Highlights

- Southwest Airlines Company (NYSE:LUV) plans to cut its carbon emissions by 20% through 2030.

- Marriott International (NASDAQ:MAR) is expected to report its Q3 FY21 results on November 3.

- Booking Holdings Inc. (NASDAQ:BKNG) will report its third-quarter earnings on November 3.

The travel stocks are on investors' radar ahead of the winter holidays. The industry was the worst hit in the Covid-19 pandemic but slowly recovering after vaccinations and lifting of curbs.

The industry is upbeat after the US government announced to lift travel restrictions for international travelers who are fully vaccinated from November 8.

Let's look at some of the travel stocks catching investors' attention in recent days.

Also Read: Dover (DOV), Halliburton (HAL) post strong Q3 revenue, profit growth

Airbnb, Inc. (NASDAQ:ABNB)

Airbnb is a vacation rental service company based in San Francisco, California. It provides an online marketplace for tourists' lodging.

The shares traded at US$172.00 at 1:35 pm ET on October 19, down 0.19% from their previous closing price. The stock increased by 23.84% YTD.

The firm has a market cap of US$102.54 billion and a forward P/E one year of -638.22. Its 52-week highest and lowest stock prices were US$219.94 and US$121.50, respectively. The trading volume was 2,793,704 on October 18.

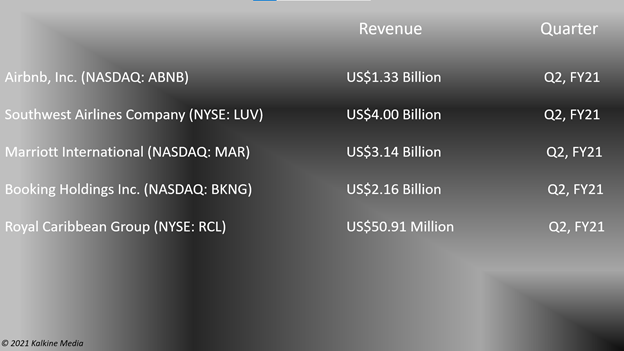

The revenue was US$1.33 billion in Q2, FY21, compared to US$334 million in the same quarter of the previous year. It reported a net loss of US$68.21 million against a loss of US$575.58 million in Q2, FY20.

Also Read: Philip Morris (PM), Bank of New York Mellon (BK) profits up in Q3

Also Read: Johnson & Johnson (JNJ), Proctor & Gamble’s (PG) quarterly sales jump

Southwest Airlines Company (NYSE:LUV)

Southwest Airlines is a major US airline company based in Dallas, Texas, and provides flight services to various destinations.

The stock of the company was priced at US$49.53 at 1:41 pm ET on October 19, down 0.48% from its previous closing price. The LUV stock rose 10.5% YTD. The market cap of the company is US$29.29 billion, and the forward P/E one year is -23.59. Its EPS is US$-2.74.

The stock saw the highest price of US$64.75 and the lowest price of US$37.48 in the last 52 weeks. Its share volume on October 18 was 6,134,221.

On October 18, the company announced a series of near-term goals, initiatives, and plans to reduce carbon emissions by at least 20% by 2030. Meanwhile, the firm is expected to report its third-quarter results on October 21 at 12:30 PM ET.

The total operating revenue of the company was US$4.00 billion in Q2, FY21, compared to US$1.00 billion in the previous year's second quarter. Its net income came in at US$348 million, against a loss of US$915 million in Q2, FY20.

Also Read: PROG, ADMP stocks jump after FDA approval, patent rights

Marriott International (NASDAQ:MAR)

Marriott International is a hotel, residential, and timeshare properties company based in Bethesda, Maryland. The shares of the company traded at US$156.50 at 1:49 pm ET on October 19, down 1.70% from its closing price of October 18. Its stock surged 27.6% YTD.

The firm has a market cap of US$50.95 billion, a P/E ratio of 147.61, and a forward P/E one year of 55.09. Its EPS is US$1.06. The 52-week highest and lowest stock prices were US$161.42 and US$88.92, respectively. Its trading volume was 1,541,852 on October 18.

Marriott will report its third-quarter financial results on November 3 before the bell.

Meanwhile, in the second quarter of fiscal 2021, the company's total revenue was US$3.14 billion, as compared to US$1.46 billion in the year-ago quarter. It reported a net income of US$422 million, against a loss of US$234 million in Q2, FY20.

Also Read: FuelCell (FCEL), Peabody (BTU) stocks gain traction on upbeat outlook

Booking Holdings Inc. (NASDAQ:BKNG)

Booking Holdings is an online travel and restaurant reservation service company based in Norwalk, Connecticut. The stock of the company was priced at US$2475.425 at 1:55 pm ET on October 19, down 1.07% from its previous closing price. The BKNG stock soared 15.62% YTD.

The market cap of the company is US$101.71 billion, the P/E Ratio is 246.49, and the forward P/E one year is 59.76. Its EPS is US$10.05. The stock saw its highest price of US$2,540.00 and lowest price of US$1,589.00 in the last 52 weeks. Its share volume on October 18 was 209,866.

The firm is expected to release its third-quarter earnings on November 3 at 4:30 PM ET.

Its total revenue was US$2.16 billion in Q2, FY21, compared to US$630 million in the same quarter of the prior year. Its net loss came in at US$167 million, versus net income of US$122 million in Q2, FY20.

Also Read: Seven Robinhood stocks to explore this festive season

Source: Pixabay

Also Read: Seven AAA-rated ESG firms: A look at how these stocks faring

Royal Caribbean Group (NYSE:RCL)

Royal Caribbean Group is a cruise holding company that provides cruise services to various locations globally. It is one of the leading cruise line operators in the world and is headquartered in Miami, Florida.

The shares of the company traded at US$84.93 at 2:01 pm ET on October 19, down by 1.11% from its closing price of October 18. Its stock value jumped 21.44% YTD.

The firm has a market cap of US$21.66 billion and a forward P/E one year of -5.07. Its EPS is US$-22.33. The 52-week highest and lowest stock prices were US$99.24 and US$51.33, respectively. Its trading volume was 2,428,997 on October 18.

The company's total revenue was US$50.91 million in Q2, FY21, as compared to US$175.60 million in the year-ago quarter. It reported a net loss of US$1.34 billion, as compared to a loss of US$1.63 billion in the second quarter of fiscal 2020.

Also Read: From Netflix, Tesla to Intel - top stocks to watch this week

Bottomline

The Dow Jones Travel & Tourism index surged 7.04% YTD while increasing 4.23% QTD.

The lifting of travel curbs for international travelers from 33 countries is expected to boost the sector’s growth. In addition, the US plans to reopen its borders with Mexico and Canada for non-essential travelers that will promote travel as the holiday season approaches.