Highlights:

- The first set of assays from the recently completed Phase VI drilling has boosted Boab Metals’ confidence in its Sorby Hills Lead-Silver-Zinc Project.

- The assays from the Beta Deposit have validated the current mineralisation model, opening the prospect for extending mineralisation.

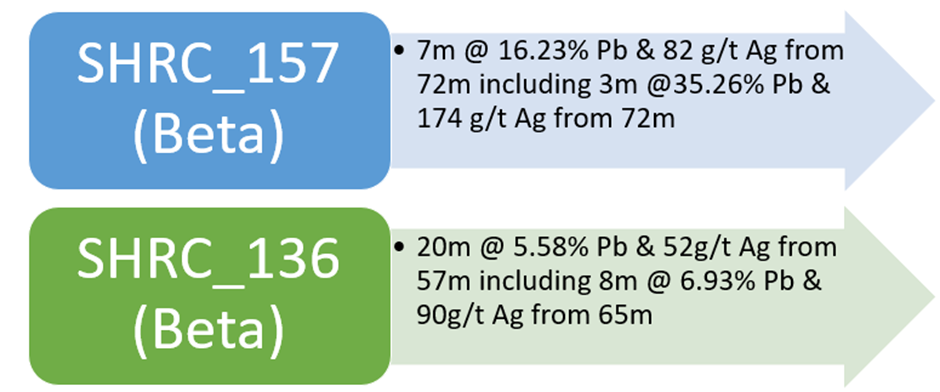

- Highly encouraging results included:

- SHRC_157 (Beta): 7m @ 16.23% Pb & 82g/t Ag from 72m including 3m @ 35.26% Pb & 174g/t Ag from 72m

- SHRC_136 (Beta): 20m @ 5.58% Pb & 52g/t Ag from 57m including 8m @ 6.93% Pb & 90g/t Ag from 65m

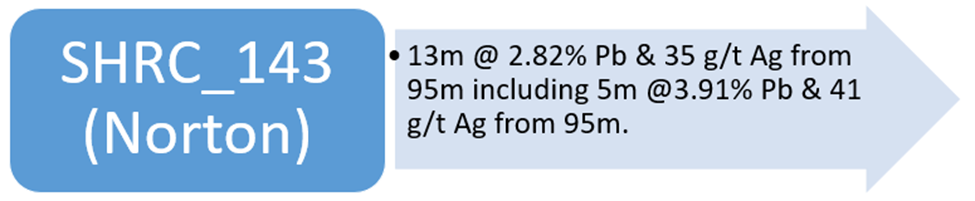

- SHRC_143 (Norton N): 13m @ 2.82% Pb & 35g/t Ag from 95m including 5m @ 3.91% Pb & 41g/t Ag from 95m

- The company expects more assay results at the beginning of 2023.

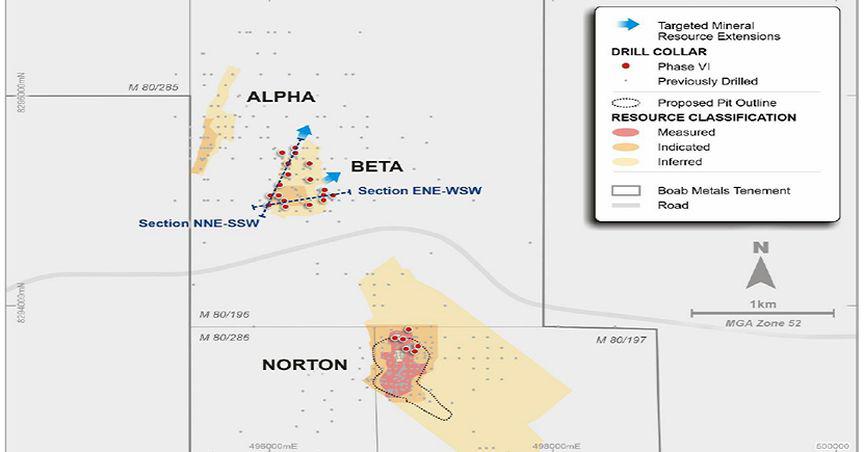

Western Australia-based exploration and development company Boab Metals Limited (ASX: BML) has shared the first set of assay results from the Phase VI drilling program carried out at its 75%-owned Sorby Hills Lead-Silver-Zinc Project.

The project is located in the Kimberley region of Western Australia.

Image Source: © 2022 Kalkine Media®, Data source: BML update

Encouraging results from Beta Deposit

The Phase V drilling campaign drilled the Beta deposit for the first time and the results conformed with the revised interpretation of the mineralisation geometry.

The company drilled 18 holes at the Beta deposit for a total of 1,800m of mud rotary and RC drilling in the Phase VI program. The mineralisation intervals in the targeted stratigraphic interval have been confirmed by geological logging supported by hand-held p-XRF testing. This provides a significant support to the resource model for estimating future resource.

The results of infill drilling along with the drilling on the eastern periphery of the Beta deposit were very encouraging and included:

Image Source: © 2022 Kalkine Media®, Data source: BML update

Boab Metals expects the latest results to have a positive impact on the future resource estimates. They are also expected to enable improved resource classification and include a large proportion of the Beta deposit into the Ore Reserve.

Significant intercept at Norton Deposit

At the Norton deposit, the company completed drilling of six reverse circulation holes for nearly 700m. the most significant assay results from two holes were received.

Image Source: © 2022 Kalkine Media®, Data source: BML update

High-grade mineralisation zones in the northeast portion of the Norton deposit were highlighted in the latest Mineral Resource estimate. Boab Metals feels that the interpreted continuity gap in high-grade zone can be bridged through tighter spacing between drill holes.

SHRC_143 has delivered a vital intercept with a potential to have positive contribution in the revision of the resources. However, the results from the outstanding drill holes are expected to have a significant outcome.

Phase VI drilling program overview and objective

Under the Phase VI drilling program, 28 reverse circulation (RC) drill holes were drilled for a total of more than 3,020m. Some of the holes were pre-collared by mud-rotary drilling and then RC drilling for completion.

The company submitted nearly 1,700 samples to Intertek Laboratories, Darwin. It was reported that 65% of the samples were analysed for elemental analysis which included lead, silver and zinc.

The company expects further assay results early in 2023.

Stock price action

The shares of Boab Metals Limited were trading at AU$0.305 midday on 30 December 2022, trading more than % up from the last close.