The Australian biotechnology industry is a promising sector for leading the innovation in the country and for producing the opportunity for economic advancements. In all the three main stages of the lifecycle of a biotech product including discovery, commercialization and manufacturing, the Australian biotech industry is not just on a robust growth path but also competes on the global scale.

In the present era of digitization, the introduction of digital health services has emerged as one of the fastest-growing industries. Digital Technologies have revolutionised the health care sector and evolved as a biggest blessing not only for patients but also clinicians, researchers and scientists.

Letâs dive deep into four healthcare technology stocks and find out their latest updates:

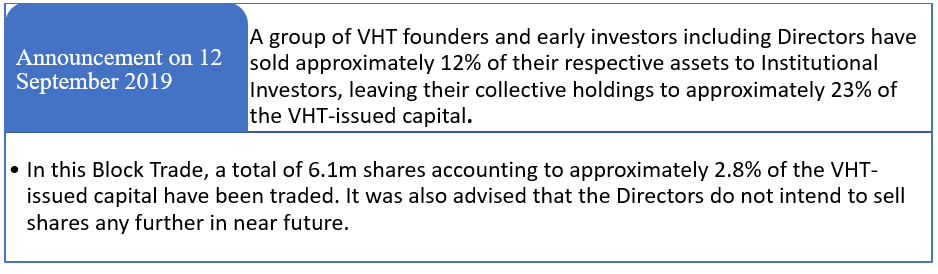

CardieX Limited (ASX: CDX)

CardieX Limited, based in West Ryde, Australia, is a leading health technology company, that is involved in designing, engineering and commercialization of medical and consumer devices for the management of cardiovascular diseases including advanced hypertension.

Agreementâs Key Highlights:

- Activities related to the development and commercialisation will be taken care by, based on ATCORâs SphygmoCor® technology on cardiovascular and hypertension algorithms and patents.

- A novel and market-leading consumer wearable health platform will be created on Googleâs Wear OS platform using ATCORâs algorithms and software together with Mobvoiâs sensor technology.

- Mobvoi will take charge for integrating the Mobvoi-specific algorithms developed by ATCOR by creating next-generation smart watch, able to integrate these algorithms.

- Significant factual validation of CardieXâs Technology and transition strategy from purely a medical device company to a multi-platform company of consumer and medical device & software/SaaS solutions.

- Amalgamation of licensing, royalty, and subscription services would drive CardieXâs business model, revenues, and commercialisation that comes under the agreement; the revenues are predicted to be recognized in FY2021.

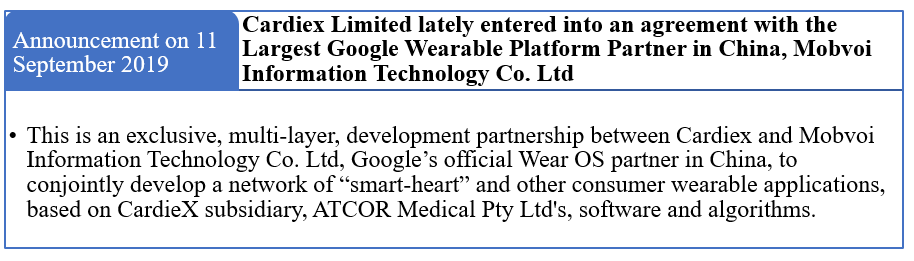

Volpara Health Technologies Limited (ASX: VHT)

Volpara Health Technologies is an Australian registered MedTech SaaS company that develops AI imaging algorithms to assist in early diagnosis of breast cancer.

Volpara Health Technologies also released an update on investor presentation for the ASX Small and Mid-cap Conference, on 2 September 2019,

Key Highlights of Investor Presentation:

- Volparaâs Technology analyses breast images (âmammogramsâ) along with related patient data and provides clinical decision support and practice management to reduce the 500,000 deaths due to breast cancer annually.

- Volparaâs Technology in early breast cancer detection offers an opportunity of ~US$750M Annual Recurring Revenue (ARR) for the Company with nearly 75 million women screened globally per year in 38 countries. At the end of the first quarter 2019, Volpara held net cash of ~NZ40 million post-MRS System Inc. acquisition. This product suite is expected to sell for up to US$10/screen.

- Fast adoption of Volparaâs software in US markets with 39 million screenings per annum while 25% of the screenings in US (Q1 end) use at least one of Volparaâs products. At the end of Q1 2019, on-track ARR of NZ$14.6M with a mid-forecast of NZ$17.1M (~US$11.5M) and gross margins of more than 80% was reported.

- The main driving factors and tailwinds at play include, guidelines provided by FD for quality controls and making breast density reporting necessary, a randomized-control trial using Volpara Density with results to be released soon, recent MRS acquisition leading to several new cross-sell opportunities, expected new products into the sales pipeline post-MRS acquisition multiple.

