During CY2019, the Australian Economy witnessed a few knee-jerk reactions primarily from the Royal Commission and change in consumer sentiments across property segment. While on the macro point, the retail consumptions stood firm during the CY19. We will be discussing five stocks, which were impacted due to the sectoral changes.

Let’s have a look on these five stocks.

MGC Pharmaceuticals Ltd (ASX: MXC)

One of the major highlights of the Australian Businesses was the increase in demand of the cannabis-based medicines. MGC Pharma is one of the businesses, which focuses on manufacturing of phytocannabinoid derived medicines. The management highlighted that the near-term outlook of the business is likely to be positive owing to the its phytocannabinoid derived medicines to patients in Australia, the U.K and currently, with access to Brazil and key Latin American markets. The business reported average prescription orders at 22 per business day.

During the year, the company launched its two proprietary products namely CannEpil® and MXP100. MXC’s business is aiming towards 3 common medical conditions like epilepsy, dementia and IBS.

Stock Update: On 2 January 2020, the stock of MXC last quoted at $0.031, slipping by 3.125 percent from its last close, with a market capitalisation of $43.88 million. The stock quoted at the lower band of its 52-week trading range of $0.030 to $0.067. The stock has generated a negative return of 21.95% on an YTD basis.

PWH Holdings Limited (ASX: PWH)

PWH Holdings Limited is engaged in design and production of customised cooling solutions used for the international elite motorsports and high-performance automotive applications across the world. The stock falls under the category of consumer discretionary sector.

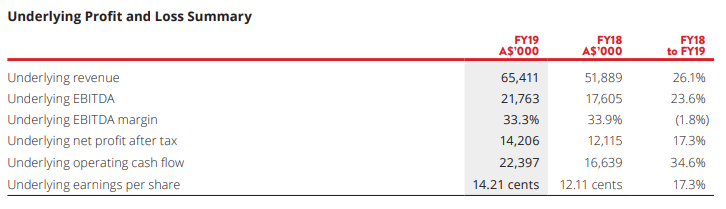

FY19 Financial Highlights for the Period ended 30 June 2019: PWH announced its FY19 results, wherein, the company reported underlying revenue of $65.411 million as compared to $51.889 million in FY18, depicting a growth of 26.1% on y-o-y basis. The business reported robust growth of 55% and 30% across Original Equipment Manufacturer (OEM) segment and Motorsport segments.

The Management expects better higher business prospect in the upcoming two-three years on account of introduction of technologies to the manufacturing facilities of the business. During FY19, the company announced OEM programmes, which have commenced production at C&R which has the capacity to deliver current programs and future OEM growth.

FY19 Financial Highlights (Source: Company’s Report)

Stock Update: The stock of PWH last quoted at $4.71, falling by 1.67 percent compared to its previous close, (as on 2 January 2020) with a market capitalisation of ~$479.42 million. The stock has generated 45.68% in the last one year. Also, the stock quoted at the upper band of its 52-week trading range of $3.070 to $5.060. The stock is available at a price to earnings multiples of 33.710x on trailing twelve months basis. At current market price, the stock has generated a dividend yield of 1.77% on an annualised basis.

Bank of Queensland Limited (ASX: BOQ)

Bank of Queensland Limited is known as one of the leading regional banks, which is also among the few of them, not maintained by the bigger banks.

FY19 Operational Highlights for the Period ending 31 August 2019: BOQ announced its FY19 financial results, wherein the bank posted net interest income at $961 million, came slightly lower than $965 million in FY18. The company reported statutory net profit after tax at $298 million, down 11% on y-o-y basis. BOQ reported cash earnings after tax at $320 million as compared to $372 million in FY18. Common Equity Tier 1 ratio, during the year, standing at 9.04%, while, on the other hand, cash return on average equity stood at 8.3%. The bank reported a y-o-y reduction of five basis points in its net interest margin, with most of the reduction evident in the first half.

The banking sector has gone through several challenges, due to the regulations imposed by Royal Commission. The sectoral impact has dampened the profitability of the bank and the business is looking forward to improving the performance to enhance the value of both customers and shareholders.

Stock Update: On 2 January 2020, the stock of BOQ last quoted at $7.28, rising up by 0.414 percent from its prior closing price, with a market capitalisation $3.2 billion. The stock is available at a price to earnings multiples of 9.770x on TTM basis. The stock has generated negative returns of 26.77% and 23.76% in the last three months and six months respectively. The stock has generated an annualised dividend yield of 8.97%. Also, the stock last quoted at the lower band of its 52-weeks trading range of $7.11 and $10.770.

Splitit Payments Ltd (ASX: SPT)

Splitit Payments Ltd is a tech entity, offering cross-border credit-based instalment solutions to both businesses and retailers.

Key Operational Highlights for the Period ending 30 September 2019: SPT announced its third-quarter operations highlights, wherein, the company reported total merchants at 624 as compared to 509 in previous quarter. Total customers, during the quarter came in at 235,000, increased from 197,000 in the second quarter of FY19. Merchant fees came in at US$466,000 as compared to US$245,070 in the previous corresponding quarter. Transaction volume stood at 30,500,000 as compared to 15,220,500 Q3FY18.

The business has seen tremendous response from both retail clients and merchants across the monthly installment segment and is expecting improved business prospect in coming quarters.

Stock Update: The stock of SPT last quoted at $0.665, with a market capitalisation of $205.61 million. The stock has generated decent returns of 10.00% and 11.86% in the last three months and six months respectively.

Scentre Group (ASX: SCG)

Scentre Group is engaged in development and management of real estate. The real estate segment has gone through a tepid time during the FY19 due to decrease in demand from the end consumers. While SCG reported marginal growth in the recent-past.

Key Operating Highlights for the Quarter Ended 30 September 2019: SCG announced its quarterly results, wherein, the company reported total in-store sales grew 2.4% on y-o-y basis. The business reported 2.9% y-o-y sales growth in Specialty in-store while majors in-store sales were down by 0.6% during the quarter. The company reported average annual specialty in-store sales at more than $1.52 million per store. The company reported total portfolio sales at $24 billion during the period.

Stock Update: On 2 January 2020, the stock of SCG last traded $3.85, rising up by 0.522 percent from its previous close, with a market capitalisation of $20.09 billion. The stock has generated -3.04% and 1.29% in the last three-months and six-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.