Highlights:

- Revenue of Microsoft Corporation (MSFT) rose 11 per cent YoY in Q1 FY23.

- Salesforce, Inc. (CRM) noted a 26 per cent YoY growth in its Q2 FY23 revenue at constant currency.

- GAAP EPS of Cisco Systems, Inc. (CSCO) tumbled seven per cent YoY in Q1 FY23.

The cloud computing sector gained prominence as consumers and businesses shifted to online platforms for their daily work after the COVID-19 pandemic.

During the pandemic, people and businesses had to operate remotely while maintaining their work throughout the globe, and the best possible way was to rely on the cloud computing sector.

Market research firm Facts and Factors expects the cloud computing market to grow from about US$ 429.5 billion in the prior year to around US$ 1.02 trillion through the next six years.

Despite the optimistic view considering the higher demand for cloud computing services, the stocks have noted a steep fall in 2022 due to several market uncertainties. Cloud computing or technology stocks are highly sensitive to interest rates, and with Fed's aggressive in raising the policy rates to curb the decades-high inflation, the investors kept a distance from the constituents.

So, today we would explore some cloud stocks, which include Microsoft Corporation (NASDAQ: MSFT), Amazon.com, Inc. (NASDAQ:AMZN), International Business Machines Corporation (NYSE: IBM), Salesforce, Inc. (NYSE: CRM), and Cisco Systems, Inc. (NASDAQ: CSCO), and their recent stock and financial performance.

Microsoft Corporation (NASDAQ:MSFT)

The leading technology firm by market cap, Microsoft Corporation, specializes in manufacturing personal computers and other related products. Besides, the tech giant also engages in the cloud and other related services.

The stock of the Redmond-based multinational technology firm slipped 28 per cent year-to-date and about the same percentage on an annual basis. However, the MSFT stock soared over three per cent QTD through November 29 after closing at over 12 per cent, up from its 52-week low of US$ 213.431 noted on November 4, 2022.

On November 29, the company announced a quarterly dividend of US$ 0.68 per share, payable on March 9 next year.

Meanwhile, in Q1 FY23, Microsoft Corporation reported a net income of US$ 17.6 billion on revenue of US$ 50.1 billion. On a reported basis, its net income fell 14 per cent YoY, and its revenue surged 11 per cent YoY.

Amazon.com, Inc. (NASDAQ:AMZN)

The e-commerce-focused tech giant, Amazon.com Inc, also engages in cloud-related services; a major part of its total revenue comes from the segment. The stock of the technology firm, which also offers digital streaming, AI, and other related services, fell 44 per cent YTD and 48 per cent YoY.

The AMZN stock tumbled around 18 per cent in the quarter through November 29 and touched its 52-week low of US$ 85.87 on November 9, 2022.

The tech leader Amazon noted a YoY growth of 15 per cent in its net sales of US$ 127.1 billion in Q3 FY22, while its AWS segment (Amazon Web Services) sales surged 27 per cent YoY to US$ 20.5 billion. AWS segment is referred to as the cloud platform of the e-commerce-focused technology firm.

International Business Machines Corporation (NYSE:IBM)

International Business Machines Corporation, commonly referred to as IBM, is a technology firm offering its clients a range of services. The stock of the multinational tech firm surged nine per cent YTD and about 23 per cent YoY.

The IBM stock added about the same percentage as its annual gain in the current quarter through Tuesday, November 29, and was at its 52-week high of US$ 150.46 on November 23, 2022.

IBM's revenue rose six per cent YoY on a reported basis and 15 per cent YoY at constant currency to US$ 14.1 billion in Q3 FY22, while in the last 12 months, its hybrid cloud revenue rose grew 15 per cent YoY to US$ 22.2 billion.

Salesforce, Inc. (NYSE:CRM)

The cloud-based technology solutions provider, Salesforce, provides CRM or customer relationship management services to its clients. The company's stock, which offers its services to improve sales, customer service, and other related aspects of its clients, fell 40 per cent YTD and about 49 per cent YoY.

The company would report its earnings results on Wednesday, November 30, after the market close. Meanwhile, in Q2 FY23, Salesforce Inc's revenue rose 22 per cent YoY on a reported basis and 26 per cent YoY on a constant currency to US$ 7.72 billion.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Cisco Systems, Inc. (NASDAQ:CSCO)

The American digital communications and technology firm, Cisco Systems holds a market cap of US$ 198.42 billion. The company's stock, which offers a range of internet-related solutions, fell about 24 per cent YTD and around 13 per cent YoY.

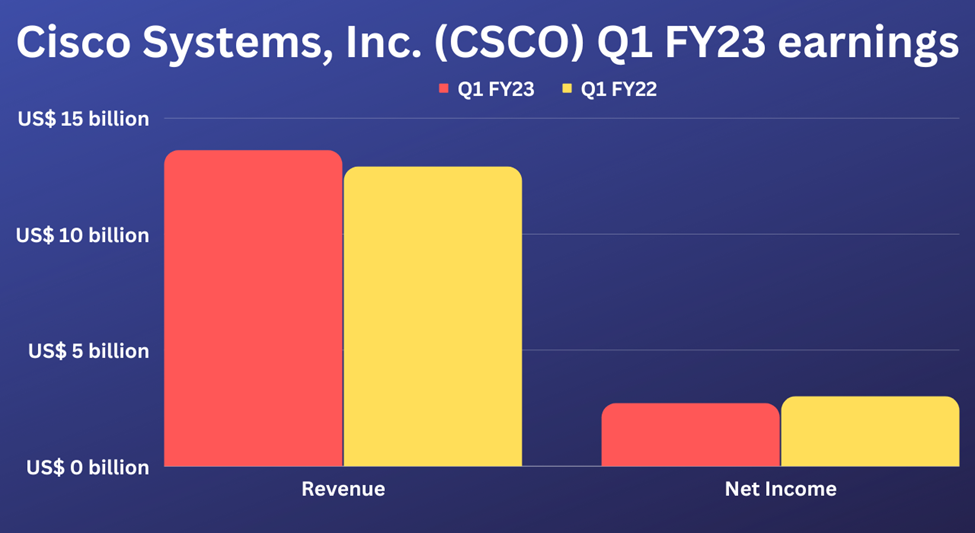

In Q1 FY23, Cisco System's revenue grew six per cent YoY to US$ 13.6 billion, and its GAAP EPS fell seven per cent YoY to US$ 0.65 apiece.

Bottom line:

Despite the sloppy trading the stocks have witnessed in recent months due to the higher inflation, increasing borrowing costs, and other hovering concerns, some still anticipate that the sector might regain its momentum in the coming years.

With global digitalization in focus, companies are also increasing their spending and budget in the cloud computing segment, which also supports the optimistic view of some analysts.

According to some market analysts, the cloud computing sector plays an important role and is crucial for other technology trends to flourish in the coming days. The related trends include 5G networking, artificial intelligence (AI), IoT, and the COVID-19-induced remote working trend.

Global corporations are migrating their workloads to cloud computing alternatives. Meanwhile, another market research firm, Gartner, anticipates the global cloud computing market to reach around US$ 360 billion in the ongoing year, up from about US$ 250 billion in the prior year.

In addition, it estimates the overall market to reach about US$ 1 trillion through 2030 on a global basis.

However, given the still-volatile trading picture in the broader market, investors should tread cautiously with their investment plans. Notably, the S&P 500 information technology index fell about 26 per cent so far this year, while the tech-savvy Nasdaq Composite Index slumped close to 30 per cent in 2022.