If you were an investor, what would be your primary attraction while investing in a stock? With a horde of probable responses, a majority would downrightly admit that their primary attraction would be Good Dividend Returns. In an ideal investing scenario, the investor undertakes all the risks, conducts market research and capitalizes his valuable money- for a simple reason- to make some bucks and generate good returns from the investments.

With respect to this context, let us understand the meaning of dividend stocks, their performances amidst low interest rates and look at the four related stocks that are trading on the Australian Securities Exchange:

What are dividend stocks?

Stocks that trade on a trading exchange and have a decent history and bear potential to generate good dividend returns for the investor, can be referred to as dividend stocks. They can also be referred to as high-yield stocks, in general terms. Investing in this category of stocks is believed to be a great way to enhance oneâs long-term wealth.

Revising the meaning of dividend, it is the amount of money that is given out of the profits or reserves, by a company to its shareholders, who hold a stake in the company. It is the distribution of the companyâs profits. These can be paid annually, semi-annually, or any periodâs pre-defined schedule rolled down by the company.

The Dividend Routine:

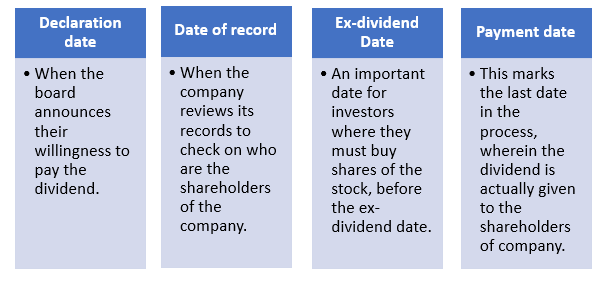

For every share of a dividend stock, the investor/shareholder is paid a portion/share of the companyâs total earnings. Dividends are paid after the approval of the companyâs Board of Directors. Four dates are essential in this context:

Are there any misconceptions associated to dividend stocks?

A blind belief makes one accept a self-driven fact that dividend stocks are always âtheâ option to go for, while investing. It sure is a much secure option available, but it is not wary of risks. There are a few misconceptions that should be understood before one decides to leap over to make an investment on high-yield stocks.

The biggest prejudice says that high returns are always great. One should consider the fact that if the firm is paying high dividends, it is not retaining much money to re-invest and grow the business.

Secondly, these stocks are not monotonous or catering to any particular sector, as they are believed to. Also, more than just looking at the dividend, one should address the financial flexibility and the rate at which the company is growing.

Last, but not the least in the list of misconceptions, it should be known that because a companyâs stock pays higher returns, does not make it the safest ideology. The management can farce dividend returns to retain shareholders and make it appealing, but a sudden crisis could burst this bubble. The 2008 financial crisis is a classic example of this scenario.

Dividend stocks amidst low interest regime in Australia:

2019 has been an eventful year in the Australian business economy. The Reserve Bank of Australia dropped the interest rate, to kickstart the Aussie economy. This recent reduction of the interest rate by 0.25 per cent, amid the trade wars, low wage situation and weak employment level, has taken the case to a historic low level of 1 per cent, marking the second consecutive rate cut in 2 months, post 2012. It should be noted here that a noteworthy part of a companyâs cost is comprised of interest payments.

Even though the situation seems and sounds unpleasant, market experts believe that investors can reap benefits out of the situation. As the recent trend showcased, with the prediction of interest rates to fall, the investment on shares paced up, as the lower interest rates motivated investors to spend more and save less and indulge in, what can be termed as, expectant purchasing. Even though this would eventually facilitate overall business growth, future predictions seem dicey. It should be noted here that falling interest rates makes the cost of borrowing to fund investments fall too.

The Aussie market is well driven by the financial sector, and low-rate environment depict that the economy could be actually underperforming, wherein firms may not be in a position to maintain their profit margins. Hence, returns may be adversely impacted, depending on further changes to the rate cuts. It should be noted that this would also impact housing prices, as low rates would motivate the settlement of loans and mortgages, which would be healthy for banks.

Moreover, the Aussie dollar is expected to fall, as happens as an ideal impact of rate cuts. This would be good for domestic business and give a healthy competitive edge to the economy. However, on the overseas market, effects on other economies would depict the future.

Hence, it is safe to say that these are times when an investor should look at the shares which are offering fair sustainable dividend yields with high franking credits. Research on sectors except the financial space, like property stocks and utilities, would aid investors to choose the best pick. Capital return can be a risky affair to rely on, hence steady or high dividend stocks should be the items to be ordered from the market menu.

