Highlights:

- Great Southern Bancorp Inc. (NASDAQ:GSBC) pays a quarterly dividend of US$ 0.40 per share.

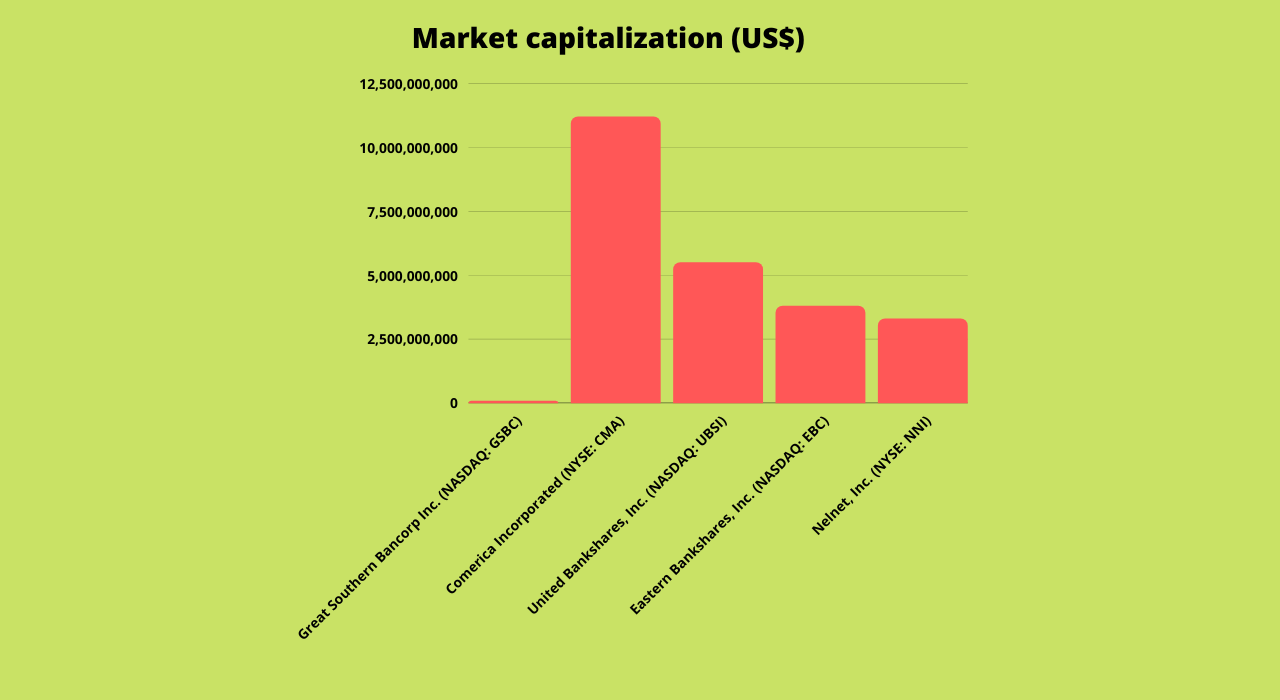

- Comerica Incorporated has a market cap of US$ 11.32 billion.

- EBC stock saw a surge of 9.31 per cent year-over-year (YoY).

The federal student loan payments moratorium will likely expire on August 31. People could be confused about whether US President Joe Biden will forgive some of their debt or continue with the moratorium.

Last week, the US Department of Education said that it would cancel US$ 4 billion worth of federal loans for 208,000 defrauded students by a for-profit organization.

Amid these developments, we explore five student loan stocks picked by Kalkine Media® and look at their performances:

Great Southern Bancorp Inc. (NASDAQ:GSBC)

Great Southern Bancorp is a bank holding company that deals in commercial and residential real estate, construction, consumer, and student loans.

The company has a market cap of US$ 78.12 million. It distributed a quarterly dividend of US$ 0.4 per share, and Great Southern Bancorp’s price-to-earnings (P/E) ratio is 11.79.

On a year-over-year basis, GSBC stock gained 20 per cent. Shares of Great Southern Bancorp increased by about seven per cent in 2022.

