Highlights

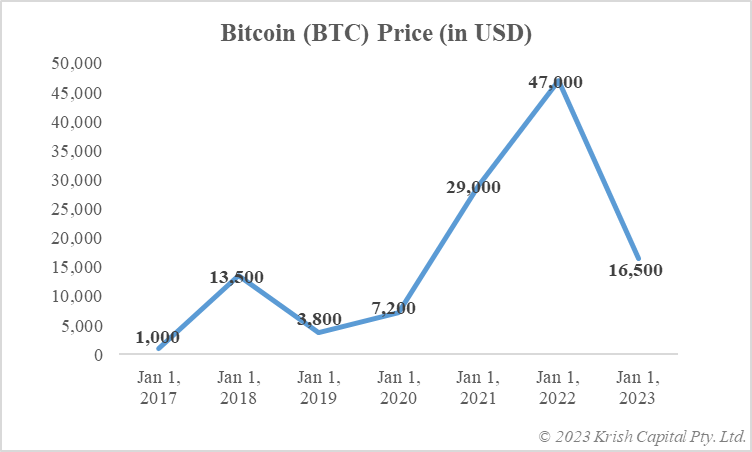

- In 2022, cryptocurrencies, including the biggest of them- Bitcoin, suffered deep losses due to negative sentiments

- Bitcoin, unlike fiat currencies, lacks government backing, and hence, it is possible that its value can drop to zero

- What will be Bitcoin’s value over coming months or years cannot be predicted using any trend or model

What is Bitcoin? Is it money like fiat currency, or is it an asset like gold and listed shares? For now, Bitcoin’s utility as money in the payments system is disputed because of the extreme volatility of its price. Altcoins like Ether and Solana’s SOL, considered the ‘native tokens’ of their respective blockchain networks, are equally volatile. Bitcoin and some altcoins gained in price terms in 2020 and 2021, but the entire cryptocurrency sector booked heavy losses last year.

The question now is whether Bitcoin can drop to zero. Even though it is not possible to predict Bitcoin’s value either in the near or long run, the subject of discussion is whether there is a possibility that the value of the multi-billion-dollar asset can fall to zero. Let us explore.

Bitcoin lacks backing

The world of cryptocurrency, be it Bitcoin or pegged stablecoins like Tether (USDT), lacks any backing as it exists in fiat currencies. Fiat money is issued and managed by central banks as representatives of their respective governments. The value is guaranteed by the sovereign, though one currency may lose or gain vis-à-vis other fiat currencies due to demand and supply forces. Bitcoin is a peer-to-peer managed currency with no role of the sovereign or any intermediary like banks.

In past years, Bitcoin has gained more acceptance as a speculative asset than a form of money. The El Salvador experiment has not produced any return after Bitcoin gained recognition as legal tender in 2021. Speculative assets like Bitcoin and altcoins can lose any value during unfavourable market conditions. When conditions are hostile, and there are fewer or no buyers of the asset, the value can even plunge to zero.

Data provided by CoinMarketCap.com

Lack of consensus

People have contrasting opinions when it comes to Bitcoin and other cryptoassets. Ace investor Warren Buffett has ridiculed Bitcoin on multiple occasions. On the other hand, Jack Dorsey has remarked that Bitcoin could become the internet’s native currency. Any speculative asset’s value depends heavily on sentiment. The TerraUSD stablecoin token nosedived from US$1 to a few cents in May last year due to negative sentiments.

Bottom line

What Bitcoin’s price could be in the near to long term is debatable. But because there is no backing like it is in the case of fiat currencies, there is a possibility that Bitcoin might lose even more value if sentiments continue to remain negative. Bitcoin essentially derives value from backers who continue to believe that the cryptocurrency can one day find broader utility. Any severe blow to this belief can trigger heavy losses in value.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.