Summary

- Healthcare stocks have gained steam amid COVID times and US President Donald Trump’s recent Covid-19 diagnosis.

- Regeneron Pharmaceuticals’ (NASDAQ:REGN or REGN:US) shares surged after Trump was prescribed its ‘antibody cocktail’.

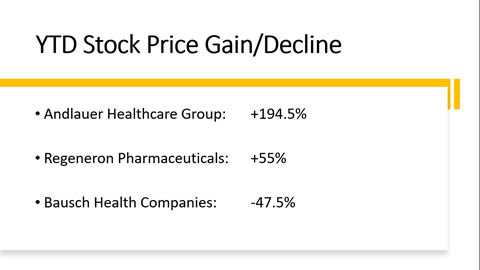

- Andlauer Healthcare (TSX:AND) stock has increased by a remarkable 194.5 per cent year-to-date.

- Bausch Health Companies Inc (TSX:BHC) launches silicone hydrogel daily disposable contact lens.

Pharmaceutical stocks started trending after President Donald Trump was diagnosed with COVID-19 last week. Regeneron Pharmaceuticals Inc’s (NASDAQ: REGN or REGN: US) experimental drug, the ‘antibody cocktail’, had been prescribed to the President to treat his COVID-19 symptoms. Following this, the company’s stock gained 7.13 per cent on Monday, October 5.

Healthcare stocks also rose in Canada, which is witnessing a second wave of COVID-19 cases. The S&P/TSX Healthcare index is up by 1.21 per cent month-to-date. Some of the Canadian healthcare companies doing well are Bausch Health Companies Inc (TSX:BHC) and Andlauer Healthcare Group Inc (TSX:AND).

The industry was also boosted by Nobel Prize 2020 in Medicine, which was jointly awarded to Harvey J. Alter, Michael Houghton, and Charles M. Rice for their discovery of Hepatitis C virus. The development has built up positive sentiments among investors for healthcare sector.

Regeneron Pharmaceuticals Inc. (NASDAQ: REGN or REGN: US)

Sector: Healthcare

Industry: Pharmaceutical

REGN Stock Price: US$ 581.64

Regeneron Pharmaceuticals Inc is a US-based biopharmaceutical firm. The company researches, produces, and commercializes a range of pharma products and medical devices. Regeneron’s products include: Eylea for old-age macular degeneration and eye diseases; Praluent for LDL cholesterol lowering; Dupixent in atopic dermatitis, asthma, and nasal polyposis; Libtayo in cutaneous squamous cell carcinoma; and Kevzara in rheumatoid arthritis. Regeneron also produces monoclonal antibodies with Sanofi in immunology and cancer, and bispecific antibodies and antibody cocktails.

On October 2, a doctor from the Walter Reed National Military Medical Center informed that President Trump was given an intravenous dose of Regeneron’s experimental "antibody cocktail." Encouraged by this development, the pharma company’s stocks surged to the highest level in five weeks and closed at US$ 605.08 on Monday. In last one year, this stock has yielded 113.86 per cent returns to the investors.

Regeneron's business continues to be resilient during COVID-19 times, delivering double digit growth in the second quarter of 2020. The company’s revenues amounted to US$ 1.95 billion, up 24 per cent Q2 2019. Its GAAP net income stood at US$ 897 million in Q2 2020, a 365 per cent increase from US$ 193 million in Q2 2019.

Andlauer Healthcare Group Inc (TSX:AND)

Sector: Healthcare

Industry: Pharmaceutical

AND Stock Price: C$45.42

Andlauer (TSX:AND) is a leading healthcare supply chain services provider across Canada. It prioritizes safe and efficient delivery of healthcare goods and services from development stage to end users such as hospitals and patients. The company offers third-party logistics’ services including distribution, and shipment solutions for healthcare manufacturers across Canada.

Andlauer Healthcare Group on October 5 acquired all of the issued and outstanding shares of TDS Logistics Ltd (TSX:TDS) and McAllister Courier Inc (TSX:MCI), two locally focused temperature-controlled transportation operations, for a purchase price of approximately C$ 15.9 million. These two companies minted approximately $22 million of net revenue in FY19. With these acquisitions, the company aims to expand its services and market presence in Ontario.

Andlauer stock has increased by an astonishing 194.5 per cent year-to-date (YTD). The stock is ranked highly on two TMX Stocklists (across TSX and TSXV) – the top price performer and top healthcare. The scrips jumped 7.53 per cent on October 5.

In Q2 2020, Andlauer reported a 1.2 per cent increase in its EBITDA to C$ 18.0 million, compared to C$ 17.7 million in Q2 2019. Its revenue was C$ 70.3 million for Q2 2020, a decrease of 1.3 per cent compared to C$ 71.1 million in Q2 2019. Andlauer paid C$ 0.05 quarterly dividend to its shareholders. Its dividend yield stood at 0.44 per cent.

Image: ©Kalkine Group 2020

Bausch Health Companies Inc (TSX:BHC)

Sector: Healthcare

Industry: Pharmaceutical

BHC Stock Price: C$ 20.39

Bausch Health is one of the largest healthcare companies in Canada with a current market capitalization of C$ 7.63 billion. The company produces drugs and supplies pharmaceuticals products and produces drugs for unmet medical requirements in the therapeutic areas of eye health, neurology, gastroenterology, and dermatology. It has operations across the world.

Bausch and Lomb, the global eye health business wing of Bausch Health, announced the launch of new silicone hydrogel daily disposable contact lens on October 6 during the American Academy of Optometry Annual Meeting.

Bausch reported 23 per cent decrease in revenue i.e. C$ 1.664 billion for Q2 2020, as compared to C$ 2.152 billion in Q2 2019. Bausch Health’s Adjusted EBITDA (non-GAAP) stood at C$ 622 million in Q2 2020, as compared to C$ 880 million for the second quarter of 2019, a decrease of C$ 258 million, or 29 per cent.

Bausch’s stock has declined by 47.5 per cent YTD. However, in last five trading days, the scrips have gained C$ 0.45, a 2.26 per cent increase.