The Australian metals & mining (M&M) equity market, i.e. S&P/ASX 300 Metals and Mining rose by ~25% during the year 2019, from 3614.20 at the beginning of the year to 4503.20 at the end of the year.

Come 2020, the M&M equity market opened optimistically, and soared by ~6.8% to 4809.03 on 22 January and later fell by ~8% to 4427.785 on 3 February due to the global epidemic over coronavirus. However, the index seems to be correcting, reaching 4488.448 in the next two days.

Interesting Read: Coronavirus Impact: Tumbling Steel and Copper Prices

S&P/ASX 300 Metals and Mining Index Price (XMM)

Will Junior Mining Stocks follow the same trend as S&P/ASX 300?

One question may always arise whether the stocks of junior companies will follow the same trends as S&P/ASX 300. To unfold the mystery, let us first evaluate how junior companies perform in different economic conditions.

Junior mining companies are firms with low production capacity, having one or two producing mines or more often includes only projects. At the time of higher commodity prices, opportunity in exploration and development increases to reap out the benefit of higher realised price, and amid the time, most of the projects become economical, which otherwise were not.

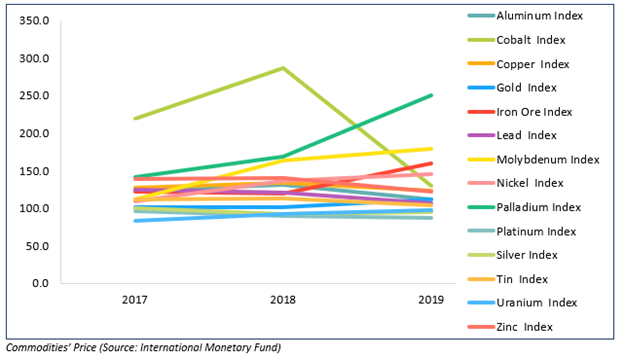

Australia's return on equity was impressive in 2019 even at the time of global turmoil due to the comprehensive monetary easing policy, interest rate cut by central banks and notably, agreement between the US and China to resume talks on the trade deal. The commodities that gained were Molybdenum, Iron ore, Nickel, Palladium and most significantly Gold – a safe-haven investment.

The soaring prices of few commodities can give a boost to the junior miners to arrange for the funds, and one of the popular ways for them is in the form of joint ventures and acquisitions.

However, it is quintessential to mention that the total deal value of 2019 was lower than in 2018.

But the prices of few commodities increased in 2019? Doesn't it have an impact on the mining M&A activities?

The reason is that the picture of the price in 2019 was murky and so do now with volatile commodity prices and geopolitical instability. The long-term consequences of the commodity prices were unclear; thus, the deal activity was lower in comparison to 2018, and it is expected to remain subdued in 2020 as well, courtesy to unclear outlook on commodities.

The best example can be the present steep rise in price of gold and palladium, posing ambiguity over long-term sustainability as the price will start correcting, depending on economic and technological factors.

Questions like, how long will it be sustained? Or how profound will be the impact on economy due to falling copper and steel prices because of deadly coronavirus? always come to investors to accurately assess and plan their strategy.

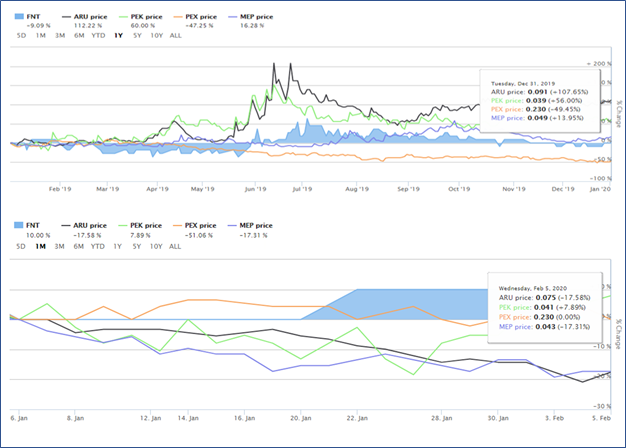

Let us now understand the performance of some junior stocks. For the same, stocks randomly chosen with small market capitalisation include ARU, FNT, PEK, PEX and MEP.

