In order to understand Cyclical Stocks, one must know the business cycle concept. While every business cycle is unlikely to remain the same from the previous observations; business cycles are fluctuations in the growth rate of any economic activity. So, what impacts the rate of growth, leading to fluctuations? As we are discussing the topic from an investing perspective; there are few reasons such as corporate profits, credit cost & availability, inventory but not limited to changes in employment and monetary policies etc. It is worth noting that unanticipated macro-economic shocks might disrupt the trend; some of the examples include the US-China trade woes, wars, famine etc.

Early Phase â In this phase, the key economic indicators such as GDP, industrial production, private investments, income, employment etc. report a positive growth rate from a continued decline in the preceding periods. Historically, this phase has been a wealth creator and it lasts up to one-year. Sectors that benefit from the low-interest rate environment should be preferred by the investors, which could be the Consumer Discretionary, Real Estate and Financials.

The three sectors - Consumer Discretionary, Real Estate and Financials are likely to benefit from the increased borrowing environment, as the increased borrowing provides upside for consumer-focused industries such as automotive and durable good â households in the consumer discretionary.

Other sectors that get a boost from the shifts from recession to recovery include Industrials, Materials and Information Technology. Stocks might rally on the back of an economic recovery in allied industries in this sector, which include transportation and capital goods â Industrials. Meanwhile, Information Technology & Material would witness an upside due to rehabilitated expectations of consumer & spending in the corporations.

Mid Phase â In this phase, the economy moves beyond the recovery level and growth rates are moderate. This phase of the business cycle is longer than any other phase and stock market corrections takes place in this phase. Mainly, Information Technology & Communication Services has been a pick for this phase on the back of capital expenditures by other sectors that drives sub-industries in the sector, which could be semiconductor and hardware. In this phase, investors should keep the exposure to sector bets at a minimum.

Late Phase â Generally, this phase lasts to a year and half, and the economic recovery is matured in this phase. Investors should closely monitor sectors like Energy & Materials as these sectors are widely dependent on raw materials. Inflationary pressure starts to show signs, and late-cycle economic expansion supports the demand.

Besides, the defensive sectors start picking up in this phase due to the fact that these companies manufacture or provide service which are necessity; therefore, these sectors are less prone to economic sensitivity â Healthcare, Utilities and Consumer Staples. The sectors that suffer during this phase include Information Technology & Consumer Discretionary due to mounting inflationary pressures contracts profit margins.

Recession Phase â This phase lasts for slightly less than a year period; the economic growth slows down, which impacts the economically sensitive sectors. Meanwhile, the defensive sector comes out on top as the revenues are dependent on necessary items. The less economically sensitive or defensive sector involves Consumer Staples, Utilities, and Healthcare wherein necessary goods and services such as toothpaste, electricity and prescribed drugs are produced or delivered. Investors should try to avoid economically sensitive sectors, which includes Industrials, Information Technology, and Real Estate.

At the outset, Investors should look for the economically sensitive sectors, and reduce the exposure to defensive stocks in the Early Phase. Similarly, the investors should restructure the portfolio in the Mid-Phase to achieve a risk-adjusted return. Meanwhile, the defensive sectors would perform better in the third phase or Late Phase. Lastly, the Recession Phase, which is wealth disruptor, investors should prefer historically stable sectors within the defensive sectors.

Now, we would discuss some stocks from the economically sensitive perspective, which are classified under the Financials and Real Estate sectors:

National Australia Bank Limited (ASX: NAB)

National Australia Bank Limited (ASX: NAB) is one of the big four banks in Australia. It is a large-cap stock and is classified in the Financials Sector under the industry group â Banks.

On 10 July 2019, the bank reported a revised outlook on the credit ratings by S&P. Accordingly, the rating house has revised the credit outlook for major Australian banks. Also, S&P revised the range of the strategically important subsidiaries of the banks to âStableâ from âNegativeâ. This development by the rating agency arrives after the release by Australian Prudential Regulation Authority (APRA) on loss-absorbing capacity, dated 9 July 2019.