A look at 4 Aussie stocks:

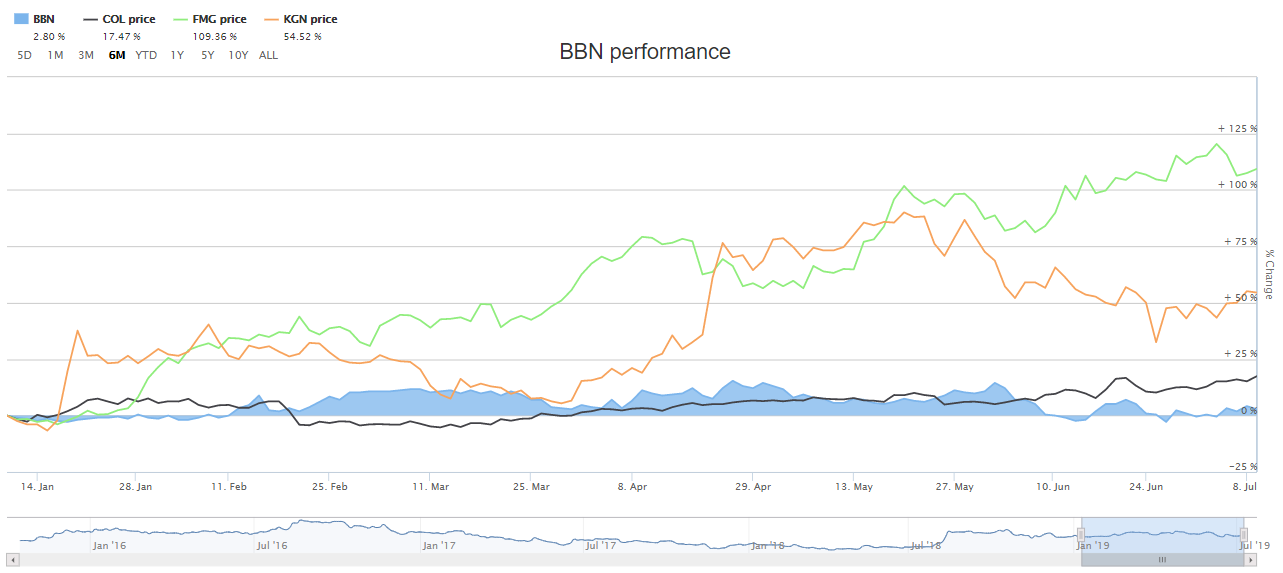

With this understanding, let us now look at the 4 stocks, pertaining to diverse sectors, which have generated fair returns in the last six months, and check the performance of their dividends and stocks in the current times.

6-month returns of BBN, COL, FMG and KGN (Source: ASX)

Baby Bunting Group Limited (ASX: BBN)

Company Profile: The countryâs largest specialty retailer of baby goods and a player of the Consumer Discretionary space, BBN caters to parents with children from new-born to three years of age. The company has its registered office in Dandenong and was listed on ASX in 2015. BBN has 52 National superstores in Melbourne and has an in-store as well as online facility too.

Stock and Dividend Performance: After the close of market on 12 July 2019, the companyâs stock was valued at A$2.340, unchanged from its previous close, with a market cap of A$295.87 million and ~126.44 million outstanding shares. With a P/E ratio of 28.540x, the YTD return of the stock is 4.46 per cent. In the last one, three and six months, the stock has delivered returns of 9.35-per cent, 0.43-per cent and 10.90 per cent, respectively.

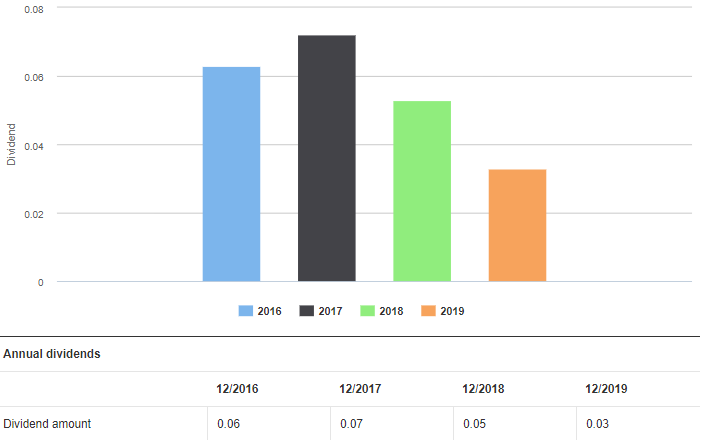

On the dividend front, the annual dividend yield of the stock is 2.48%. The dividend amount for December 2019 stands at A$0.03, lower than A$0.05 of the previous corresponding period.

BBNâs dividend history (Source: ASX)

Coles Group Limited (ASX: COL)

Company Profile: A player of the consumer staples department, COL is an Aussie retail chain that provides products such as fresh food, groceries, household goods, liquor, fuel and financial services via its stores and online as well. The company has its registered office in Hawthorne and was listed on ASX, last year in November.

