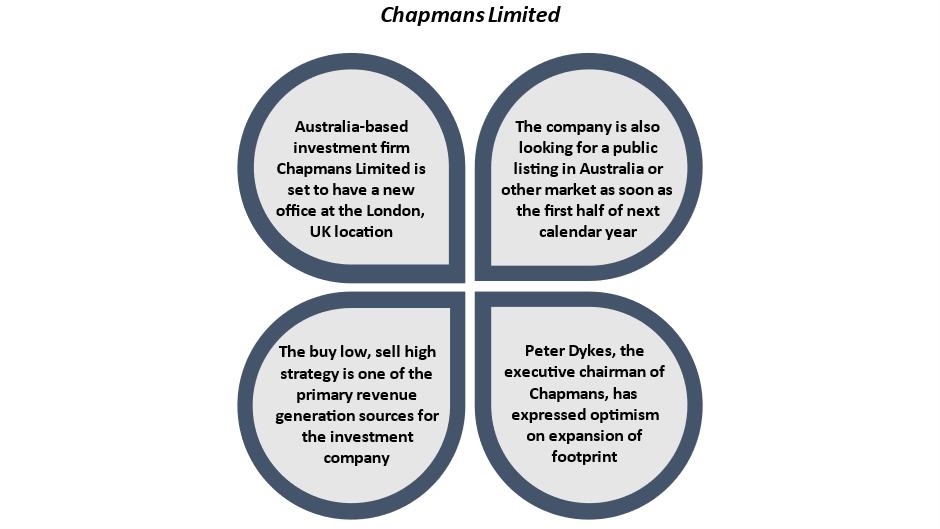

- Investment company Chapmans Limited has zeroed in on London for its new office

- The company has lately announced its plans for a public listing in Australia, Canada, or the UK

- Chapmans undertakes early stage and mature business investments, including special-situation investing

Chapmans Limited is all set to have a new office in the United Kingdom. The Australia-based company -- a leading name in the special-situation investing space -- is also looking to hire staff for its new London location. New local directors could also be added to the company.

The company’s new office would be located at 25 Wilton Rd, Pimlico, London SW1V 1LW, United Kingdom. This takes Chapman a step further toward its goal of having global operations spanning multiple continents, including Australia and Europe. The company’s existing Sydney office would continue to serve as the headquarters, executive director Peter Dykes said.

Dykes has expressed optimism on the expansion of footprint, and he is hopeful that the latest move would present a whole new market opportunity for Chapmans. He commented that operating an office from the financial capital of the world was as much a psychological boost as it was a financially prudent decision.

New listing

It was earlier reported that Chapmans was looking for a public listing as soon as the first half of upcoming calendar year. For this exercise, the company is exploring such options as Australia-based National Stock Exchange, Canada-based TSX Venture Exchange/Canadian Securities Exchange, and the UK’s Alternative Investment Market.

© 2022 Kalkine Media®

About Chapmans

Chapmans is into the direct funding of early-stage ventures, which is one of the primary revenue generation sources for the company. Further, Chapmans backs mature businesses, which can demonstrate a well-defined pathway for revenue and capital growth over the medium term. Dykes, who serves as Chapman’s key investment adviser, also favours exploring lucrative special situation events.

Chapmans Limited commits to any investment with a pre-determined exit strategy. This strategy begins with a robust due diligence process and ends at a point where returns accrue to all stakeholders. The company is also into short-term arbitrage trading.