Wall Street’s main indexes closed higher on Tuesday, March 22, as technology, financials, and consumer discretionary segments saw a strong rebound amid upbeat quarterly results.

The S&P 500 rose 1.13% to 4511.61. The Dow Jones gained 0.74% to 34807.46. The NASDAQ Composite Index rose 1.95% to 14108.82, and the small-cap Russell 2000 was up 1.08% to 2088.34.

Energy stocks traded lower, although the benchmark oil prices hovered above the US$100 mark a barrel. Brent and WTI crude marginally declined from the previous day’s close. The yields in 10-year and 30-year Treasury notes were up over 2.5% on Monday. Yields move inversely to the price.

Investors shrugged off concerns that Fed’s aggressive stance on inflation may slow down the economic growth. Some analysts predicted slower growth due to the expected multiple hikes in interest rates.

Last week, the central bank raised the rates by 25 basis points and said that it was ready to increase it further by a half percentage point.

Technology, consumer discretionary, and communication services sectors were the top gainers on the S&P 500 index on Tuesday. The energy and utility sectors were the laggards. Seven out of the 11 stock segments of the S&P 500 index stayed green.

NIKE, Inc’s (NKE) better-than-expected third-quarter results boosted the sentiments. The stock was up around 2.75% near the close of the regular session.

Nike posted third-quarter revenue of US$10.9 billion, up 5% YoY, on Monday. Its store sales increased by 15% to US$4.6 billion, while digital sales rose by 19% year on year.

Technology company Adobe Inc (ADBE) was expected to report in the after-market hours on Tuesday. The ADBE stock was trading up 2.84% in intraday trading.

Also Read: What is Qtum (QTUM) crypto and why is it rising?

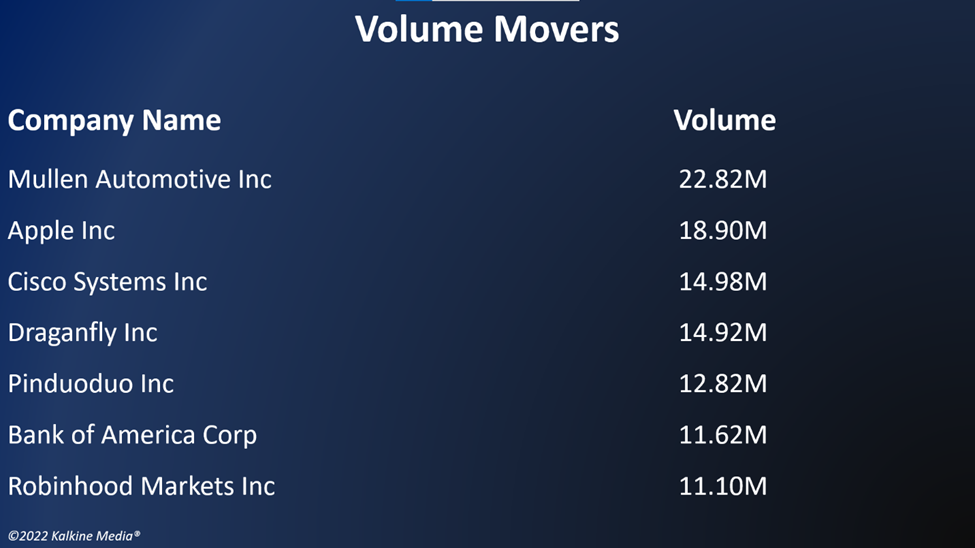

Shares of China’s largest agricultural trade platform Pinduoduo Inc (PDD) surged over 19% after posting fourth-quarter results. Its total revenue rose by 3% to RMB27,230.9 million (US$24,273.1 million) YoY. In other Chinese stocks, Alibaba Group (BABA) jumped 11.55%, while JD.com, Inc. (JD) was up 5.44%.

In the technology sector, Apple Inc. (AAPL) rose about 2.15%, Microsoft Corporation (MSFT) gained 1.51%, ASML Holding N.V. (ASML) was up 1.00%, and Broadcom Inc. (AVGO) rose 1.54%.

In financial stocks, JPMorgan Chase & Co. (JPM) rose 1.90%, Bank of America Corporation (BAC) rose 2.89%, Visa Inc. (V) gained 0.46%, and Wells Fargo & Company (WFC) gained 3.83%.

Consumer discretionary stocks Amazon.com, Inc. (AMZN) was up 2.18%, Tesla, Inc. (TSLA) surged 7.58%, and NIKE, Inc. (NKE) rose 2.75%. The Home Depot, Inc. (HD) and Lowe's Companies, Inc. (LOW) were marginally up by 0.29% and 0.48%, respectively.

In energy stocks, Exxon Mobil Corporation (XOM) declined 0.32%, Chevron Corporation (CVX) fell 0.41%, Shell plc (SHEL) 0.50%, and BP plc (BP) shed around 0.32%.

In communication services stocks, Alphabet Inc. (GOOGL) gained 2.77%, Meta Platforms, Inc. (FB) grew 2.44%, and The Walt Disney Company (DIS) soared 1.07%. Comcast Corporation (CMCSA) and Netflix, Inc. (NFLX) ticked up 1.18% and 2.22%, respectively.

The global cryptocurrency market was up 2.69% to US$1.92 trillion at around 4:30 pm ET, according to coimmarket.com. Bitcoin’s (BTC) price rose 3.2% to US$42,479.45 in the last 24 hours.

Also Read: When is Tokyo-based crypto exchange Coincheck going public?

Also Read: Will NeuroSense Therapeutics (NRSN) stock continue its rally in 2022?

Also Read: Why is Oasis (ROSE) crypto rising?

Futures & Commodities

Gold futures declined about 0.46% to US$1,920.60 per ounce. Silver fell 1.68% to US$24.887 per ounce, while copper was flat at US$4.7105.

Brent oil futures were down around 0.67% to US$114.90 per barrel and WTI crude fell about 1.04% to US$108.76 a barrel.

Also Read: Top cyber stocks to watch in 2022: PANW, CHKP, LDOS, TENB & NLOK

Bond Market

The 30-year Treasury bond yields were up 2.94% to 2.611, while the 10-year bond yields rose 2.98% to 2.386.

US Dollar Futures Index fell 0.06% to US$98.44.