Stock and Dividend Performance: After the close of market on 12 July 2019, the companyâs stock was valued at A$13.97, up by 0.576 per cent, with a market cap of A$18.53 billion and ~1.33 billion outstanding shares. With a P/E ratio of 18.010x, the YTD return of the stock is negative 2.78 per cent. In the last one, three and six months, the stock has delivered returns of 6.93 per cent, 14.79 per cent and 20.47 per cent, respectively.

On the dividend front, the company announced in its Investorâs Day presentation that it had a Target dividend payout ratio of 80 per cent to 90 per cent, which would be payable in September 2019.

Fortescue Metals Group Limited (ASX: FMG)

Company Profile: A metals and mining giant, FMG is into the business of Mining, processing and transporting of iron ore for export, mainly from its deposits within the Pilbara region of Western Australia. Listed way back in 1987 on ASX, the company has its registered office in Perth.

Stock and Dividend Performance: After the close of market on 12 July 2019, the companyâs stock was valued at A$8.78, up by 0.114 per cent, with a market cap of A$27 billion and ~3.08 billion outstanding shares. With a P/E ratio of 22.18x, the YTD return of the stock is 130.39 per cent. In the last one, three and six months, the stock has delivered returns of 8.27per cent, 16.87 per cent and 108.76 per cent, respectively.

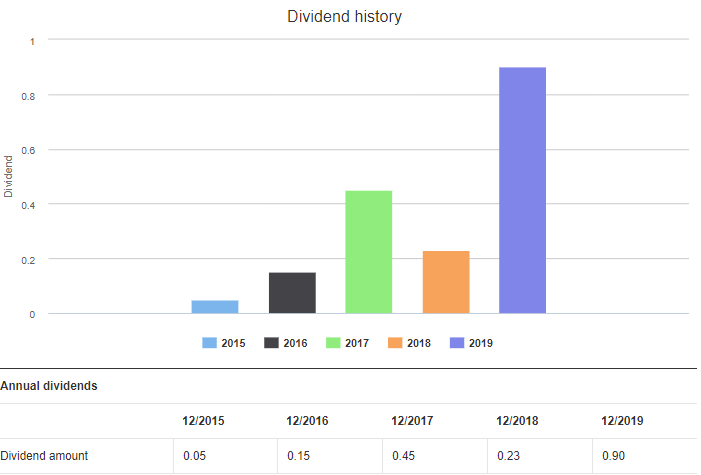

On the dividend front, the annual dividend yield of the stock is 3.53%. The dividend amount for December 2019 stands at A$0.90, soared when compared to A$0.23 of the corresponding last period.

FMGâs dividend history (Source: ASX)

KOGAN.COM LIMITED (ASX: KGN)

Company Profile: A portfolio of retail and services businesses, KGN was listed on the ASX in 2016 and has its registered office in Melbourne. The brand has over 8 million active subscribers, and it aims to making in-demand products and services more affordable and accessible.

Stock and Dividend Performance: After the end of the trading session, on 12 July 2019, the companyâs stock was valued at A$5.29, unchanged from its closing price, with a market cap of A$495.83 million and ~93.73 million outstanding shares. With a P/E ratio of 37.520x, the YTD return of the stock is 51.58 per cent. In the last one, three and six months, the stock has delivered returns of -3.82per cent, 25.06 per cent and 65.83 per cent, respectively.

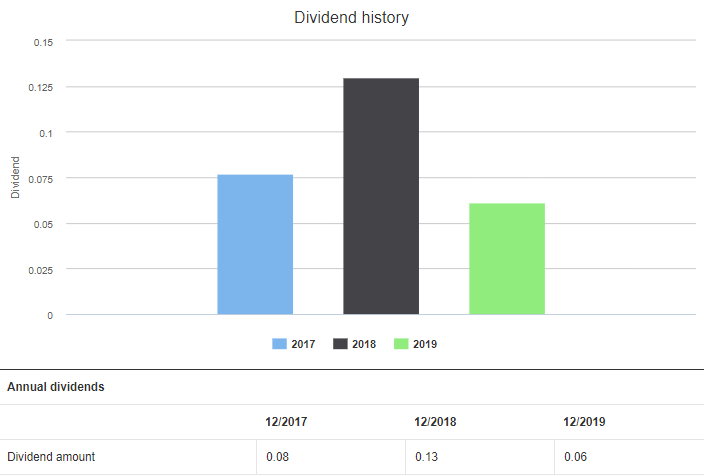

On the dividend front, the annual dividend yield of the stock is of 2.31%. The dividend amount for December 2019 stands at A$0.06, lower to the A$0.13 amount when compared to the corresponding last period.

KGNâs dividend history (ASX:KGN)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.