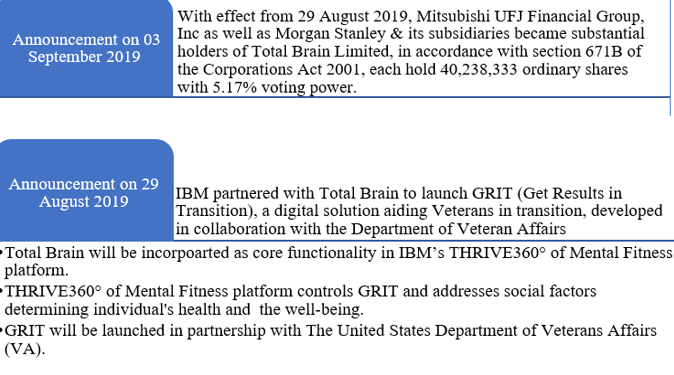

Total Brain Limited (ASX:TTB)

Total Brain Limited is a San Francisco and Sydney based technology company that deals in commercialisation of worldâs first holistic mental health and fitness platform; Total Brain, driven by the worldâs largest standardized brain database.

FY2019 Operating and Financial Review:

- Revenue generated from ordinary activities dipped by 0.5% to $2,602,137 compared to the previous fiscal year.

- Loss from ordinary activities after tax attributable to the owners of the Company was recorded as $8,570,754, a decrease of 62.9% on the previous corresponding period.

- Net tangible assets per ordinary security stood at 0.68 cents as compared to 1.34 cents for the year ended 30 June 2018.

- From TTBâs corporate business, 33% growth in revenue was achieved with flat annual growth in total revenue.

- Sixteen sales and strategic partnerships were recorded, either new or the expansion of existing B2B Corporate and B2C affinity clients.

- Annual growth of 19% and a 56% CAGR was noted since December 2015, as indicated by the growth in cumulative new User Registrations to 715k and a cumulative number of Brain profiles to 534k.

- Completed several operational initiatives including the launch of Total Brain that replaced the entire series of MyBrainSolutions product with a complete renovation and rebranding, successful migration of existing users (>60,000), corporate customers (23), and channel partners (5) to the new platform, launch of an account-based marketing strategy, a 3x YoY increase in promotional activities.

- Fundraise of A$6.9 million was undertaken, governed by US-based family offices and HNW investors along with evocative contribution by the current and new institutional as well as HNW investors in AU and Hong Kong, dedicated to, amid other functions, growth in sales and marketing and software & product development.

- Decrease in total expenditure by a margin of $15.4 million (58%) to $11.2 million was recorded due to a decrease in non-cash, non-recurring costs by $17.7 million (90%) and an increase in cash expenses by $2.9 million (46%) to $9.2 million.

- Average monthly cash consumption, net of revenue, was $751,923 compared to $475,304 in the preceding year.

- As on 30 June 2019, the Company held cash of $5.2 million.

FY2020 Outlook:

- To fast-track the sales cycle of B2B Corporate returns.

- To expand over B2B affinity market.

- To retain and upsell existing book of business.

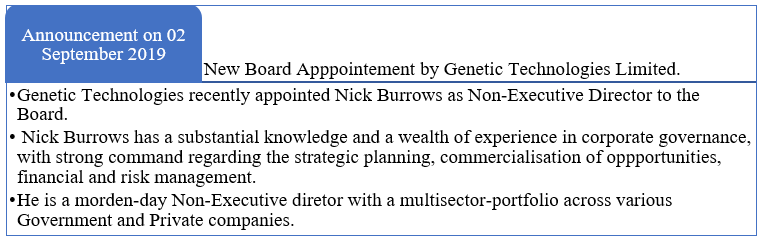

Genetic Technologies Limited (ASX:GTG)

Genetic Technologies is a leader in the development of genetic risk assessment technology, delivering cancer predictive assessment tools and helping clinicians to manage patientâs health.

Genetic Technologies Limited recently released Preliminary financial report for the year ended 30 June 2019.

Key Highlights of Preliminary Financial Report:

- A combined gross revenue recognized from continuing operational activities, excluding other revenues, amounted to nearly $25k in FY2019 in comparison to $189k million in the preceding year; this variation is a result from a reduction in the overall sales of the BREVAGenplus®

- A loss of $6.8 million including $0.5 million (attributable to the voluntary liquidation of GeneType AG, the dormant Swiss subsidiary) for the year 2019, compared to $5.4 million for the previous corresponding period.

- Net tangible assets per ordinary security stood at 0.05 cents as compared to 0.19 cents for the year ended 30 June 2018.

- There were no changes in controlled entities during FY2019 ended 30 June.

- Launched GeneType for Breast Cancer with ability to deliver a world-leading clinically actionable insight for doctors and genetic counsellors.

- Launched first-to-market genetic risk assessment test for colorectal cancer; GeneType for Colorectal Cancer, which is the first of a suite of ground-breaking new products the Company will deliver in the next 12 months.

- Further genetic risk assessment tests for Cardiovascular Disease and Type 2 Diabetes with the targeted launch in late 2019, and Prostate Cancer & Melanoma targeted to be launched in 2020.

- Operational Expansions will continue to be explored in China.

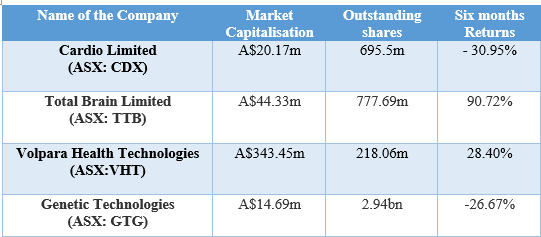

Stock Performance at one glance:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.