Benchmark US indices edged higher on Tuesday, October 19, as strong quarterly earnings of companies for the third consecutive session lifted investors’ risk appetite.

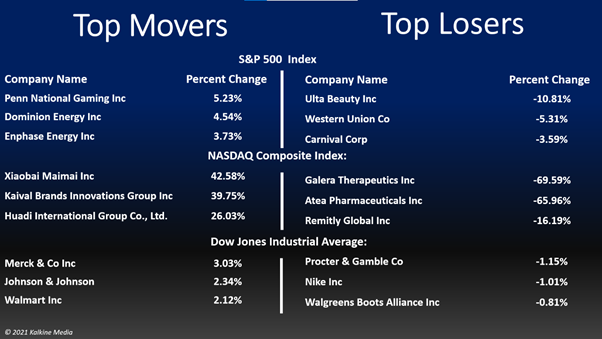

The S&P 500 was up 0.74% to 4,519.63. The Dow Jones rose 0.56% to 35,457.31. The NASDAQ Composite rose 0.71% to 15,129.09, and the small-cap Russell 2000 was up 0.36% to 2,275.91.

Traders have apparently ignored inflation and supply concerns as quarterly results lifted their mood. On Tuesday, the Commerce Department said new home constructions dropped in September after increasing in August, while building permits fell to a one-year low.

Although there is demand for houses, builders face increased challenges like labor shortage and the rising cost of raw materials. Housing starts fell to 1,555,000 units in September, down 1.6% from August, the department's data showed.

Global Markets rose on upbeat corporate earnings

Technology, healthcare, and utility stocks were the top gainers on S&P 500 index on Tuesday. Consumer discretionary and consumer staple stocks trailed. Nine of the 11 segments of the index stayed in the green. Of the total S&P 500 companies reported for the latest quarter so far, about 80% of them have surpassed expectations. The S&P 500 companies are likely to register 32.4% growth in the third quarter, Refinitiv data showed.

Shares of Johnson & Johnson (JNJ) surged 2.09% after reporting third-quarter results on Tuesday. Its total sales increased by 10.7% YoY to US$23.3 billion, while its net earnings rose 3.2% YoY to US$3.66 billion.

Shares of Procter & Gamble Company (PG) fell 1.29% in intraday trading after reporting a profit decline in the latest quarter. Its net sales rose 5% YoY to US$20.33 billion in Q1, FY22, while its net earnings fell around 4% YoY to US$4.12 billion.

The Travelers Companies, Inc. (TRV) stock gained 1.62% after topping analysts' forecast in the third quarter. Its total revenue was US$8.80 billion, and its net income was US$662 million.

In the healthcare sector, Pfizer, Inc. (PFE) rose 1.90%, Eli Lilly and Company (LLY) rose 1.32%, and Danaher Corporation (DHR) gained 1.53%. Abbott Laboratories (ABT) and Merck & Company, Inc. (MRK) advanced 2.27% and 2.90%, respectively.

In consumer staple stocks, Philip Morris International Inc (PM) fell 1.53%, Estee Lauder Companies, Inc. (EL) declined 2.00%, and Kimberly-Clark Corporation (KMB) fell 2.12%. Hormel Foods Corporation (HRL) tumbled 1.09%, while Walmart Inc. (WMT) rose 2.10%.

In the utility sector, NextEra Energy, Inc. (NEE) gained 1.35%, Duke Energy Corporation (DUK) rose 1.27%, and Dominion Energy, Inc. (D) rose 4.56%. American Electric Power Company, Inc. (AEP) and PPL Corporation (PPL) rose 1.02% and 1.14%, respectively.

Also Read: Top travel stocks to explore this holiday season

Also Read: SEC finds no foul play in GameStop's meteoric rally: Key takeaways

Also Read: Dover (DOV), Halliburton (HAL) post strong Q3 revenue, profit growth

Futures & Commodities

Gold futures were up 0.18% to US$1,768.85 per ounce. Silver increased by 1.83% to US$23.690 per ounce, while copper fell 0.94% to US$4.6810.

Brent oil futures increased by 0.90% to US$85.09 per barrel and WTI crude was up 0.92% to US$82.44.

Bond Market

The 30-year Treasury bond yields was up 3.75% to 2.093, while the 10-year bond yields rose 3.86% to 1.645.

US Dollar Futures Index decreased by 0.16% to US$93.793.