Great Southern Bancorp’s net interest income for the second quarter of 2022 grew by US$ 4.1 million to US$ 48.8 million compared to US$ 44.7 million for the same quarter in 2021.

In Q2 2022, the company earned US$ 18.2 million compared to US$ 20.1 million in the year-ago quarter.

Comerica Incorporated (NYSE:CMA)

Comerica Incorporated, as a financial services company, deals in retail banking with operations in Canada and Mexico, apart from the several states in the US.

Comerica paid a quarterly dividend of US$0.68 per share; the next payable date is October 1, 2022. Comerica has a market cap of US$ 11.2 billion.

In the last six months, CMA stock fell below nine per cent. However, over the past month, it surged more than 11 per cent.

Comerica reported a Q2 2022 net income of US$ 261 million compared to US$ 328 million in the year-ago quarter.

Comerica’s Q2 2022 loans grew from US$ 1.8 billion to US$ 50 billion compared to the previous quarter. Relative to the first quarter of 2022, its net interest income rose from US$ 105 million to US$ 561 million in the second quarter.

United Bankshares, Inc. (NASDAQ:UBSI)

The US$ 5.5 billion market cap company, United Bankshares, has an earnings-per-share (EPS) of US$ 2.58.

UBSI stock surged close to nine per cent year-to-date (YTD). On a yearly basis, shares of United Bankshares gained over 14 per cent.

United Bankshares reported Q2 2022 earnings of US$ 95.6 million, or US$0.71 per diluted share, relative to US$94.8 million, or $0.73 per diluted share.

United Bankshares’ earnings for the second quarter of 2022 were US$ 95.6 million compared to earnings of US$ 94.8 million for the same quarter of 2021.

As per Refinitiv, UBSI stocks had a Relative Strength Index of 65.41 as of August 19, 2022. It points toward a stable market condition of the stock.

Source: ©Kalkine Media®; © Canva via Canva.com

Eastern Bankshares, Inc. (NASDAQ:EBC)

Commercial bank Eastern Bankshares Inc offers a range of products and services catering to retail, commercial, and small business customers. It primarily has two segments-banking and insurance.

Eastern Bankshares has a market valuation of US$ 3.8 billion. The company paif a quarterly dividend of US$ 0.1. EBC stock saw a surge of 3.28 per cent year-to-date. On a year-over-year basis, shares of Eastern Bankshares rose 9.31 per cent.

Eastern Bankshares posted a net income of US$ 52.5 million or US$ 0.32 per diluted share in Q2 2022, up 42 per cent from the comparable prior-year quarter.

Its second-quarter 2022 net interest income of US$ 137.8 was 32 per cent higher than the year-ago quarter’s US$ 104.7 million.

EBC stock’s RSI value of 66.20 as of August 19, 2022, on Refinitiv, which could mean it is witnessing a moderate trend.

Nelnet, Inc. (NYSE:NNI)

Nelnet, Inc. is a Lincoln, Nebraska-based company that offers administration, repayment of student loan facilities, and other educational and financial services.

The 7,000-plus employee-strength company, Nelnet, has a market cap of US$ 3.30 billion. The company pays a quarterly dividend of US$ 0.24 per share.

The price-to-earnings (P/E) ratio of Nelnet shares is 7.39. Its earnings-per-share (EPS) is US$ 12.01. NNI stock surged by 15.8 per cent on a year-over-year basis. However, Nelnet shares gained 10.83 per cent over the past six months.

For the quarter ended June 30, 2022, Nelnet Bank reported a loan portfolio of US$ 423.6 million, which comprised US$ 346.1 million of private education loans.

Nelnet achieved a total interest income of US$ 151.6 million in the second quarter of 2022, relative to US$ 133.6 million in the year-ago quarter. The company reported total assets of US$ 20.7 billion in Q2 2022 compared to US$ 23.02 billion in Q2 2021.

Bottom line

Investing during market volatility is always difficult for traders. Stocks fluctuate every single day of trading, as we have seen in 2022.

It seems that long-term investors can hope to wade through the bearish phase in the market. Investors should analyze the companies thoroughly along with the future prospects by gauging the macroeconomic factors that might impact the stocks they choose to put their money in.