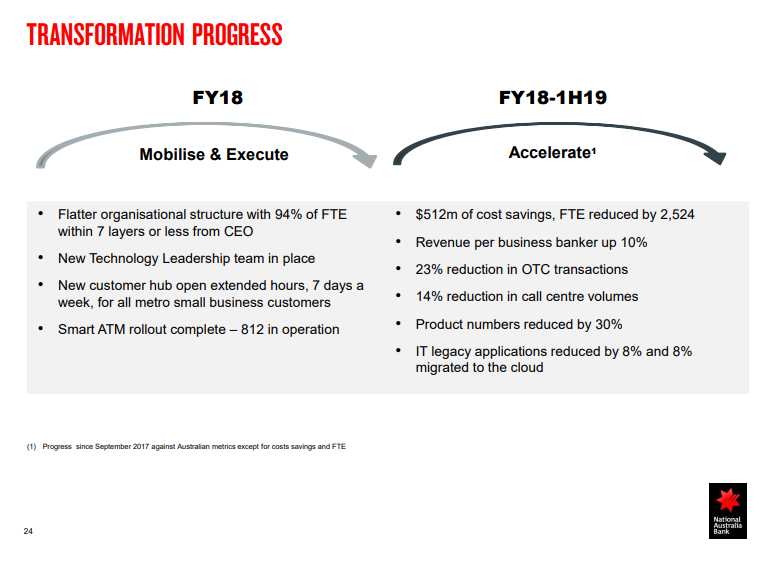

Transformation Progress (Source: Half-Year Presentation)

As per the release by APRA, the regulator necessitates increasing the total capacity by three percentage point of Risk Weighted Assets (RWA). Also, it expects the banks to execute this before 1 January 2024.

Subsequently, the rating house had revised the outlook to âAA-â for long-term and âA-1+â for short-term. Also, S&P has kept the Hybrid and subordinated consistent with previous ratings.

On 10 July 2019, NAB last traded at A$26.86, up by 0.675 from the previous close. The performance of the stock over the past one year has been -4.78%. In the past three months and year-to-date periods, the return of the stock has been +8.5% and +12.91%, respectively.

Charter Hall Group (ASX: CHC)

Charter Hall Group is a real estate sector stock, and it constitutes to S&P/ASX 200, S&P/ASX200 A-REIT (Sector) and more. The group operates across property businesses, and it is an integrated property group. Some of the capabilities of the group include property fund management, property development, property management and investment and property investment banking.

On 3 July 2019, Charter Hall forwarded the announcement made by Australian Unity Investment Real Estate Limited (AUIREL), as responsible entity of Australian Unity Office Fund (ASX: AOF). Accordingly, an entity allied with Abacus Property Group (ASX: ABP) and Charter Hall Group (ASX: CHC) (Consortium) had sent an unsolicited, indicative & non-binding proposal to acquire all the remaining units in AOF. In layman terms, the Consortium has an entity, and it intends to fully-acquire the Australian Unity Office Fund at $2.95 cash per unit (Original Proposal).

As per the release, AOF reported that the Consortium had improved the offer to $3.04 (Improved Proposal) cash per unit. Also, the improved offer would be impacted if the proposed distribution by AOF would be other than 3.95 cents per unit. Besides, the Consortium has indicated that the improved offer would be the final offer in the absence of better proposal, and the Consortium does not intend to improve the $3.04 cash per unit offer further.

Reportedly, the improved offer represents a premium of 9.4% to the closing price of AOF on 03 June 2019 â $2.78. Also, 11.8% premium is depicted to the 30 days VWAP of $2.72 until 03 June 2019. Importantly, the new offer would be subject to a limited number of conditions including due-diligence, entry into a scheme of arrangement (to be unanimously recommended by independent directors of AUIREL. Lastly, one more condition would be the approval of the Foreign Investment Review Board.

Portfolio Overview (Source: Charter Hall Development Showcase â Presentation, June 2019)

On 10 July 2019, CHC last traded at A$ 11.46, up by 0.615% from the previous close. The performance of the stock over the past one year has been 71.02%. In the past three months and year-to-date periods, the return of the stock has been +14.24% and +54.97%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.