COVID-19 turmoil causing devastation across the globe over the past few months has now brought the global economy to a standstill. Everyone across the world is dealing with this biological tragedy created by a tiny virus, that has caused a financial breakdown due to sector-wide closures, production shutdowns and employment losses.

Globally, there have been more than 4.5 million confirmed cases of COVID-19, including nearly 307,537 deaths, recorded by WHO as of 6:42 PM CEST, 17 May 2020. Australia has flattened the curve for new cases of COVID-19 and eased lockdown restrictions, and the Australian economy is on track to recover by controlling the coronavirus spread.

TO KNOW MORE, DO READ: Australian states ease restrictions, road ahead for the economy

According to the business council of Australia, the country is well positioned to make a speedy recovery in the economy although it must footstep prudently in the upcoming weeks. During these unprecedent times, investors are also frustrated and pondering to invest in lucrative markets in order to survive during the Great Virus Crisis (GVC).

Meanwhile when many businesses are going through loss due to shut down of the industries, one ASX-listed agribusiness company has reported outstanding profit amid the COVID-19 doom and gloom and turned into a story of hope.

DO READ: Style-Up Your Investment Portfolio Amidst COVID-19 Crisis

Let us delve deep and discuss Elders Limited-

ASX-listed Australian agribusiness company Elders Limited (ASX:ELD) is engaged with the provision of extensive range of services including rural services, financial planning, banking, real estate as well as trading of grain.

Primary manufacturers across Australia work closely with Elders to gain access to products, marketing services, as well as specialist technical assistance across retail and financial product categories. Also, feed and processing business of Elders functions a top-tier beef cattle feedlot in NSW Australia, a premium food distribution model in China and an integrated beef supply chain in Indonesia.

Elders Profit in 1H20 Almost Doubled to $52 Million

Elders Limited disclosed that the Company delivered a solid financial result for the first half of the fiscal year ended 31 March 2020. Moreover, the Company highlighted that it would continuing to deliver on its Eight Point Plan initiatives.

Highlights from cash flow front-

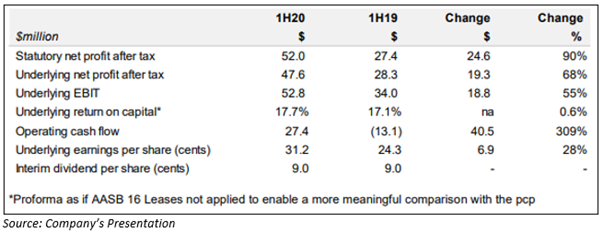

A quick financial summary of Half-yearly performance is presented in the image depicted below-

- The Company reported that its profit in 1H2002 almost doubled to $52 million and all the divisions have performed well.

- The Company disclosed that it has reported robust performance from rural products with gross margin increased by recent winter crop confidence, high prices for both cattle and sheep, as well as steady earnings in both real estate and financial services. The underlying EBIT reported to be $52.8 million.

- The operating cash inflow of $27.4 million reflected EBITDA of $60.0 million. Notably, the Company anticipates higher cash conversion in the remaining half of FY2020.

- Elders reported additional earnings from Australian Independent Rural Retailers (AIRR) acquisition and outperformance across most products and services, including the wholesale network that is up with AIRR acquisition contributing almost $17.4 million in gross margin.

Rain Brought Advantages for Elders, Highlights from Operation Front-

- Successive rainfall events across major cropping areas on the East Coast have had a positive impact on operational performance within the last period. This has lifted the confidence of farmer and drove robust demand for crop inputs.

- Notably, outcomes from the agency services were up, driven by robust prices in cattle and sheep, restricted domestic supply and continued demand from significant export markets.

- Wool margins deteriorated with lower bales sold because of lower prices deterring growers from trading.

- It is noteworthy to highlight that the real estate delivered a higher outcome with sales turnover up across most service offerings.

Elders’ third Eight Point Plan (FY21 to FY23)

The strategic priorities for this plan are-

- To win market share across all business units through customer centricity, sales force effectiveness and strategic acquisitions;

- Capture increased Rural Products gross margin;

- Expansion of complementary service offerings, including financial services and consulting;

- Increase participation in downstream value added market segments via its feed and processing service; develop and deliver an authentic and industry leading sustainability program.

- Elders costs increased on the previous year by nearly $12.0 million owing to the AIRR acquisition along with expansion across geographies and further corporate initiatives taken.

Outlook for the remaining half-

Elders notified that global COVID-19 implications would continue to generate some ongoing uncertainty in both market requirement and agricultural supply chains, however, subsequent to rainfall events there is now a positive outlook for winter crop-

- Elders is on track to deliver a complete year result in line with the consensus of analyst views of between $96.5-$112.9 million EBIT and $85.8-$102.9 million NPAT subject to any future negative impacts arising from global volatility. Moreover, the Company has estimated a positive outlook for winter crop on the back of recent rainfalls across the Eastern States.

- The Company notified that a few domestic AgChem suppliers are undergoing interruptions due to COVID-19 crisis, which is being carefully observed; however, AgChem supply chains in China have returned to normal.

- Livestock supply chains continue to operate without significant disruption from COVID-19 with digital solutions in place to facilitate transactions alternatively to in-person methods. Notably, cattle and sheep prices are estimated to remain high.

- Wool export to China is operationally sound; however, the impact of reduced end-market demand across North America and Europe would likely continue to place downward pressure on price and volume.

- Notably, the financial services to benefit from a full year of earning from Livestock in Transit (LIT) delivery warranty products, launched in June 2019.

- Real Estate residential sales and property management activities are expected to decline in line with the wider real estate market due to COVID-19 related restrictions and broader economic impacts.

- In feed and processing, Killara feedlot utilisation is projected to continue at high utilisation levels with partial impact from coronavirus outbreak, however, high end cattle might experience price pressures because of reduced demand for restaurant quality meat and exports.

- The costs and capital are anticipated to rise in line with footprint growth and continued investment in Elders eight-point plan.

Stock Information-

Shares of ELD surged up by 9.883% from its previous close and was at $10.340 on 18 May 2020 with a market cap of $1.46 billion and 155.67 million outstanding shares on ASX. The stock has delivered a positive return of 42.58% and 15.46% in the previous six and three months, respectively. The P/E ratio of ELD was noted at 16.510x with an annual dividend yield of 1.91%.

NOTE: Currency is reported in Australian Dollars unless stated otherwise.