Benchmark US indices closed in the green for the second consecutive day on Tuesday, February 1, after strong quarterly earnings and upbeat labor data lifted sentiment.

The S&P 500 rose 0.69% to 4,546.54. The Dow Jones gained 0.78% to 35,405.24. The NASDAQ Composite was up 0.75% to 14,346.00, and the small-cap Russell 2000 rose 1.09% to 2,050.48.

On Tuesday, the Labor Department said job openings increased to 10.9 million in December end, suggesting fewer resignations and fewer people coming forward for work.

According to an industry report cited by WSJ, the US manufacturing activity declined to 57.6 points in January, from a reading of 58.8 in the previous month.

Six of the 11 stock segments of the S&P 500 stayed in the positive territory. Energy, basic materials, and industrial stocks gained the most. Utilities, real estate, and tech stocks trailed.

Retail investors were encouraged by strong quarterly results on Tuesday. According to Refinitiv data, of the 184 S&P 500 companies reported so far, 78.8% have beat forecasts.

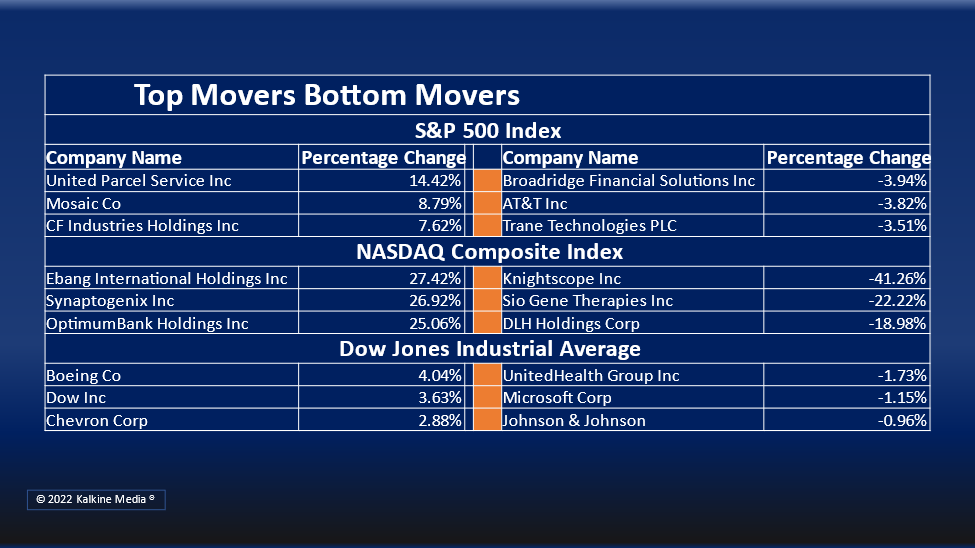

Shares of United Parcel Service, Inc. (UPS) grew more than 14% after reporting record earnings.

Exxon Mobil (XOM) stock rose over 6.4% after its quarterly profits rose to a seven-year high.

The AT&T Inc. (T) stock plunged 3.8% after the company said to spin off WarnerMedia in a US$43 billion deal. The deal will see WarnerMedia merger with Discovery.

Alphabet Inc. (GOOGL) stock jumped over 1.2% ahead of its earnings in aftermarket hours.

In energy stocks, Chevron Corp (CVX) gained 2.98%, ConocoPhillips (COP) rose 3.21%, and EOG Resources Inc. (EOG) was up 1.58%. Pioneer Natural Resources Company (PXD) gained 2.02%.

In the material sector, Linde Plc (LIN) stock surged 0.86%, Sherwin Williams Company (SHW) increased by 2.23%, and Ecolab Inc. (ECL) rose 1.06%. Freeport-McMoran Inc. (FCX) was up 4.53%, while Air Products and Chemicals Inc. (APD) increased by 0.75%.

In the utility sector, NextEra Energy Inc. (NEE) stock fell 1.20%, Duke Energy Corporation (DUK) plunged 1.26%, and Southern Company (SO) fell 2.05%. Dominion Energy (D) declined by 0.62%, and Exelon Corporation (EXC) decreased by 0.37%.

The global cryptocurrency market was up 1.50% to US$1.77 trillion, as per coinmarketcap.com at 3:50 pm ET. Bitcoin (BTC) rose 0.50% to US$38,681 in the last 24 hours.

Also Read: Top 30 stocks on Dow Jones (Part 1)

Also Read: Top 30 stocks on Dow Jones (Part II)

Also Read: Can McDonald's (MCD) influence food companies to enter metaverse?

Futures & Commodities

Gold futures surged 0.34% to US$1,801.05 per ounce. Silver futures increased by 1.10% to US$22.640 per ounce, while copper futures jumped 2.49% to US$4.4320.

Brent oil futures increased by 0.10% to US$89.35 per barrel and WTI crude futures were up by 0.22% to US$88.34.

Bond Market

The 30-year Treasury bond yields increased 1.23% to 2.124, while the 10-year bond yields were up 1.21% to 1.804.

US Dollar Futures Index fell 0.27% at US$96.280.