Australia has one of the best healthcare systems in the world in terms of cost, access, and quality of services and products offered. Globally, health is challenged by demographic and economic changes, threatening a countryâs ability to deliver the level of quality healthcare to which their populations aspire. However, in Australia, there is an extensive R&D and innovations occurring in the healthcare sector which caters to not just the domestic market but the international demand as well. According to a study released by market research firm, Australia has a rising as well as ageing population and its private health insurance services are also improving. These factors are expected to generate strong demand for health services and thereby support revenue growth over the five years through 2018-19.

Letâs look at the three healthcare companies operating in Australia.

Cochlear Limited

Sydney-based Cochlear Limited (ASX: COH) provides implantable hearing solutions to customers in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. With a market capitalisation of AUD 11.65 billion and around 57.72 million outstanding shares, the COH stock was trading at a price of AUD 204.080 (as on 18 June 2019, 3:05 PM AEST), up by 1.115% by AUD 2.250 with 140, 847 shares traded till now.

In addition, the stock has generated positive return yields of 15.19% for the last six months and 15.40% for YTD.

On 17 June 2019, the company announced that it had received FDA approval for the Nucleus® Profile⢠Plus Series cochlear implant and will commence an immediate US launch.

Cochlear had announced the launch of Nucleus® Profile⢠Plus Series cochlear implant on 16 April 2019. It has been designed to conduct routine 1.5 and 3 Tesla magnetic resonance imaging scans without the need to remove the internal magnet. The new technology will be first introduced for commercial sale in Germany, followed by commercialisation in other European countries in the upcoming months as Cochlear seeks respective regulatory approvals.

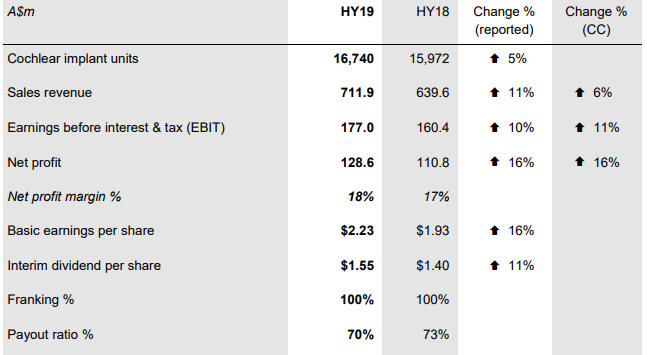

As per the companyâs half-year 2019 results for the six months to 31 December 2018, the business recorded a 11% increase in the sales revenue to $711.9 million and 16% rise in the profits to $ 128.6 million. The highlight was the Services business which grew revenue by 28% (21% in CC), with sound processor upgrade revenue increasing by 26% in CC. In addition, Cochlearâs Acoustics business also recorded a revenue growth of 7% (1% in CC) and the demand continues to gradually grow for the Baha 5 sound processor range of product.

Besides, the Cochlear implant units were up 5% to 16,740 (see figure below).

Source: Financial Results for The Six Months Ended December 2018

Source: Financial Results for The Six Months Ended December 2018

In addition, the companyâs operating cash flow increased by $71.4 million to $164.1 million and the Board declared an interim dividend of $1.55, an increase of 11% on the last year.

ResMed Inc

World-leading health company ResMed Inc (ASX: RMD) is based in Bella Vista, Australia and engaged in the development, manufacturing and commercialisation of cloud-connected medical devices for supporting diagnosis, treatment and management of chronic obstructive pulmonary disease, sleep apnoea, and other chronic diseases. With a market capitalisation of AUD 24.63 billion and around 1.43 billion outstanding shares, the RMD stock was trading (on 18 June 2019, 3:36 PM AEST) at AUD 17.390, edging up 1.222% by AUD 0.210 with approximately 1,284,148 shares traded.

On 10 May 2019, ResMed announced a dividend of USD 0.0370 on its security named RMD - CDI 10:1 FOREIGN EXEMPT NYSE, with a record date of 9 May 2019 and the payment date of 13 June 2019. Previously on 6 May 2019, the company issued 1,433,459,720 CDI Equivalent of Ordinary Shares each fully paid at an average issue price for stock option being USD 4.65 under the Incentive Award Plan and Employee Stock Purchase Plan.

