The COVID-19 pandemic has deteriorated global economic growth, not leaving any sector untouched. Whereas in some countries like Australia, situation is improving each passing day and most of the companies in countries have started commencing their business as usual. In the present unpleasant scenario, let us have a look on some ASX-listed companies with recent business updates:

Do Read: Record Level for a Afterpay amid COVID-19 Pandemic.

Sydney Airport

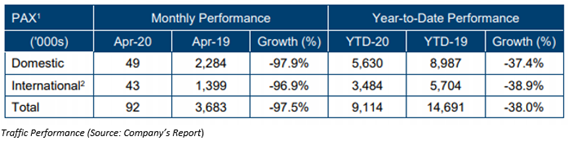

Sydney Airport (ASX: SYD) is a parent to Southern Cross Airports Corporation Holdings Limited and Sydney Airport Corporation Limited. Its engaged into operation of airport starting from managing traffic to safety and so on. The company recently notified the market with its traffic performance for the month of April 2020, wherein, it stated that the total passenger traffic in April 2020 stood at 92,000 passengers, reflecting a fall of 97.5% over prior corresponding period. International passengers traffic went down by 96.9% to 43,000 and the domestic passengers totalled 49,000 for April 2020, which experienced a fall of 97.9% over pcp.

Sydney Airport anticipates the fall in passenger traffic to exist until government provides some ease in travel restrictions.

Do Read: Discussion on Airline and Travel Sector.

The stock of SYD closed the day’s trading session at $5.700 per share on 22nd May 2020, indicating a rise of 1.968% against its previous closing price.

Downer EDI Limited

Downer EDI Limited (ASX: DOW) is into designing, building and sustaining assets, infrastructure and facilities. DOW dates to 150 years of history and is listed both on Australia and New Zealand stock exchange. The Company recently announced that Spotless Group Holdings Limited has agreed on an offer to settle the class action initiated against Spotless in the Federal Court of Australia in May 2017.

Downer has strong balance sheet and decent liquidity with $500 million in syndicated bank facility as announced on 20th April 2020. The company has deferred interim dividend of $83 million until September 2020.

The stock of DOW closed the day’s trading session at $4.180 per share on 22nd May 2020, indicating a fall of 3.687% against its previous closing price.

Elders Limited

Elders Limited (ASX: ELD) is primarily in the provisioning of retail products and associated services to the rural sector. Recently, the Company has inked agreement to refinance with existing financiers in line with its rationale to maximise the efficiency and flexibility of debt facilities in support of business strategy and growth.

The re-financing package include (1) new $50 million facility with the tenor of 2-year, and (2) a rise in the committed limit for the its debtor securitisation program from $120 million to $200 million as well as an extension in tenor from Dec 2020 to Dec 2021.

The stock of ELD closed the day’s trading session at $9.720 per share on 22nd May 2020, indicating a fall of 0.917% against its previous closing price.

AVJennings Limited

AVJennings Limited (ASX: AVJ) is an Australia based real-estate company, which develops residential property and land. Recently, the Company notified the market with the update on COVID-19 and stated that the company entered the crisis having decent position with a strong balance sheet, sound liquidity and enough funding capacity for the medium term.

In response to the pandemic, the Company is managing its workflows and decreasing operating costs and overheads. The horizontal nature of AVJ’s operations allows it to rapidly review and adjust the level of site activity.

For FY20, the company expects its results to be stronger than the financial year 2019 despite some uncertainty.

The stock of AVJ closed the day’s trading session at $0.385 per share on 22nd May 2020, ending flat as per previous day closing price.

Virgin Australia Holdings Limited

Virgin Australia Holdings Limited (ASX: VAH) is involved into operation of airlines in Australia. On 18th May 2020, Moody's Investors Service has downgraded VAH’s Corporate Family Rating to Ca from Caa1 and downgraded Virgin's senior unsecured and backed senior unsecured ratings to C from Caa2.

This decision by Moody’s follows the quick and widening spread of the COVID-19, worsening global economic outlook, tumbling oil prices, and asset price declines. These factors are creating a severe and extensive credit shock in many sectors, regions, and markets.

Another recent update about company stated that group capacity reduction has deepened to 6% from 3% in 2H FY20 and it is expected to reach 7.7 per cent in 1H FY21. It has withdrawn earning guidance due to uncertainty and the evolving nature of the COVID-19.

The stock of VAH last traded on 9th April 2020 at $0.086 per share.

Eclipx Group Limited

Eclipx Group Limited (ASX: ECX) is a provider of fleet leasing, management and vehicle rental services to corporate, SME and consumers in Australia and corporate and SME customers in New Zealand. Recently, the company has provided business update and outlined that it has decided to extend leases which are expected to expire between April and September 2020. ECX added that the lease extensions as a percentage of total leases expiring during this period witnessed a rise from 13% to 18% over the last two weeks.

As at 30th April 2020, the available liquidity of the company stood at $114 million against $106 million at 31 March 2020.

The stock of ECX closed the day’s trading session at $1.080 per share on 22nd May 2020, indicating a rise of 8% against its previous closing price.