Summary

- The stock of A. O. Smith Corp. (NYSE:AOS) jumped 54% in the past six months.

- Cintas (NASDAQ:CTAS) topped the Forbes’ list for “Best Employers for Diversity 2021” award.

- Based in Downers Grove, Illinois, Dover (NYSE:DOV) is one of the world’s leading manufacturers of diversified products with annual revenue of around US$7 billion.

Here are three dividend-paying industrial stocks that may benefit from the US economic recovery. The capital goods industry has witnessed one of the worst storms during the covid pandemic.

The US government’s economic stimulus plan has boosted the spirit of the sector. Besides increased spending in critical economic sectors, the government also has made borrowings cheaper, which is expected to help industries recover from covid losses.

The following dividend-paying industrial stocks: A.O. Smith Corporation (NYSE:AOS), Cintas Corp. (NASDAQ:CTAS), and Dover Corporation (NYSE:DOV) are set to gain from an upturn in the economy.

Thus, an insight into how they performed and what they plan for the future may be worth taking.

Pic Credit: Pixabay.

Also Read: Will These Three Entertainment Stocks Rally On Consumer Optimism?

A.O. Smith Corporation

It is one of the world’s leading manufacturers of water treatment plants, boilers, and water-heaters. One of its major market is Asia, where it has registered a significant sales growth for water treatment plants. It also has a significant client base for residential gas-and-electric water heaters.

Its first-quarter sales jumped 21% to US$769.0 million, compared to the same period last year. Net earnings rose 89% to US$97.7 million, while EPS saw an 88% increase to US$0.60 in Q1.

Also Read: Dogecoin Wasn’t the Only Crypto to Fall After Musk’s SNL Appearance

In North America, sales rose 4% to US$552.9 million, compared with Q1 of 2020. The numbers were boosted by the demand for water heating equipment in Canada and an inflation-linked price hike.

The company saw a 100% increase in sales to US$222.3 million in the rest of the world, driven mainly by the demand from China. It expects a 15% increase in sales this year. It also forecast an EPS of US$2.55-US$2.65 in the fiscal year.

The stock was trading at US$72.25, up 1.57% from the previous close on Monday, May 10. The shares of A.O. Smith jumped 54% in the past six months.

It announced a quarterly dividend of US$0.26 per share last month.

Cintas Corporation

Cintas is a leading provider of restroom supplies such as mat, mops, etc. It is headquartered in Cincinnati, Ohio. The company also operates first aid and fire protection services businesses, which account for 11% and 6% of its sales, respectively.

The stock was trading at US$360.74, up 0.02% from the previous close, on Monday, May 10. The stock price did not see major changes in the past six months.

Also Read: Colonial Pipeline Service To Remain Suspended For The Week

Cintas’s Vice President Thomas E. Frooman to step down from the post on July 31, 2021, after 20 years in that role.

Cintas topped the Forbes’ list for “Best Employers for Diversity 2021” award. It was selected following an independent survey of more than 50,000 employees working in different companies.

Cintas also gives out the Cintas Custodian of the Year award. This year’s winner is a high school student, Mike Heiry, who won over 70,000 votes. He will receive a cash prize of US$10,000.

The company has announced a quarterly dividend of US$0.75 per share for the latest quarter.

Pic Credit: Pixabay.

Also Read: Five penny stocks that are charging higher today

Dover Cooperation

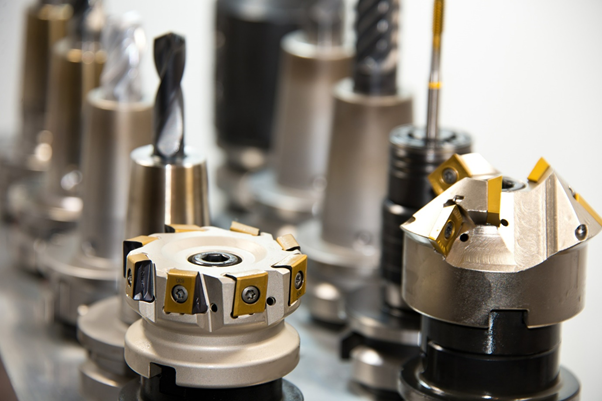

Headquartered in Downers Grove, Illinois, Dover is one of the world’s leading manufacturers of diversified products, with annual revenue of around US$7 billion. It provides various products for imaging, fueling, pumps, and food and refrigeration equipment, among others.

The stock was trading at US$153.45, up 0.35% at the market close on Monday, May 10. It surged 28% over the past six months.

The company has recently launched a new pump product in the market. The Wilden ISD Series dampeners provide more effortless discharge flow, according to the company.

Dover’s Q1 revenues ended March 31, 2021, rose 13% to US$1.9 billion. GAAP net earnings jumped 32% to US$233 million, while GAAP diluted EPS soared 33% to US$1.61. On May 7, 2021, Dover had declared a quarterly dividend of $0.495 per share for its shareholders.