Source: Australian Stock Exchange

Positive returns were posted by Arafura Resources Limited (ASX: ARU) 112%, Peak Resources Limited (ASX: PEK) 60%, and Minotaur Exploration Ltd (ASX: MEP) 16.28% in 2019. Whereas, stocks such as Frontier Resources Limited (ASX: FNT) and Peel Mining Limited (ASX: PEX) witnessed a decline in their one-year returns by 9.09% and 47.25%, respectively, on 31 December 2019.

In the last one month (as on 5 February 2020), returns were FNT (+10%), PEK (7.89%), ARU (-17.58%), PEX (-51.06%) and MEP (-17.51%).

- Frontier Resources Limited is a high-grade precious and base metal and mineral exploration company. It owns high-grade gold prospect tenements, which are witnessed in its growth beginning 2020 and after effect of drilling and sampling activities in 2019. The FNT stock closed the day’s trading at A$0.010 on 7 February 2020 with a market cap of A$5.38 million.

Must Read: Optimistic 2020 Gold Outlook Brightens Middle Island’s Growth Prospects

- Arafura Resources Limited is an Australian listed company with world-class Neodymium-Praseodymium (NdPr) resources in Northern Territory of Australia. The extensive use of NdPr to manufacture magnets, catalysts to batteries, is the testimony to the company’s tremendous growth in 2019. However, the start of 2020 witnessed a fall in the share price due to the Chinese lunar holiday and coronavirus epidemic. The ARU stock settled at A$0.076 on 7 February 2020 with a market cap of A$78.06 million. Its 52 weeks high and 52 weeks low stand at A$0.140 and A$0.04, respectively.

- Peak Resources Limited is following the same trend as ARU, as both the companies have access to NdPr deposits. Neodymium (Nd) and praseodymium (Pr) are used in producing permanent magnets (NdFeB magnets). The stock closed the day’s trading at A$0.041 on 7 February 2020 with a market cap of A$52.21 million. Its 52 weeks high and 52 weeks low stand at A$0.066 and A$0.024, respectively.

- Minotaur Exploration Ltd is focused on copper and base metal exploration in Australia. The yearly return was around 16.28% in 2019 may be due to the presence of commodities in its tenements such as nickel, gold and copper, demand for which is expected to increase in future. The stock settled at A$0.042 on 7 February 2020 with a market cap of A$15.3 million. Its 52 weeks high and 52 weeks low stand at A$0.076 and A$0.038, respectively.

- Peel Mining Limitedis an exploration and development company listed in Australia. It focuses on precious and base metal assets located in New South Wales. The commodity in the projects includes gold, palladium, zinc, lead and silver. The fall in share prices during 2019 is yet not clear, but the sentiments were not that bullish for the company, and it remains sustained for beginning 2020. The stock closed the day’s trade at A$0.230 on 7 February 2020 with a market cap of A$56.05 million. Its 52 weeks high and 52 weeks low stand at A$0.525 and A$0.215, respectively.

Junior mining companies perform differently depending on their commodities and macro-economic impact on the demand side of the commodity. The trend is complex and difficult in predicting. Generally, the stock price of junior mining companies remains very volatile because of the dependency on project study results and economic factors.

What will be the performance of Junior Miners in 2020?

The performance is expected to be dependent on the underlying economy. The domestic economy of Australia is likely to gain post the ceasing of bushfire and a federal election due in May. However, the global economy is related to the China economy due to its maximum share in importing almost all the resources worldwide.

The update on coronavirus and its eradication is looked up by investors to gauge their portfolio and invest accordingly for maximum returns. Similarly, the trend in junior miners is anticipated to remain positive with commodities benefitting in 2020.

Want to know about the future opportunity? Must read: Upcoming Projects in Australia and Mining Equipment Market Opportunity

The optimism amongst junior mining companies can be assessed with new listings on ASX. In the last two months, Godolphin Resources Limited (ASX:GRL) and COBRE Limited (ASX:CBE) listed on ASX while there are several other upcoming floats and listings to record soon on ASX. Some of them are: -

- Castile Resources Ltd with proposed ASX code as CST,

- Metal Hawk Limited with recommended ASX code as MHK,

- Nemex Resources Limited with recommended ASX code as NXR,

- Tartana Resources Limited with recommended ASX code as TNA and

- Virgo Resources Ltd with recommended ASX code as VIR.