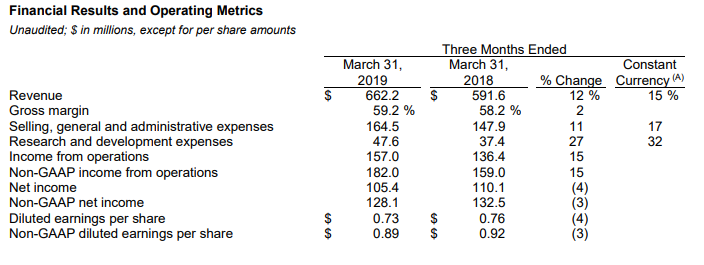

In April 2019, ResMed released the results for the third quarter of FY2019, reporting another three months of strong top-line revenue growth recorded across all business categories, including a significant contribution from recently acquired SaaS companies and impressive growth in the device sales internationally. There was a 12 percent year-on-year improvement in the revenue to $ 662.2 million, (up 15 percent on a constant currency basis) while the gross margin also extended to 59.2% (by 100bps). There was also a 15% rise in the net operating profit and the non-GAAP operating profit was up 15%. The company posted the GAAP diluted earnings per share of $ 0.73 and the non-GAAP diluted earnings per share of $ 0.89. The results for the 2019 third quarter are depicted in the image below.

Source: Third Quarter Results 2019

Source: Third Quarter Results 2019

CSL Limited

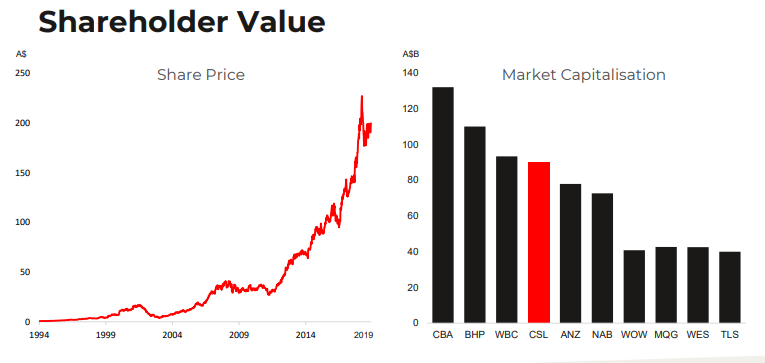

CSL Limited (ASX: CSL), established in 1916 and headquartered in Parkville, Australia, is engaged in the research, development, manufacturing, marketing, and distribution of biopharmaceutical and allied products in the United States, Australia, Switzerland, Germany, the United Kingdom, China, and other countries worldwide. The company operates through two segments, CSL Behring and Seqirus. With a market capitalisation of AUD 95.8 billion and around 453.14 million outstanding shares, the CSL stock was trading at AUD 215.545, edging up 1.951% by AUD 4.125 with around 944,606 shares traded on 18 June 2019 (AEST 3: 52 PM).

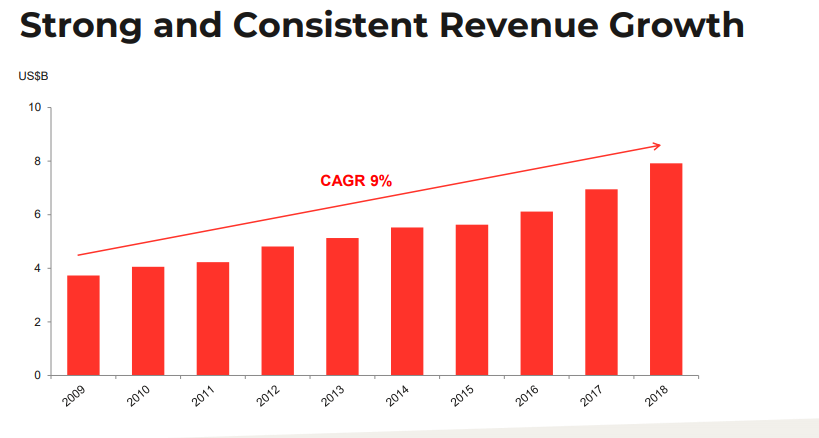

Source: Shareholder Information Meetings presentation

Source: Shareholder Information Meetings presentation

Recently on 14 May 2019, the company issued around 28, 268 fully paid ordinary shares under the Performance Rights Plan (PRP) upon exercise of Rights and Options granted. The PRP was adopted by the shareholders at the 2003 Annual General Meeting (AGM) and was recently approved at the 2018 AGM.

As per CSLâs half-year results for the six months to 31 December 2018, the revenues from continuing operations increased to USD 4.5 billion (see figure 2), up 8.6% while the net profit after tax for the period attributable to members was up 6.8% to USD 1.2 billion. Besides, the company also launched 5 major products in the last 24 months (see figure 1).

Figure 1; Source: Shareholder Information Meetings presentation

Figure 1; Source: Shareholder Information Meetings presentation

Figure 2; Source: Shareholder Information Meetings presentation

Figure 2; Source: Shareholder Information Meetings presentation

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.