Health care industry is one of the worldâs fastest-growing industries, providing services to treat patients with preventive, curative and palliative care. The industry includes pharmaceutical & biotech companies, medical device producers & distributors and more. Australiaâs health care system offers a variety of services including general as well as preventive health to treat complex conditions which may need hospital care. Medicare is the basis of the Australian health care system and is the governmentâs scheme to provide the public access to health care.

In the health care sector, research is required to find out the solutions for rare diseases and unmet medical needs. Many health care companies in Australia are investing an enormous amount in their R&D and developing new treatment solutions for rare diseases. The companies are generating good revenue by providing effective treatments for the patients.

Let us have a look at six heath care stocks trading on the ASX.

Bionomics Limited (ASX: BNO)

Australia-based health care player, BNO is into discovering and developing novel drug candidates. The lead compound of BNO, BNC210, is a negative allosteric modulator of ?-7 nicotinic acetyl-choline receptor, while the company has a pipeline of pre-clinical ion channel programs which target pain, cognition, depression and epilepsy.

FDA Grants Fast Track Designation

According to a company announcement on 4 November 2019, the US Food and Drug Administration (FDA) approved the BNC210 development program for a Fast Track designation. The designation was granted to the program for the treatment of patients with post-traumatic stress disorder (PTSD) and other trauma & stress related disorders, and the company now plans to work closely with the agency in the design and commencement of the next Phase 2b study in PTSD patients.

The company is currently engaged in the development of a new solid dose formulation of the drug candidate.

Stock Performance

The BNO stock was trading at $0.105 with a daily volume of ~1.36 million, and a market capitalisation of ~$62.64 million, on 5 November 2019 (AEST 01:02 PM). The stock has a 52 weeks high price of $0.250 and a 52 weeks low price of $0.031. The YTD return of the stock stands at 6.98%, while the three-month return is 194.87%.

Pro Medicus Limited (ASX: PME)

Leading medical imaging provider, Pro Medicus Limited (ASX: PME) provides a comprehensive range of radiology IT software and services to health care organisations, hospitals, and imaging centres across the globe. The company has its offices in Melbourne, San Diego and Berlin.

Five-Year Contract with OSUWMC

On 4 November 2019, PME unveiled that its subsidiary, Visage Imaging, Inc., signed an agreement with a large multi-disciplinary academic medical centre, named The Ohio State University Wexler Medical Center (OSUWMC). Under this five-year contract, the Visage 7 technology will be implemented across all the OSUWMCâs radiology departments. The implementation will start in the second quarter of FY2020, with completion expected in mid-2020.

Financial Highlights - FY2019 (ended 30 June 2019)

- Total revenue for FY2019 stood at $50.11 million, representing an increase of 47.9% compared to the last fiscal year.

- Underlying after-tax profit reached $22.74 million, up 83.1% from the previous year.

- EBIT margins increased to 51.6%.

- The companyâs cash reserves for FY2019 stood at $32.32 million, up 28% year-on-year.

Stock Information

The PME stock was trading at $25.520 on 5 November 2019 (AEST 01:04 PM), up 1.876% with a daily volume of 265,412 and a market cap of nearly $2.6 billion. The YTD return of the stock stands at 120.29%.

EBOS Group Limited (ASX:EBO)

EBOS Group Limited (ASX:EBO) is the biggest and most diversified Australasian company in terms of the marketing, distribution and wholesaling products catered to the medical, health care and pharma industries.

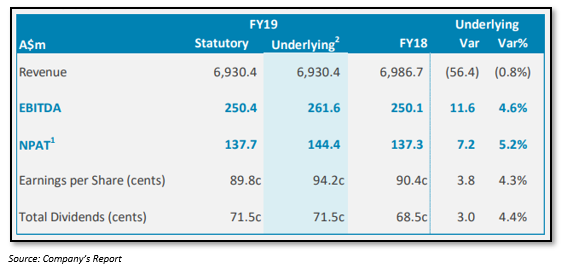

FY2019 Summary for the period ended 30 June 2019

- In the last financial year, EBOS registered statutory revenue of $6,930.4 million.

- In FY2019, the company posted statutory EBITDA of $250.4 million.

- Statutory NPAT of the company for FY2019 stood at $137.7 million.

Strategic Acquisitions in FY2019

In the financial year 2019, EBOS Group completed several strategic acquisitions and invested approximately $93.6 million during the year.

- Acquisition of all the minority shares in TerryWhite Group Limited, in December 2018 for nearly $46.7 million.

- The company expanded Animal Careâs Australian vet wholesaling business with the acquisition of Therapon for $6.5 million.

- Warner & Webster acquisition worth ~$32.0 million.

- By acquiring Quitnits head lice brand, EBOS expanded its Endeavour Consumer products business in December 2018.

