Highlights

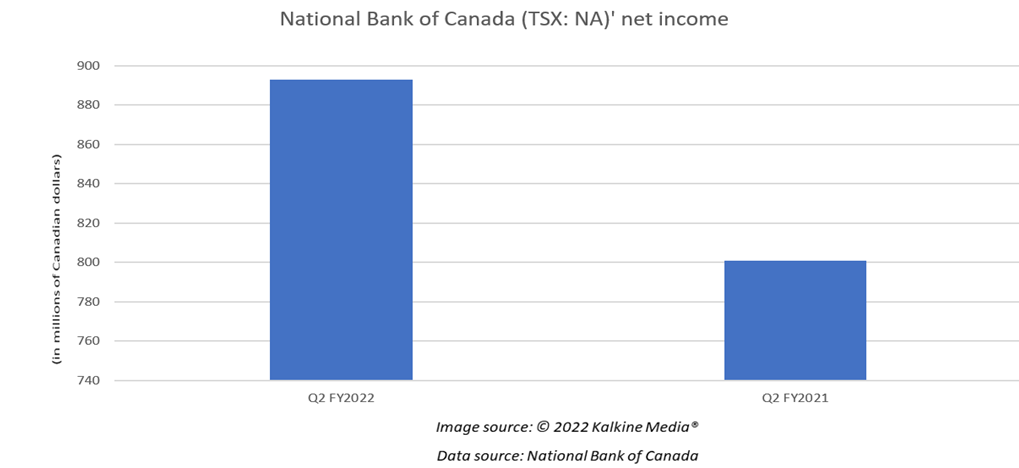

- National Bank of Canada (TSX:NA) reported net profit growth of 11 per cent in Q2 FY2022 compared to Q2 2021.

- It also expanded its dividend by six per cent, scheduled for August 1.

- The C$ 32-billion market cap company reported a net profit of C$ 893 million in the second quarter of 2022.

National Bank of Canada (TSX:NA) wrapped up the earnings season for Canada’s big six banks on Friday, May 27, with a year-over-year (YoY) net profit growth of 11 per cent in Q2 FY2022. The Canadian lender said that this surge was led by revenue increment across its business divisions.

It also expanded its quarter-based dividend by six per cent to C$ 0.92, scheduled for August 1.

So, let us take a deep dive into its Q2 FY2022 results without any more delay.

National Bank of Canada (TSX: NA) Q2 FY2022 results

The C$ 32-billion market cap lender posted a net profit of C$ 893 million in the second quarter of 2022, noting an increase from C$ 801 million in Q2 2021. National Bank of Canada’s total revenue rose to C$ 2.43 billion in Q2 FY2022, marking a YoY jump of nine per cent.

Canada’s sixth-biggest bank (by market capitalization) reported that its diluted earnings per share (EPS) swelled by 13 per cent YoY to C$ 2.55 in the latest quarter. The bank said that its profit before provision for credit losses (PCL) and income taxes was up 10 per cent in Q2 2022 against Q2 2021.

National Bank’s Personal and Commercial segment saw a net profit of C$ 313 million in the second quarter of 2022 compared to C$ 305 million in the same period of 2021. Its Wealth Management saw a net profit surge of three per cent YoY in Q2 2022, while that of Financial Markets was 17 per cent YoY and that of US Specialty Finance was 18 per cent YoY.

Also read: RY, TD & CM stocks fly after Q2 results: Which TSX bank stock to buy?

National Bank of Canada stock performance

NA stock was trading about three per cent higher at C$ 97.64 at 10.28 AM EST on May 27. Stocks of the National Bank of Canada have returned almost six per cent month-to-date (MTD).

However, the bank stock has dipped by roughly 11 per cent since November 22, 2021, when it achieved a 52-week high of C$ 106.1.

According to Refinitiv data, NA stock seems to be on a bullish trend with a Relative Strength Index (RSI) value of 60.90 at the time of writing.

Bottomline

National Bank President and CEO Laurent Ferreira said that the bank’s focus lies on “delivering a high return on equity (ROE)” and ascertaining “prudent” supervision of risk and regulatory capital.

National Bank currently holds an ROE of nearly 21 per cent. ROE generally expresses a company’s profitability relative to shareholders’ equity. Its price-to-earnings (P/E) ratio, which indicates the market sentiment towards the stocks, is around 10.

National Bank of Canada can be an option to explore for investors with a long-term perspective as NA stock has grown by almost 145 per cent from a pandemic-triggered low of C$ 38.73 (March 23, 2020) in the last roughly two years.

Also read: VMware & Broadcom stocks soar on acquisition plans: What you must know

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.