Summary

- Collins Foods has announced strong sales and earnings growth for FY20, along with a final dividend of 10.5 cps, taking full-year dividend to 20 cps.

- Retail Food has notified that ASIC concluded its investigation. The company expects to report an underlying EBITDA of around $35 million in FY20.

- Rory Macleod, CEO and MD of Freedom Foods Group, has resigned from his position. Last week, FNP CFO had also resigned.

Three consumer-focused companies listed on ASX released significant market updates today. Collins Foods, the operator of KFC and Taco Bell, has disclosed strong performance and final dividend for FY20. Retail Food has been advised by ASIC regarding its investigation completion with no enforcement action, while Freedom Foods has updated about the resignation of its Chief Executive Officer.

Collins Foods Limited (ASX:CKF)

Collins Foods has released results for the full-year period ended 3 May 2020, registering strong sales and earnings growth amid extraordinarily challenging times. The company has declared a fully franked final dividend of 10.5 cents per share (cps), which has a record date of 16 July 2020 and pay date of 30 July 2020, taking the full-year dividend to 20 cps.

Post the market update, CKF stock settled the day’s trade at $9.420 on 30 June 2020, surging by 12.679% from its previous close.

FY20 Robust Performance

CKF incoming CEO, Drew O’Malley stated that the full-year results demonstrating robust growth in sales and earnings are underpinned by strong brands, business model, and dedication and commitment of the company’s extraordinary team.

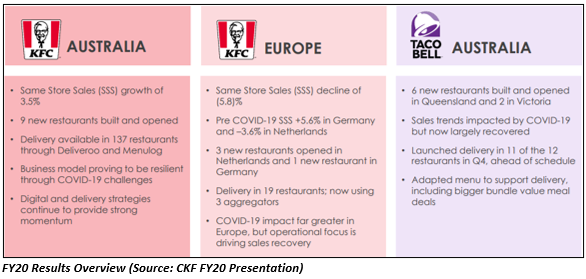

- KFC Australia recovered its same store sales (SSS) growth and continued to digital and delivery channel expansion.

- KFC Europe was impacted by COVID-19 restrictions that are now receding.

- Taco Bell is moving towards drive-thru and home delivery channels, enabling its recovery close to pre-COVID-19 sales levels.

Revenue for the period grew by 8.9% to $981.7 million compared to $901.2 million in FY19 ended 28 April 2019. The SSS growth in KFC Australia was noted at 3.5% against 3.7% in the previous year and SSS growth declined by 5.8% for KFC Europe.

Collins Foods recorded statutory EBITDA of $175.6 million and NPAT of $31.3 million compared to EBITDA of $112.1 million and NPAT of $39.1 million in FY19. Excluding AASB 16, the company’s underlying EBITDA stood at $120.6 million, up by 6.3% from $113.5 million in FY19. Underlying NPAT for the period was $47.3 million, representing an increase of 5.1% from $45 million in the previous year.

Interesting Read: Uptick in May retail sales, Retail Players Under Spotlight

Priorities for FY21

Collins Foods’ management remains vigilant of the possibility of a second wave, despite restrictions easing in its markets. CKF is operationally prepared for the second wave and is confident to maintain strong unit economics of the business, according to Mr O’Malley.

In KFC Australia, the company plans to emphasise on value and convenience to maintain core brand strength in the post COVID-19 environment, as well as accelerate digital initiatives around app and delivery. CKF expects to increase delivery network by 9-12 new restaurants and would continue to look for organic growth opportunities and acquisitions.

In Europe, the focus is on regaining the pre-COVID sales momentum. The company is planning to open 3-4 additional restaurants in the region.

For Taco Bell, the emphasis is on building the brand, driving sales growth through targeted marketing efforts, and cost optimisation. The company plans to open 4-6 new restaurants for Taco Bell during the period.

Retail Food Group Limited (ASX:RFG)

Retail Food Group reported that ASIC has decided not to pursue any enforcement action after concluding its investigation. However, if the circumstances were to change, the regulator may restart the investigation and proceed with legal action. Last year, the company reported that the regulator is investigating RFG on account of breaches of the Corporation Act.

Trading Update and FY20 Guidance

Last week, Retail Food Group provided a trading update and guidance for FY20, highlighting that the business experienced increased customer base within shopping centres, following easing government restrictions concerning COVID-19.

Recent trading data has demonstrated a 13.76% weighted average decline amongst all brands over the same period last year; however, the decline is well below pre-COVID-19 levels. At the same time, the company continues to monitor the situation in Victoria, where new infections are being traced.

For its remaining 17 temporarily closed stores due to the pandemic, Retail Food Group is working with franchisees for the reopening, but the company anticipates that around 7 stores would be permanently closed. Meanwhile, rental reliefs were obtained for around 415 outlets.

RFG’s international franchise network has restarted trading considerably, but around 138 stores remain closed, of which 30 would permanently close their doors. Around 230 stores are operating on a takeaway mode, while ~150 outlets are operating with limited dine-in services.

As a result of restructuring of its wholesale coffee business, the company would realise approx. $6 million in annualised cost savings. RFG continues to anticipate that trading conditions would remain challenging over the foreseeable term.

Retail Food Group has an underlying EBITDA guidance of around $35 million for FY20, which considers full-year contributions from continuing operations and excludes the impact of AASB 15 and AASB 16. The company also expects net debt to be around $25 million, as of 30 June 2020.

On 30 June 2020, RFG last traded at $0.070, up by 2.941% from the previous close.

Freedom Foods Group Limited (ASX:FNP)

FNP continues to remain on a trading suspension for ongoing investigations into the company’s financial position. The company has reported that the Board of FNP has accepted resignation of Chief Executive & Managing Director, Rory Macleod, who resigned from all executive and Board positions.

Mr Macleod’s resignation follows the resignation of FNP’s Chief Financial Officer last week. Since last week, investors of the company have been left stranded. Freedom Foods has disclosed a number of problems concerning inventory and bad debts, and maybe an accounting issue.

Ashurst and PwC are assisting the management in undertaking the investigation. Freedom Foods has reported to incur inventory write-downs of around $60 million in FY20. Earlier, the company had indicated that write-downs could be ~$25 million. But FNP has come to know that the inventory could not be reworked, as it would not be operationally viable. The company is also consulting whether $2 million of its inventory, which is outside the country, should be impaired or not.

Related: Time for Distressed Investors to Look at Freedom Foods

Moreover, Freedom Foods Group is investigating whether the cost of goods that have been carried forward as a capital item should have been included as a cost of sales. After undertaking the review of its debtor book, the company expects an EBITDA impact of negative $10 million from $4 million earlier due to provision.

The company may also review debtor balances in the balance sheet for prior periods to include adjustments to the timing of revenue recognition. Moreover, estimates provided by the company are subject to year-end audit and Board review.

FNP noted that its shareholder Perich family has advised to extend its support to the business as well as capital requirements when they arise.

(All currencies in AUD, unless or otherwise stated)

.jpg)