Highlights

- The S&P/TSX Capped Industrial Index rose by more than 20 per cent in 2021.

- An aircraft manufacturer’s stock mentioned here zoomed by over 493 per cent in the last 12 months.

- An airline stock listed below signed a memorandum of understanding (MOU) on November 10 to explore the direct capture technology for aviation decarbonization.

The Canadian industrial sector is known to be a major contributor to the country’s economy. Therefore, being a crucial part of it, the aviation industry too plays an important role in Canada’s growth.

After being severely beaten down by the pandemic, the aviation space has been slowly taking a turn for the better amid the easing of lockdown restrictions. A reflection of this improvement can be seen on the S&P/TSX Capped Industrial Index, which has risen by more than 20 per cent in 2021.

Keeping that in mind, let us explore two aviation stocks listed on the TSX.

Also read: Top 5 Canadian industrial stocks to buy in Q4 2021

1. Bombardier Inc (TSX: BBD.B)

Headquartered in Montreal, Bombardier Inc manufactures and markets business aircraft worldwide. It is also said to provide aftermarket support for certain commercials aircraft.

Amid rising vaccination rates, the company saw a year-over-year (YoY) rise of 17 per cent in its business jet revenues of US$ 1.4 billion in the third quarter of fiscal 2021. In addition, its revenue from business aircraft services grew by US$ 76 million in the latest quarter.

On Wednesday, November 17, Bombardier stock hit a day high of C$ 1.82 apiece before closing at C$ 1.78.

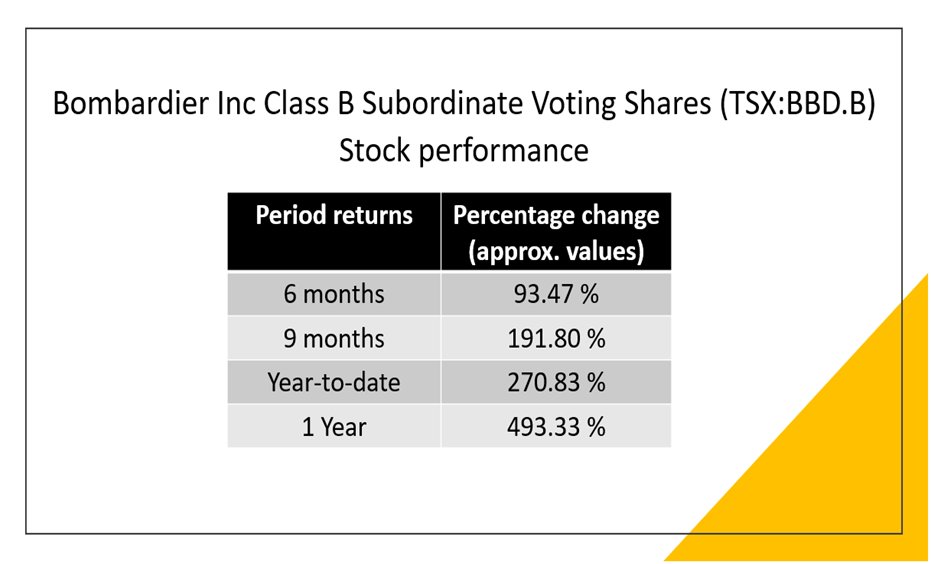

The Canadian aircraft maker’s stock has soared by more than 93 per cent in the past three months and zoomed by over 493 per cent in the last 12 months.

Image source: © 2021 Kalkine Media Inc

On the valuation front, Bombardier held a market capitalization of C$ 3.7 billion and a return on assets (ROA) of 23.06 per cent.

2. Air Canada (TSX: AC)

Montreal-based carrier Air Canada took quite a beating amid travel bans last year. But with the restrictions slowly going down, it reported a significant growth in its passenger counts and booking in the latest quarter.

The biggest Canadian airline reported operating revenues of C$ 2.1 billion in Q3 FY2021, notably up from that of C$ 757 million in Q3 FY2020.

Its cargo segment also noted a robust performance in its latest quarter, along with improvements in Air Canada Vacations and Aeroplan divisions as well.

While Air Canada has incurred a net loss of C$ 640 million in Q3 FY2021, it was comparatively lower than that of C$ 685 million in Q3 FY2020.

On November 10, Air Canada signed a memorandum of understanding (MOU) with Carbon Engineering Ltd to explore its direct capture technology for aviation decarbonization.

As for its stock performance, Air Canada scrip jumped by more than five per cent in the last month. It surged by over seven per cent on a year-to-date (YTD) basis and expanded by nearly 18 per cent in the past year.

AC stock closed at C$ 24.45 apiece on November 17.

Also read: 2 real estate stocks to buy as Canada’s home sales surge

Bottom line

Although the rising inflation is something to keep in mind, the Canadian economy has been improving from its pandemic lows. This recovery is expected to the industrial growth of the country.

While the industrial sector is often overlooked by some investors due to its cash and expenditure intensity, it is also a sector that holds growth opportunities.