Highlights

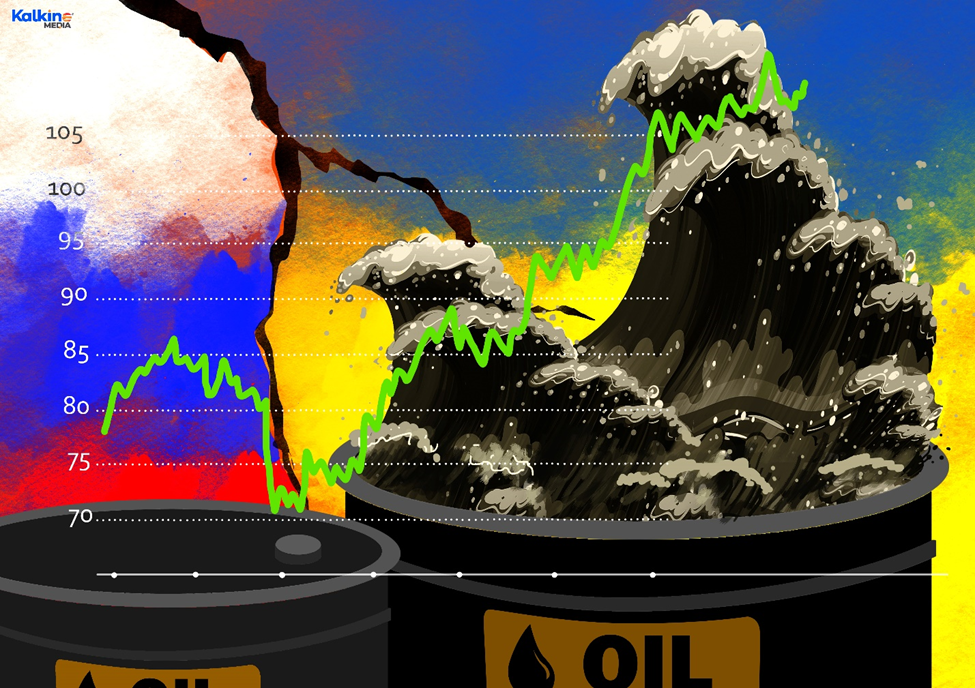

- As the Russia-Ukraine war is raging on, the energy markets are in chaos at present.

- Tougher sanctions on Russia by the Western countries, pushed Brent crude oil prices to its highest level since March 2012.

- Brent crude oil prices jumped to over US $119 per barrel on Thursday and is expected to touch US$125 per barrel.

The cost of Brent crude oil has jumped to its highest level since March 2012, as Russia continued with its assault on Ukraine, following which tougher sanctions were imposed on Russia by the Western countries. Skyrocketing gas and oil prices has created supply and trade disruption.

Brent crude oil prices jumped to over US $119 per barrel on Thursday. Brent crude makes over half of the world’s globally traded supply of crude oil. Meanwhile, European gas prices jumped by around 20% to its hit record high of €198 per megawatt-hour and the Dutch April gas futures contract gained over 12% to make a new record of €186 per megawatt-hour.

World-largest shipping companies, including Maersk, MSC and France, have temporarily suspended shipments to and from Russia and the Western countries are also avoiding commodities from Russia to show solidarity towards Ukraine.

West Texas Intermediate was also trading over US$115, as the US has imposed sanctions on Russia’s oil refining sector, and it is expected that its oil and gas exports will be next in line. To stabilise global energy markets, the US, along with other major energy-consuming countries have decided to release 60 million barrels from their stockpiles. But as Russia is one of the major oil and gas exporters, it is creating panic in the global energy markets.

© 2022 Kalkine Media®

It is expected that the geopolitical tension may push Brent crude prices further to US$125 per barrel, as the Organization of the Petroleum Exporting Countries (OPEC) has refused to respond to the soaring oil prices by sticking to its 400,000 barrels per day increase in output in March 2022 and the market undaunted by the International Energy Agency’s (IEA) global crude reserve release.

According to RAC, UK drivers have been facing record petrol and diesel prices, up by £4.5p a litre to new record highs with a consistent rise in prices for four months to February. Analysts have already cautioned that prices may even reach £1.60 per litre, hurting motorists and households across the UK.

Let us look at five FTSE-listed oil and gas stocks that may get impacted by the rising prices.

Shell Plc (LON: SHEL)

The market cap of the multinational energy and petrochemical company, Shell Plc stood at £155,728.44 million as of 3 March 2022. The company has delivered a return of 35.37% to its shareholders over the last one year as of 3 March 2022 and its year-to-date return standing at 24.39%. Shell plc’s shares were trading at GBX 2,017.50, down by 1.51%, at 12:30 PM (GMT), on 3 March 2022.

Also Read: Why Evraz and Polymetal will lose their FTSE 100 status?

BP Plc (LON: BP.)

The market cap of the global oil and gas company, BP Plc stood at £72,914.69 million as of 3 March 2022. The company has delivered a return of 22.68% to its shareholders over the last one year as of 3 March 2022 and its year-to-date return standing at 13.21%. BP plc’s shares were trading at GBX 373.55, down by 0.23%, at 12:30 PM (GMT) on 3 March 2022.

Centrica Plc (LON: CAN)

The market cap of the international energy services and solution company, Centrica Plc stood at £4,312.42 million as of 3 March 2022. The company has delivered a return of 38.97% to its shareholders over the last one year as of 3 March 2022 and its year-to-date return standing at 4.65%. Centrica plc’s shares were trading at GBX 75.06, up by 2.37%, at 12:30 PM (GMT) on 3 March 2022.

Harbour Energy Plc (LON: HBR)

The market cap of the leading oil and gas company, Harbour Energy Plc stood at £3,813.19 million as of 3 March 2022. The company share value has depreciated by -27.58% to its shareholders over the last one year as of 3 March 2022. However, it has performed well this year with its year-to-date return standing at 16.27%. Harbour Energy plc’s shares were trading at GBX 410.40, down by 0.39%, at 12:30 PM (GMT) on 3 March 2022.

Also Read: Tesco, Ocado, M&S: Stocks you may buy as shop prices rise at highest rate

© 2022 Kalkine Media®

Capricorn Energy Plc (LON:CNE)

The market cap of the oil and gas exploration and production company, Capricorn Energy Plc stood at £1,068.70 million as of 3 March 2022. The company has delivered a return of 10.94% to its shareholders over the last one year as of 3 March 2022 and its year-to-date return standing at 15.78%. Capricorn Energy plc’s shares were trading at GBX 218, up by 1.11%, at 12:30 PM (GMT) on 3 March 2022.

Note: The above content constitutes a very preliminary observation or view based on industry trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.