Highlights

- An independent metallurgical review of Ark’s Sandy Mitchell project highlights the unique benefits of the Sandy Mitchell deposit.

- The report confirms Ark’s development strategy for Sandy Mitchell with focus on cost-effective downstream processing and low environmental impact.

- The report suggests that the placer deposit mineralogy at the Sandy Mitchell deposit is ideal for low-cost beneficiation processes, such as gravity processing.

Ark Mines Limited (ASX: AHK) has announced summary of an expert consulting report into its fully owned Sandy Mitchell project. Prepared by Met-Chem Consulting (Met-Chem), on behalf of Harrier Project Management, the report is an independent metallurgical review of the Sandy Mitchell project.

The report emphasises the distinctive benefits of the Sandy Mitchell deposit, particularly in terms of placer deposits. The report indicates that placer deposits at the site are ideal for simple, low-cost beneficiation processes, such as gravity processing. Beneficiation processes for placer deposits are significantly less expensive to build and operate than traditional methods, highlighted the report..

Commenting on the report, the company’s Executive Director, Ben Emery stated, “The report reaffirms our view that Ark is on the right track to develop Sandy Mitchell with a focus on low-cost downstream processing and a low environmental impact. The Company is now focused on a busy period of near-term news flow, commencing with a maiden Mineral Resource estimate which will be based on the Phase 1 drill programme.”

He further stated that additional testwork will support a planned prefeasibility study for Sandy Mitchell in the second half of 2024.

Advantages of placer deposits

The report analysed and compared three types of REE deposits contributing to global production: placer deposits in mineral sands, hard rock deposits, and ionic clay. Compared to hard rock and ionic clay, the report outlined several advantages of placer deposits, such as:

- The deposit style of mineralogy is highly appropriate for a simple, low-cost beneficiation process, such as gravity processing.

- Extensive crushing and grinding is usually not required due to natural liberation.

- Beneficiation processes for placer deposits are substantially cheaper to build than whole-ore flotation processes usually employed for hard rock rare earth element (REE) deposits and are also significantly cheaper to operate.

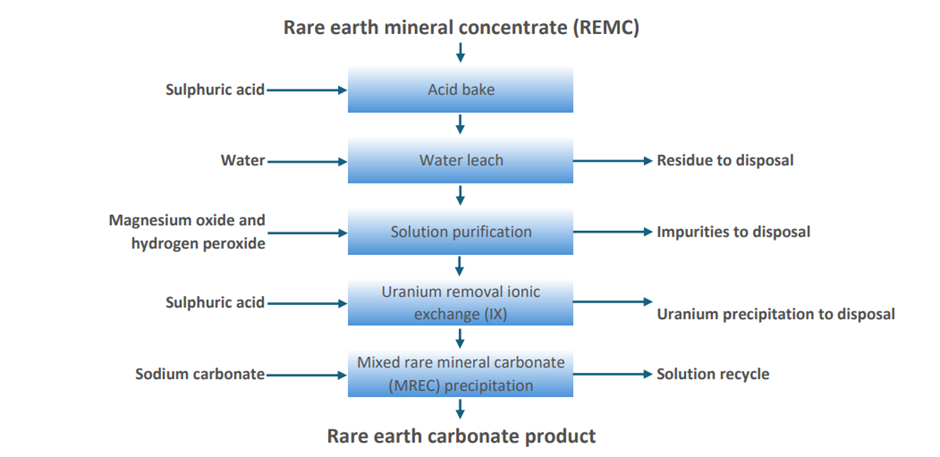

The report further highlighted the following project advantages for downstream processing:

- As initial exploration samples returned high-grade rare earth mineral concentrate (REMC) of up to 51.9% TREO, REMC from Sandy Mitchell will almost certainly be suitable for existing sulphuric acid baking refiners accepting third-party concentrate.

- The sulfuric acid baking process stands as the predominant method for treating refractory concentrates. Lynas Rare Earths Ltd employs this process in its processing facilities in Malaysia and its cracking and leaching plant in Kalgoorlie. It is also deployed at numerous REE processing facilities across China.

Image source: Company update

Concerning ongoing metallurgical test works at Sandy Mitchell, the Harrier report recommended work program to further refine the geometallurgical model of the resource at Sandy Mitchell, with flexible processing alternatives aligning with staged development of the project.

Overall, the report emphasised the distinctive benefits of the Sandy Mitchell deposit, in terms of placer deposits, which allow for a mining operation with a reduced environmental footprint. It highlighted significant advantages including a lower operational expenditure and capital expenditure, shorter development time to production, earlier payback on investments and long-term production potential.

As of 16 May 2024, the closing price of AHK was AU$0.140