Stock Performance

The EBO stock was trading at $22.200 on 5 November 2019 (AEST 01:13 PM). The market capitalisation of EBO stands at nearly $3.6 billion with approx. 162.12 million outstanding shares. The stock has delivered a return of 13.85% on a year to date basis.

Ansell Limited (ASX: ANN)

Australia-based company, Ansell Limited (ASX: ANN) is one of the worldâs most advanced safety solution providers and is engaged in the manufacturing of protective industrial and medical gloves. Ansell was previously a well-known condom manufacturer, but it sold its division in 2017.

FY2019 CSR Highlights (ended 30 June 2019)

- The company received third-party certification of greenhouse (GHG) gas inventory in FY19 by Control Union International.

- In FY2019, fourth bio-mass boiler started operating at full capacity at Ansellâs largest manufacturing in Colombo, Sri Lanka.

- A 728kW solar photovoltaic (PV) system was completed during the financial year at glove knitting facility in Sri Lanka.

- The company is currently installing its fifth bio-mass boiler at Bangkok facility and expects the boiler to start service during FY2021.

Stock Information

The ANN stock was trading at $28.140 on 5 November 2019 (AEST 01:29 PM), up 0.716%, with a daily volume of 83,258 and a market capitalisation of approximately $3.7 billion. The stock has a 52 weeks high price of $28.440 and a 52 weeks low price of $21.070. The YTD return of the stock stands at 27.81%.

Nanosonics Limited (ASX:NAN)

Australia-headquartered health care company, Nanosonics Limited (ASX:NAN) has its offices in the United Kingdom, North America, Canada and Europe. The company is an innovator in providing solutions for the prevention of infection and manufactures & distributes trophon® EPR and trophon®2.

Appointment of New Non-Executive Director

In a recent announcement, the company unveiled the appointment of Lisa McIntyre as a Non-Executive Director, effective from 13 December 2019. Lisa McIntyre is a healthcare and commercial experience.

Financial Highlights FY2019 (ended on 30 June 2019)

- The company showed a robust growth & reported a strategic expansion in FY2019.

- Nanosonics generated total revenue of approximately $84.3 million.

- A gross profit of $62.8 million was registered during the reported fiscal year.

- The R&D expenses of the company for the financial year were ~$11.3 million, 15% up compared with the last fiscal year.

Outlook

- Geographical expansion- During FY2020, the company is expanding and investing in new markets.

- Nanosonics is focusing on establishing the trophon technology as the standard of care for the high-level disinfection.

- The company is focusing on unmet need for infection prevention by developing and commercialising new products.

Stock Information

The NAN stock was trading at $6.850 on 5 November 2019 (AEST 01:31 PM), down 2.56%, with a daily volume of 698,585 and a market capitalisation of approximately $2.11 billion. The YTD return of the stock stands at 152.88%.

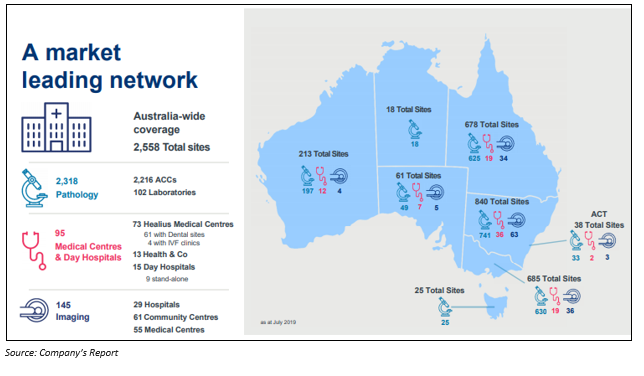

Healius Limited (ASX: HLS)

Australia-based Healius Limited (ASX:HLS), formerly known as Primary Health Care Ltd, is a diagnostic imaging centres company, which also provides pathology services and health technology to independent general practitioners, radiologists and other health care professionals.

In a recent announcement, the company unveiled that it will conduct its Annual General Meeting (AGM) on Monday, 25 November 2019 at Sydney.

Financial Year 2019 highlights (ended 30 June 2019)

- The company generated NPAT of $93.2 million, up 6.5%.

- EBIT was up 4.5% with growth in Imaging and Medical Centres. All three divisions - pathology, medical centres and imaging delivered positive results.

- Pathology up 46% 2H v 1H

- Medical Centres delivered two halves of improved returns

- Imaging delivered three years of double-digit growth

- Revenue stood at $1,804.5 million

Stock Performance

The HLS stock was trading at $3.100 on 5 November 2019 (AEST 01:43 PM), down 2.208%, with a daily volume of 503,043 and a market capitalisation of nearly $1.97 billion. The stock has delivered a return of 29.92% on a year to date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.