Summary

- Growth of 40-50% in international aviation capacity, as projected, is needed for meeting the long-term needs of Tourism Australia.

- Over 93,000 people are employed across major subsectors in the Aviation industry, which is a significant contributor to the Australian economy.

- Reshaping of the Airline industry is a continues process, but the airport security remains to be the primary concern area.

- Several stocks such as SYD and AIA- constituting the Australian aviation industry have witnessed significant growth over the past years with the enhancements in the technology across the industry and the need to travel.

The aviation industry is said to be one of the most uncertain sectors for investors to invest. There has been evidence of bankruptcies and several financial hit that have been swinging investor confidence in the industry. Lately, due to the COVID-19, airline services are thoroughly grounded, and the growth trajectory of the industry ran out of road.

Over the years, the Australian economy has received a significant contribution from aviation, tourism, and related industries. Looking at the present times, the critical component in achieving the Australian tourism industry long-term goal of growing overnight tourism expenditure annually beyond AU$ 115 billion by the end of 2020 is “access to air”.

Tourism 2020 strategy of Tourism Australia (launched in December 2009) for the endorsement of which Tourism Australia had projected the need for growth of 40-50% in international aviation capacity of Australia, share the same long-term goal.

Developments in the Australian Aviation Industry

Aviation industry, one of the largest industries in Australia, connects businesses and people not only domestically but also internationally is a major economic contributor, facilitating worldwide trade and tourism, and creating jobs.

Besides employing over 93,000 people across the major subsectors, the industry had an estimated annual revenue over $45.98 billion in 2018. Over the past years, the sector had reported:

- An increasing need for more pilots, flight instructors, and maintenance engineers, especially in regional airlines

- Rapid reshaping of aviation operations through new technologies, especially in remotely piloted aircraft systems, ground operations, and air traffic control systems, where operational efficiency and safety has improved

- Improvement in customer services by streamlining processes through the adoption of innovations such as SmartGate, automated check-in and bag drops, biometric technologies, and facial recognition

- Offering several services through digital platforms and smart devices to improve efficiency and create a seamless passenger experience at airports

- New systems transformed Air traffic control and airport operations through harmonising operations through data sharing and collaborative and predictive decisions.

Growth in International Aviation Capacity

Australia is in close vicinity to the biggest aviation market of the world, and the same was earlier expected to be a facilitating element for Australian tourism industry, in conjunction with projections of sturdier loads and yields on Australian channels.

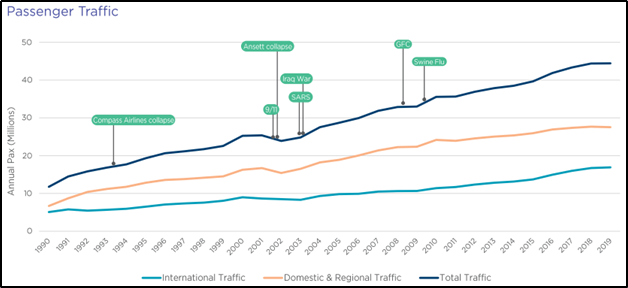

International aviation capacity to Australia has grown at an average annual growth rate of 4% over the previous two decades and reached 26.9 million inbound seats in 2019 from 9.3 million inbound seats in 1995. This was largely driven by improved capacity from New Zealand, China, the USA, the Middle East and Southeast Asia.

Over the years, some of the stocks in the Australian aviation industry have also shown significant growth taking push from the macro-economic factors in the industry. Let us look at some of the top three stocks during recent years.

Sydney Airport (ASX:SYD)

Formerly known as Sydney Airport Holdings Limited, Sydney Airport (ASX:SYD) stock has shown decent performance over the years with 117.24% growth over the decade till 2 June 2020. The Company’s growth over the years has been characterised by continued growth in demand for air travel.

Sydney Airport’s revenue has grown from AU$ 946 million in FY09 to AU$ 1,639.7 million in FY19 while delivering on its strategy to preserve and increase investor value. Sydney Airport celebrated both, its centenary and the arrival of its billionth passenger during the year 2019 and the year was also marked by several other highlights.

Source: Company's Report

The year 2019 was a remarkable year for SYD with 44.4 million passengers welcomed during the year and robust performance across its aeronautical as well as non?aeronautical businesses. Sydney Airport consolidated its position as Australia’s busiest airport and reaffirmed the leading role in the social and economic fabric of Sydney and NSW.

With a proven track record of performance and growth through all economic cycles, SYD is confident to be a strong, stable, and resilient asset entering a new decade. Moreover, SYD looks forward to pursuing growth opportunities across both aeronautical and non-aeronautical businesses despite any challenge in 2020 and continuously seek ways to raise the bar for its customers.

On 3 June 2020, the SYD stock increased by 3.807% (AEST: 03:53 pm) and settled at a price of AU$ 6.135, with a market capitalisation of AU$ 13.36 billion.

Auckland International Airport Limited (ASX:AIA)

Another stock that has grown significantly is Auckland International Airport Limited (ASX:AIA). It’s the third busiest international airport in Australasia and has delivered 310.52% returns to its shareholders over a period of last ten years till 02 June 2020.

AIA is driven by its focus on transforming Auckland into an aviation hub for New Zealand and the Pacific Rim while also turning into an airport that can have room for the growing number of aircraft and passengers.

In the year 2009, the company reported a revenue of NZ$ 369.2 million and the same reported revenue of NZ$ 743.4 million during the year 2019. Moreover, for the six months ended 31 December 2019, AIA recorded revenue of NZ$ 374.7 million, higher than what the Company filed for FY2009, ten years ago.

Since this does highlight the company’s growth over the years in terms of financials, there has been significant growth in the EPS from 3.41 cents per share in FY 2009 to 22.8 cents for the 2019 financial year.

The Company plays a pivotal role in connecting New Zealanders to the world and encouraging traveller to visit New Zealand. The AIA stock is trading at a price of AU$ 6.42, up by 5.246% (AEST: 03:53 pm) with a market capitalisation of AU$ 8.98 billion on 3 June 2020.

Alliance Aviation Services Limited (ASX:AQZ)

Australia’s leading air charter services operator, Alliance Aviation Services Limited (ASX:AQZ) has witnessed a growth of 511.11% in its stock over the period of last five years as on 2 June 2020. Being a main fly-in, fly-out air charter operator in the country, AQZ has a track record of providing the highest benchmarks of secure, trustworthy, and operational performance for its users.

Over the years, AQZ has transformed into a promising aviation player with a growth in revenue from AU$ 199.4 million in FY2015 to AU$ 277.1 million during FY19. For the half-year ended 31 December 2019, the Company reported revenue of AU$ 151.3 and a record number of 19,710 flight hours were operated utilising a fleet of up to 40 aircraft during the half-year.

The Company’s rapid growth reflects upon its ability to react quickly to the needs of its clients and realize the necessity to meet short as well as long-term requirements. Alliance continues to be the preferred airline for the Australian mining and resources sector and has maintained delivery of highest levels of services, safely, on time and in a cost-effective manner to all clients.

The AQZ stock decreased by 0.364% on 3 June 2020 (AEST: 03:53pm) and is trading at AU$ 2.750 with a market capitalisation of AU$ 350.54 million.