The Australian share market is currently one of the most eventful and talked-about exchanges in the world. Why? Because it is celebrating the first Earnings Season of the new decade!

The period during which ASX-listed companies release their earnings report and notify the share market participants about their performance and outlook is always awaited. Not only does the phase form a key crux for shareholders to re-visit their investment portfolios by tapping companies they like, it also provides the Australian business flavour to the rest of the world.

To read about the Earnings Season schedule and browse over what to expect from companies, we encourage you to read our exclusive Reporting Calendar.

In this article, we will be discussing Australia’s fifth-largest retail bank, Bendigo and Adelaide Bank Limited (ASX:BEN), which recently announced interim results for the half year ended 31 December 2019. Before deep diving into the results, let us have a brief understanding of the Bank.

Bendigo and Adelaide Bank Limited

Catering to over 1.7 million customers, BEN envisions to be Australia's bank of choice. It has assets under management of more than $71.4 billion, a market capitalisation of approximately $5.22 billion and over 110,000 shareholders.

BEN brands include Bendigo Bank, Adelaide Bank, Bendigo Wealth, Sandhurst Trustees, Leveraged, Rural Bank, Delphi Bank and Alliance Bank®. These brands provide wide-ranging services and products, including business and personal banking, commercial mortgages, unsecured loans, superannuation and investment products, to name a few.

BEN’s Financial Performance

As soon as BEN’s securities were placed on a trading halt on 17 February 2020 pending the release of its interim results and a proposed capital raising comprising an institutional share placement and a share purchase plan, investors and media houses awaited the updates with inquisitiveness.

The Australian banking sector witnessed a period of low rates, escalating regulatory pressure, low business and consumer confidence and rising competition throughout 2019. Though the Bank’s results were affected by ongoing technology investment, regulatory and compliance costs and staff investment to aid mortgage growth, it registered a 1.4% year on year increase in total income on a cash basis to $814.7 million.

For the half year ended 31 December 2019-

- BEN reported statutory net profit of $145.8 million, down 28.2% against the half year ended 31 December 2018 (pcp). The decrease was primarily attributed to software impairments and software accelerated amortisation adjustments

- Cash earnings after tax were noted at $215.4 million, down 2% on pcp

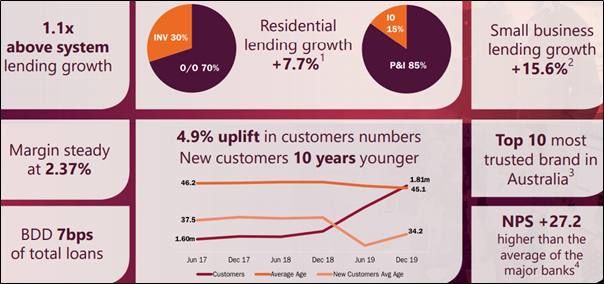

- Total lending continued to grow to $62.9 billion, up 2.8% on pcp and above system and residential lending was well above system at 7.7%

- Net interest margin was 2.37%, up by 2 basis points on pcp

- BEN’s bad and doubtful debts were $23.2 million, down 9% on pcp

- Operating expenses were $487.4 million, up 5% on pcp

- The first half dividend (to be paid on 31 March 2020) was reduced by 4 cents to 31 cps, to ensure sustainability, retain funds for growth and enable the Bank to continue to deliver its strategy

BEN’s Overview of 1H20 (Source: BEN’s Report)

Business Performance

Despite the challenging environment in Australia, BEN continues to be ranked one of Australia’s top 10 most trusted brands and amongst the top-rated companies for customer experience. It has been focussed on digitisation and investment in future capability, leading to net growth in the number of millennials choosing the Bank (349% more than the pcp).

Up, the first digital or neobank to launch in Australia, partnered with BEN, which resulted in a 57% lift in the former’s customer numbers in the reporting period.

BEN has been modernising its physical distribution network based on customer demand with a national point of presence of over 700. During the period, BEN launched two additional innovative concept branches in Carlton and Leichhardt (foot traffic was increased by 56% and 188%, respectively, since opening two and four months ago).

Besides this, BEN successfully finalised the transfer of Bendigo Financial Planning to Bridges Financial Services, automated its scheduled review process and transferred Rural Bank to Bendigo and Adelaide Bank’s authorised deposit-taking institution licence, providing cost savings and efficiencies.

Interestingly, 1H20 witnessed an additional $16.9 million invested in systems and process simplification, automation, strengthened digital services and capability.

In the light of the recent bushfires that disturbed Australia’s livelihood, BEN’s National Bushfire Disaster Appeal was successful in raising over $35.4 million from more than 140,000 generous donors.

$300 Million Capital Raising

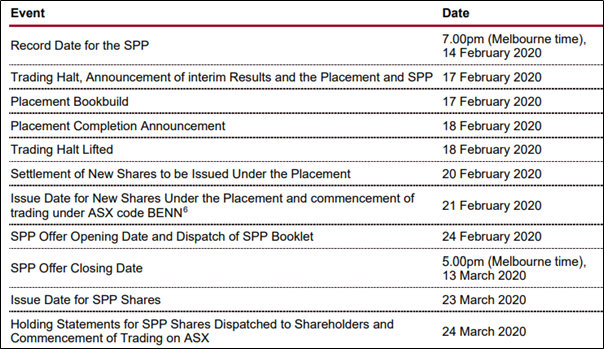

Besides announcing the 1H20 results, BEN launched a capital raising on 17 February 2020, comprising of a fully underwritten $250 million institutional share placement and a non-underwritten share purchase plan to raise approximately $50 million.

The $300 million capital raising is likely to aid in growing BEN’s residential mortgage business, boosting the balance sheet and offering a buffer over APRA’s unquestionably strong CET1 capital ratio requisites. It will also provide flexibility for investments in technology and regulatory related change initiatives.

Key dates pertaining to the capital raising (Source: BEN’s Report)

BEN’s Outlook

Managing Director and CEO, Marnie Baker stated that the Australian market currently faces heightened regulatory focus, below average business confidence, severe weather conditions driven by drought, bushfires and Coronavirus, constantly changing consumer behaviour and global trade tensions.

Despite these triggering issues, BEN’s mortgage lending growth rates are expected to exceed system growth and the small business portfolio is likely to grow at similar rates along with a rise in Commercial Real Estate business.

The adverse impact of drought and bushfires is expected to lift BDD (within 11bps long-term average). Further, the CTI ratio is anticipated to increase marginally in 2H20 with NIM expected to decrease from 1H20 margin of 2.37% and operating expenses, including accelerated investment in technology, to rise by 2-3% from 1H20.

The Company will focus on investment in partnerships, automation technology, risk and compliance, and complexity reduction to ensure improved scalability of the business and flexibility to support sustainable future growth.

Stock Performance

The securities of BEN were placed on a trading halt on 17 February 2020 and trading is expected to resume on 18 February 2020. The stock last traded on 14 February 2020 at $10.57 with an annual dividend yield of 6.62%. It was available at a P/E ratio of 13.71x and an EPS of $0.771. In the past one year, BEN has delivered a return of 7.2%.